Applying for Social Security benefits can be a daunting task, especially when it comes to filling out the necessary forms. One of the most important forms you'll need to complete is the SSA-10, also known as the "Application for Widow(er)'s, Mother's, Father's, and Parent's Benefits." In this article, we'll break down the SSA-10 form and provide a step-by-step guide on how to fill it out accurately and efficiently.

The SSA-10 form is used to apply for survivor benefits, which are available to the spouses, children, and parents of deceased workers who were insured under Social Security. These benefits can provide financial support during a difficult time, but the application process can be complex and time-consuming.

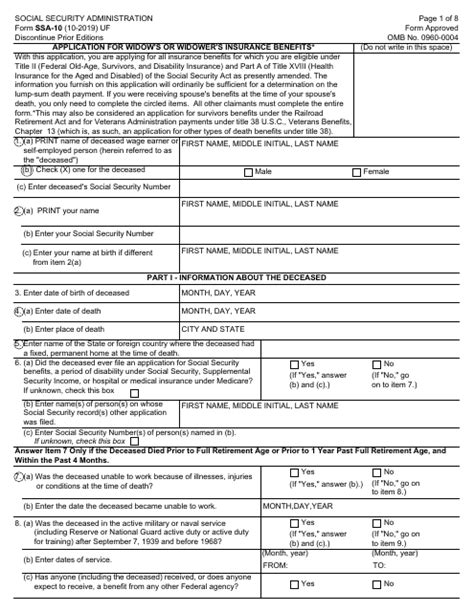

Understanding the SSA-10 Form

Before we dive into the step-by-step guide, let's take a closer look at the SSA-10 form and its various sections.

The SSA-10 form is divided into several sections, each of which requires you to provide specific information about yourself and the deceased worker. The sections include:

- Section 1: Information about the deceased worker

- Section 2: Information about you (the applicant)

- Section 3: Information about your relationship to the deceased worker

- Section 4: Information about your work history and income

- Section 5: Information about your benefits and payments

Section 1: Information about the Deceased Worker

In this section, you'll need to provide information about the deceased worker, including their name, Social Security number, date of birth, and date of death.

You'll also need to provide information about the deceased worker's employment history, including their occupation, employer, and dates of employment.

Section 2: Information about You (the Applicant)

In this section, you'll need to provide information about yourself, including your name, Social Security number, date of birth, and address.

You'll also need to provide information about your relationship to the deceased worker, including your marriage certificate or proof of parental relationship.

Section 3: Information about Your Relationship to the Deceased Worker

In this section, you'll need to provide information about your relationship to the deceased worker, including your marriage certificate or proof of parental relationship.

You'll also need to provide information about your dependent children, if applicable.

Section 4: Information about Your Work History and Income

In this section, you'll need to provide information about your work history and income, including your occupation, employer, and dates of employment.

You'll also need to provide information about your income, including your annual salary and any other sources of income.

Section 5: Information about Your Benefits and Payments

In this section, you'll need to provide information about your benefits and payments, including any other benefits you're receiving or have received in the past.

You'll also need to provide information about your bank account and payment preferences.

Step-by-Step Guide to Filling Out the SSA-10 Form

Now that we've broken down the SSA-10 form and its various sections, let's take a step-by-step look at how to fill it out accurately and efficiently.

- Start by gathering all the necessary documents and information, including the deceased worker's Social Security number, date of birth, and date of death.

- Fill out Section 1, providing information about the deceased worker, including their name, Social Security number, date of birth, and date of death.

- Fill out Section 2, providing information about yourself, including your name, Social Security number, date of birth, and address.

- Fill out Section 3, providing information about your relationship to the deceased worker, including your marriage certificate or proof of parental relationship.

- Fill out Section 4, providing information about your work history and income, including your occupation, employer, and dates of employment.

- Fill out Section 5, providing information about your benefits and payments, including any other benefits you're receiving or have received in the past.

- Review your application carefully to ensure you've provided all the necessary information and documentation.

- Sign and date your application, and have it witnessed by a notary public, if necessary.

Common Mistakes to Avoid When Filling Out the SSA-10 Form

When filling out the SSA-10 form, it's essential to avoid common mistakes that can delay or deny your application. Here are some common mistakes to avoid:

- Incomplete or inaccurate information

- Missing or incomplete documentation

- Failure to sign and date the application

- Failure to have the application witnessed by a notary public, if necessary

Conclusion

Filling out the SSA-10 form can be a complex and time-consuming process, but by following this step-by-step guide, you can ensure you provide all the necessary information and documentation accurately and efficiently. Remember to avoid common mistakes, and don't hesitate to seek help if you need it.

By following these steps and avoiding common mistakes, you can ensure a smooth and successful application process and receive the benefits you're eligible for.

What is the SSA-10 form used for?

+The SSA-10 form is used to apply for survivor benefits, which are available to the spouses, children, and parents of deceased workers who were insured under Social Security.

What information do I need to provide on the SSA-10 form?

+You'll need to provide information about the deceased worker, yourself, your relationship to the deceased worker, your work history and income, and your benefits and payments.

How do I avoid common mistakes when filling out the SSA-10 form?

+Avoid incomplete or inaccurate information, missing or incomplete documentation, failure to sign and date the application, and failure to have the application witnessed by a notary public, if necessary.