When a disaster strikes, it can have a devastating impact on individuals and communities. To help alleviate some of the financial burdens, the government provides various forms of relief, including tax-free payments. Form 8915-F is used to report qualifying disaster relief payments that are exempt from income tax. In this article, we will delve into the details of Form 8915-F, its purpose, and how to complete it.

The Importance of Disaster Relief Payments

Disasters, such as hurricanes, wildfires, and floods, can cause significant damage to property and disrupt businesses. In the aftermath of a disaster, individuals and businesses may receive various forms of assistance, including payments from government agencies, insurance companies, and charitable organizations. These payments can help cover essential expenses, such as housing, food, and medical care.

However, not all disaster relief payments are created equal. Some payments may be taxable, while others are exempt from income tax. This is where Form 8915-F comes in – to report qualifying disaster relief payments that are exempt from income tax.

What is Form 8915-F?

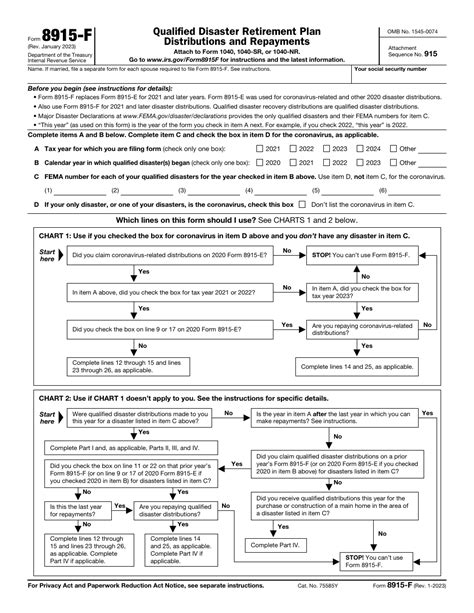

Form 8915-F is a tax form used to report qualifying disaster relief payments that are exempt from income tax. The form is used to calculate the amount of payments that are not subject to income tax and to claim any necessary adjustments to the taxpayer's income tax liability.

Who Should File Form 8915-F?

Individuals and businesses that receive disaster relief payments should file Form 8915-F if the payments meet certain criteria. To qualify, the payments must be:

- Made to alleviate the effects of a qualified disaster.

- Made to an individual or business affected by the disaster.

- Not subject to income tax under the Internal Revenue Code.

What Payments Qualify as Disaster Relief Payments?

The following types of payments may qualify as disaster relief payments:

- Payments from government agencies, such as the Federal Emergency Management Agency (FEMA).

- Payments from insurance companies, such as insurance proceeds for damaged or destroyed property.

- Payments from charitable organizations, such as donations to help with disaster relief efforts.

How to Complete Form 8915-F

To complete Form 8915-F, you will need to provide the following information:

- Your name and taxpayer identification number (TIN).

- The type of disaster relief payment you received (e.g., government agency, insurance company, charitable organization).

- The date and amount of the payment.

- A description of the payment, including the purpose of the payment.

Calculating the Tax-Free Amount

To calculate the tax-free amount, you will need to complete Part II of Form 8915-F. This involves subtracting any amount that is subject to income tax from the total amount of the payment.

Adjustments to Income Tax Liability

If the tax-free amount is greater than zero, you may need to make adjustments to your income tax liability. This involves completing Part III of Form 8915-F.

Additional Resources

For more information on Form 8915-F and disaster relief payments, you can visit the IRS website or consult with a tax professional.

Common Questions and Answers

Here are some common questions and answers about Form 8915-F:

Q: What is the deadline for filing Form 8915-F? A: The deadline for filing Form 8915-F is the same as the deadline for filing your income tax return (typically April 15th).

Q: Can I claim a refund for disaster relief payments that were previously reported as taxable income? A: Yes, you may be able to claim a refund if you previously reported disaster relief payments as taxable income.

Q: Can I file Form 8915-F electronically? A: Yes, you can file Form 8915-F electronically through the IRS website or through a tax preparation software.

Conclusion

Form 8915-F is an important tax form that helps individuals and businesses report qualifying disaster relief payments that are exempt from income tax. By understanding the purpose and requirements of Form 8915-F, you can ensure that you are taking advantage of the tax-free benefits available to you. If you have received disaster relief payments, consult with a tax professional to determine if you need to file Form 8915-F.

Encourage Engagement

Have you received disaster relief payments and are unsure about how to report them on your tax return? Share your questions and concerns in the comments below. Don't forget to like and share this article with others who may be affected by disasters.

FAQ Section

What is the purpose of Form 8915-F?

+Form 8915-F is used to report qualifying disaster relief payments that are exempt from income tax.

Who should file Form 8915-F?

+Individuals and businesses that receive disaster relief payments should file Form 8915-F if the payments meet certain criteria.

What payments qualify as disaster relief payments?

+Payments from government agencies, insurance companies, and charitable organizations may qualify as disaster relief payments.