Completing a Form 1007 appraisal report is a crucial step in the mortgage lending process, as it provides lenders with an independent and unbiased opinion of a property's value. For appraisers, navigating the complexities of this report can be daunting, especially considering the strict guidelines and regulations that govern its completion. In this article, we will delve into five essential tips for completing a Form 1007 appraisal report, highlighting the key elements that ensure accuracy, compliance, and professionalism.

Understanding the Form 1007 Appraisal Report

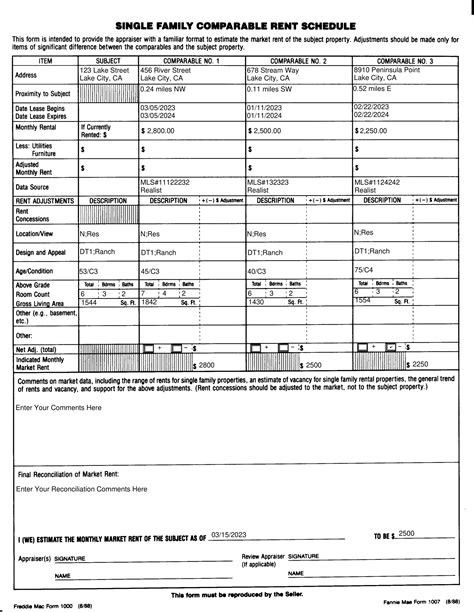

Before diving into the tips, it's essential to understand the purpose and scope of the Form 1007 appraisal report. This report is used for single-family dwellings and provides a detailed analysis of the property's value, including its physical characteristics, location, and market conditions. The report is typically required for mortgage lending transactions, including purchases, refinances, and home equity loans.

Tip 1: Ensure Accurate Property Identification

Accurate property identification is critical to the appraisal process. Ensure that the property address, legal description, and tax parcel number are correctly stated in the report. Double-check the information with the client, local government records, or other reliable sources to avoid errors.

Best Practice:

- Verify the property's physical address and location.

- Confirm the property's legal description and tax parcel number.

- Document the property's characteristics, including age, size, and amenities.

Tip 2: Provide a Detailed Property Description

A thorough property description is essential to understanding the property's value. Provide a detailed description of the property's physical characteristics, including its age, size, materials, and condition. Include information about the property's amenities, such as appliances, fixtures, and upgrades.

Best Practice:

- Document the property's exterior and interior characteristics.

- Note the property's condition, including any needed repairs or defects.

- Describe the property's amenities and upgrades.

Tip 3: Analyze the Market and Neighborhood

A comprehensive market and neighborhood analysis is crucial to determining the property's value. Research the local market conditions, including recent sales, listings, and trends. Analyze the neighborhood's characteristics, including its location, demographics, and amenities.

Best Practice:

- Research recent sales and listings in the neighborhood.

- Analyze the local market trends and conditions.

- Document the neighborhood's characteristics and amenities.

Tip 4: Calculate the Property's Value

Calculating the property's value is the appraiser's ultimate goal. Use a combination of methods, including the sales comparison approach, income approach, and cost approach, to estimate the property's value. Ensure that the calculation is well-supported by market data and analysis.

Best Practice:

- Use a combination of methods to estimate the property's value.

- Ensure that the calculation is well-supported by market data and analysis.

- Document the calculation and supporting data.

Tip 5: Ensure Compliance with Regulatory Requirements

Compliance with regulatory requirements is essential to avoiding penalties and ensuring the report's credibility. Familiarize yourself with the Uniform Standards of Professional Appraisal Practice (USPAP) and other relevant regulations. Ensure that the report meets the required standards and guidelines.

Best Practice:

- Familiarize yourself with USPAP and other relevant regulations.

- Ensure that the report meets the required standards and guidelines.

- Document compliance with regulatory requirements.

By following these five tips, appraisers can ensure that their Form 1007 appraisal reports are accurate, compliant, and professional. Remember to stay up-to-date with regulatory requirements and best practices to maintain the highest level of quality and integrity in your work.

What is the purpose of the Form 1007 appraisal report?

+The Form 1007 appraisal report is used to provide an independent and unbiased opinion of a property's value for mortgage lending transactions.

What are the key elements of the Form 1007 appraisal report?

+The key elements of the Form 1007 appraisal report include accurate property identification, a detailed property description, market and neighborhood analysis, calculation of the property's value, and compliance with regulatory requirements.

What are the best practices for completing the Form 1007 appraisal report?

+Best practices include verifying property information, documenting the property's characteristics and amenities, researching market trends and conditions, using a combination of methods to estimate value, and ensuring compliance with regulatory requirements.