As a resident of Missouri, understanding the state's tax credits can be a great way to reduce your tax liability and maximize your refund. One of the most popular tax credits in Missouri is the Form 2827, also known as the Missouri Tax Credits for Seniors, Disabled, and Surviving Spouses. In this article, we will delve into the world of Missouri tax credits, specifically focusing on Form 2827, and provide you with a comprehensive guide to help you navigate the process.

What is Form 2827?

Form 2827 is a Missouri state tax form that allows eligible residents to claim a tax credit of up to $750. The form is specifically designed for seniors, disabled individuals, and surviving spouses who meet certain income and eligibility requirements. The tax credit is intended to provide relief to low-income individuals who are struggling to make ends meet.

Eligibility Requirements

To be eligible for the Form 2827 tax credit, you must meet certain requirements. These include:

- Age: You must be 65 years or older, or be permanently and totally disabled.

- Income: Your income must not exceed $25,000 for single filers or $30,000 for joint filers.

- Residency: You must be a resident of Missouri for at least six months of the tax year.

- Spousal Status: If you are a surviving spouse, you must have been married to your spouse for at least one year prior to their death.

How to Claim the Form 2827 Tax Credit

Claiming the Form 2827 tax credit is a relatively straightforward process. Here are the steps you need to follow:

- Determine your eligibility: Review the eligibility requirements to ensure you qualify for the tax credit.

- Gather required documents: You will need to provide proof of income, residency, and age or disability status.

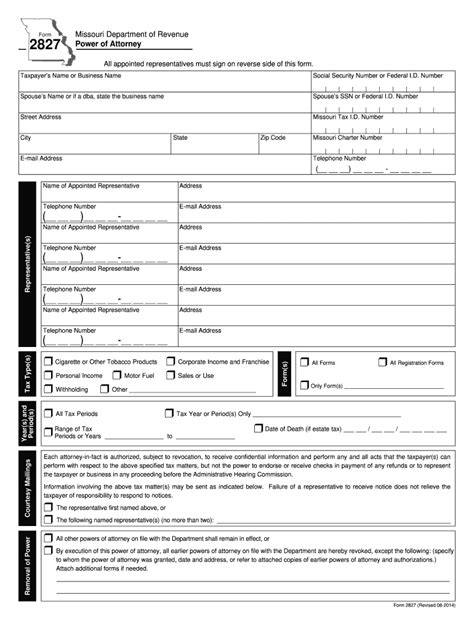

- Complete Form 2827: Fill out the form accurately and completely, making sure to sign and date it.

- Attach supporting documentation: Attach all required documentation, including proof of income and residency.

- Submit the form: Mail the completed form to the Missouri Department of Revenue.

Required Documentation

To support your claim for the Form 2827 tax credit, you will need to provide the following documentation:

- Proof of income (e.g., W-2 forms, 1099 forms)

- Proof of residency (e.g., utility bills, lease agreements)

- Proof of age or disability status (e.g., birth certificate, disability award letter)

Benefits of the Form 2827 Tax Credit

The Form 2827 tax credit provides several benefits to eligible Missouri residents. These include:

- Reduced tax liability: The tax credit can reduce your state tax liability, resulting in a lower tax bill.

- Increased refund: If the tax credit exceeds your tax liability, you may be eligible for a refund.

- Relief for low-income individuals: The tax credit is designed to provide relief to low-income individuals who are struggling to make ends meet.

Tips for Filing Form 2827

Here are some tips to keep in mind when filing Form 2827:

- File electronically: Filing electronically can speed up the processing of your tax credit.

- Use a tax professional: If you are unsure about the filing process, consider using a tax professional.

- Keep accurate records: Keep accurate records of your income, residency, and age or disability status.

Common Errors to Avoid

When filing Form 2827, there are several common errors to avoid. These include:

- Inaccurate income reporting: Make sure to report your income accurately to avoid delays or disqualification.

- Insufficient documentation: Ensure you provide all required documentation to support your claim.

- Late filing: File your form on time to avoid missing the deadline.

Consequences of Late Filing

If you fail to file Form 2827 on time, you may face consequences, including:

- Loss of tax credit: You may lose your eligibility for the tax credit.

- Penalties and interest: You may be subject to penalties and interest on your tax liability.

Conclusion

In conclusion, the Form 2827 tax credit is a valuable resource for eligible Missouri residents. By understanding the eligibility requirements, benefits, and filing process, you can take advantage of this tax credit and reduce your state tax liability. Remember to file accurately, provide required documentation, and avoid common errors to ensure a smooth filing process.

We hope this guide has provided you with the information you need to navigate the Form 2827 tax credit process. If you have any questions or concerns, feel free to comment below or share this article with others who may benefit from it.

What is the deadline for filing Form 2827?

+The deadline for filing Form 2827 is April 15th of each year.

Can I file Form 2827 electronically?

+What documentation do I need to provide to support my claim?

+You will need to provide proof of income, residency, and age or disability status.