Crowdfunding has become a popular way for startups and small businesses to raise capital, but it's essential to comply with the Securities and Exchange Commission's (SEC) regulations. One crucial aspect of crowdfunding is the SEC Form C, also known as the Crowdfunding Disclosure Requirements. In this article, we'll delve into the world of crowdfunding and explore the SEC Form C, its importance, and what it entails.

The Rise of Crowdfunding

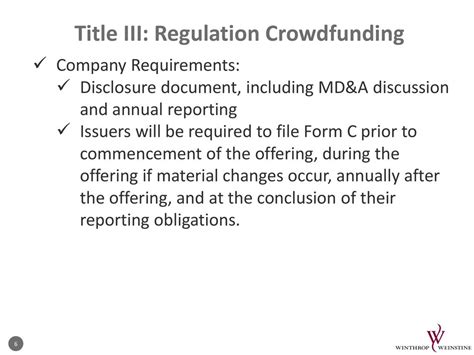

Crowdfunding has revolutionized the way companies raise funds, offering a platform for entrepreneurs to connect with investors and bring their ideas to life. With the passage of the Jumpstart Our Business Startups (JOBS) Act in 2012, the SEC introduced rules to regulate crowdfunding, ensuring that investors are protected and that companies provide transparent information. The SEC Form C is a critical component of this regulatory framework.

What is SEC Form C?

The SEC Form C is a disclosure document that crowdfunding issuers must file with the SEC. It provides essential information about the company, its financial condition, and the terms of the crowdfunding offering. The form is designed to help investors make informed decisions about investing in the company.

Key Components of SEC Form C

The SEC Form C is a comprehensive document that requires crowdfunding issuers to provide detailed information about their company, including:

- Company Description: A brief overview of the company, its business, and its products or services.

- Financial Information: Financial statements, such as balance sheets and income statements, that provide insight into the company's financial condition.

- Management Team: Information about the company's management team, including their experience and qualifications.

- Business Plan: A detailed description of the company's business plan, including its marketing strategy, revenue projections, and use of proceeds.

- Risk Factors: A discussion of the risks associated with investing in the company, including market risks, regulatory risks, and operational risks.

Filing Requirements for SEC Form C

Crowdfunding issuers must file the SEC Form C with the SEC at least 21 days before the start of the crowdfunding campaign. The form must be filed electronically through the SEC's EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system.

What Happens After Filing SEC Form C?

After filing the SEC Form C, the crowdfunding issuer must wait for the SEC's review and approval. The SEC will review the form to ensure that it meets the required disclosure standards. Once approved, the issuer can begin its crowdfunding campaign.

Benefits of SEC Form C

The SEC Form C provides several benefits to both crowdfunding issuers and investors. Some of the key benefits include:

- Transparency: The form provides essential information about the company, its financial condition, and the terms of the crowdfunding offering.

- Accountability: The form holds crowdfunding issuers accountable for the information they provide, ensuring that they comply with the SEC's regulations.

- Investor Protection: The form helps investors make informed decisions about investing in the company, reducing the risk of investment losses.

Common Mistakes to Avoid When Filing SEC Form C

When filing the SEC Form C, crowdfunding issuers must avoid common mistakes that can delay or even prevent the approval of their crowdfunding campaign. Some of the most common mistakes include:

- Incomplete or inaccurate information

- Failure to provide required financial statements

- Insufficient disclosure of risk factors

- Failure to file the form electronically through EDGAR

Best Practices for Filing SEC Form C

To ensure a smooth filing process, crowdfunding issuers should follow best practices when preparing and filing the SEC Form C. Some of the best practices include:

- Seek professional advice from a lawyer or accountant

- Ensure accuracy and completeness of information

- Provide clear and concise disclosure of risk factors

- File the form electronically through EDGAR

Conclusion

The SEC Form C is a critical component of the crowdfunding regulatory framework, providing essential information about crowdfunding issuers and their offerings. By understanding the requirements and benefits of the SEC Form C, crowdfunding issuers can ensure compliance with the SEC's regulations and provide transparent information to investors. Remember, accurate and complete disclosure is key to a successful crowdfunding campaign.

What is the purpose of SEC Form C?

+The purpose of SEC Form C is to provide essential information about the company, its financial condition, and the terms of the crowdfunding offering.

Who needs to file SEC Form C?

+Crowdfunding issuers must file SEC Form C with the SEC at least 21 days before the start of the crowdfunding campaign.

What are the common mistakes to avoid when filing SEC Form C?

+Common mistakes to avoid include incomplete or inaccurate information, failure to provide required financial statements, insufficient disclosure of risk factors, and failure to file the form electronically through EDGAR.