The DTF-802 form is a crucial document for individuals and businesses in New York State, as it pertains to the state's tax laws and regulations. The form, officially known as the "Application for Registration of a New York State Sales Tax Certificate of Authority," is a necessary step for businesses to obtain a Sales Tax Certificate of Authority, which is required for collecting and remitting sales tax.

As a taxpayer in New York State, it's essential to understand the purpose and requirements of the DTF-802 form to ensure compliance with state tax laws and avoid potential penalties. In this article, we'll delve into the world of the DTF-802 form, exploring its purpose, who needs to file it, and the steps involved in completing the form.

What is the DTF-802 Form?

The DTF-802 form is a registration application for a New York State Sales Tax Certificate of Authority. This certificate is mandatory for businesses that sell tangible personal property or services subject to sales tax in New York State. The form is used to register for a sales tax account, which enables businesses to collect and remit sales tax to the state.

Purpose of the DTF-802 Form

The primary purpose of the DTF-802 form is to:

- Register for a sales tax account

- Obtain a Sales Tax Certificate of Authority

- Collect and remit sales tax to the state

By completing the DTF-802 form, businesses demonstrate their compliance with New York State tax laws and regulations. This ensures that they can lawfully collect and remit sales tax, avoiding potential penalties and fines.

Who Needs to File the DTF-802 Form?

The following entities need to file the DTF-802 form:

- Businesses selling tangible personal property or services subject to sales tax in New York State

- Out-of-state businesses with nexus in New York State (i.e., a physical presence or economic connection)

- Online retailers with sales in New York State

- Wholesalers and distributors

- Manufacturers and producers

If your business falls into one of these categories, it's essential to complete the DTF-802 form to obtain a Sales Tax Certificate of Authority.

Steps to Complete the DTF-802 Form

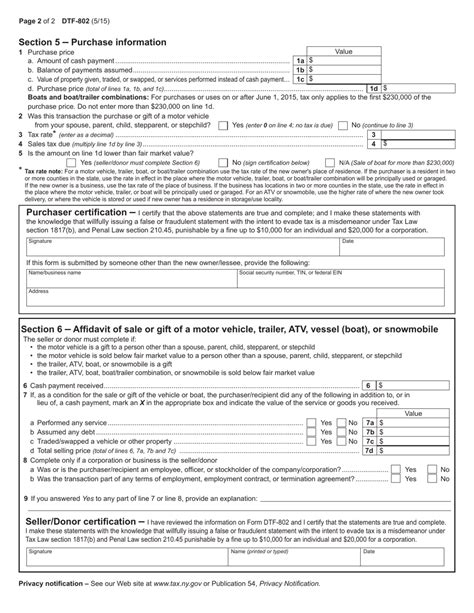

To complete the DTF-802 form, follow these steps:

- Gather required information: Collect your business's identifying information, including the name, address, and Federal Employer Identification Number (FEIN).

- Determine your business type: Identify your business type (e.g., sole proprietorship, partnership, corporation) and select the corresponding box on the form.

- Provide sales tax information: Indicate the type of sales tax account you're applying for (e.g., retail, wholesale, or manufacturing).

- Sign and date the form: Sign and date the form, acknowledging that the information provided is accurate and true.

Benefits of Filing the DTF-802 Form

Filing the DTF-802 form provides several benefits, including:

- Compliance with state tax laws: Demonstrates your business's compliance with New York State tax laws and regulations.

- Avoids penalties and fines: Helps avoid potential penalties and fines for non-compliance.

- Ability to collect and remit sales tax: Enables your business to lawfully collect and remit sales tax to the state.

- Streamlined sales tax process: Simplifies the sales tax process, reducing administrative burdens.

Common Mistakes to Avoid

When completing the DTF-802 form, avoid the following common mistakes:

- Inaccurate or incomplete information: Ensure all information provided is accurate and complete.

- Failure to sign and date the form: Sign and date the form to acknowledge the accuracy of the information provided.

- Late filing: File the form in a timely manner to avoid potential penalties and fines.

Conclusion

In conclusion, the DTF-802 form is a crucial document for businesses in New York State, enabling them to register for a sales tax account and obtain a Sales Tax Certificate of Authority. By understanding the purpose and requirements of the form, businesses can ensure compliance with state tax laws and regulations, avoiding potential penalties and fines. Remember to gather required information, determine your business type, provide sales tax information, and sign and date the form to complete the DTF-802 form successfully.

Take Action

If you're a business owner in New York State, take the necessary steps to complete the DTF-802 form and obtain a Sales Tax Certificate of Authority. Don't hesitate to reach out to a tax professional or the New York State Department of Taxation and Finance for guidance and support.

Share Your Thoughts

Have you completed the DTF-802 form for your business? Share your experiences and tips in the comments below. Help others understand the importance of this form and how to complete it successfully.

FAQ Section

What is the purpose of the DTF-802 form?

+The DTF-802 form is used to register for a sales tax account and obtain a Sales Tax Certificate of Authority, enabling businesses to collect and remit sales tax to the state.

Who needs to file the DTF-802 form?

+Businesses selling tangible personal property or services subject to sales tax in New York State, out-of-state businesses with nexus in New York State, online retailers, wholesalers, distributors, manufacturers, and producers need to file the DTF-802 form.

What are the benefits of filing the DTF-802 form?

+Filing the DTF-802 form demonstrates compliance with state tax laws, avoids penalties and fines, enables businesses to collect and remit sales tax, and streamlines the sales tax process.