As a non-resident of New Jersey, navigating the tax system can be overwhelming, especially when it comes to filing taxes. One of the most important forms for non-residents is the NJ Form 1040NR, which is used to report income earned from sources within the state. In this article, we will provide a comprehensive guide to help non-residents understand the process of filing NJ Form 1040NR, including who needs to file, what income is reportable, and how to complete the form.

Who Needs to File NJ Form 1040NR?

NJ Form 1040NR is used by non-residents who have earned income from New Jersey sources, such as wages, self-employment income, or investment income. This includes individuals who are not residents of New Jersey but have earned income from the state, as well as residents of other states who have earned income from New Jersey sources.

Some examples of individuals who may need to file NJ Form 1040NR include:

- Non-residents who work in New Jersey but live in another state

- Non-residents who own rental property in New Jersey

- Non-residents who have investments in New Jersey businesses or real estate

- Non-residents who have earned income from a New Jersey source, such as a trust or estate

What Income is Reportable on NJ Form 1040NR?

Not all income earned by non-residents is reportable on NJ Form 1040NR. Only income earned from New Jersey sources is subject to taxation. This includes:

- Wages earned from a job in New Jersey

- Self-employment income earned from a business located in New Jersey

- Investment income earned from New Jersey sources, such as dividends or interest

- Rent or royalty income earned from property located in New Jersey

- Income earned from a trust or estate located in New Jersey

Some types of income are not reportable on NJ Form 1040NR, including:

- Income earned from sources outside of New Jersey

- Tax-exempt income, such as Social Security benefits or interest earned on tax-exempt bonds

- Income earned by a non-resident who is a member of the armed forces or a diplomatic corps

Types of Income that are Subject to Taxation

- Wages: Wages earned from a job in New Jersey are subject to taxation, regardless of where the employer is located.

- Self-Employment Income: Self-employment income earned from a business located in New Jersey is subject to taxation.

- Investment Income: Investment income earned from New Jersey sources, such as dividends or interest, is subject to taxation.

- Rent or Royalty Income: Rent or royalty income earned from property located in New Jersey is subject to taxation.

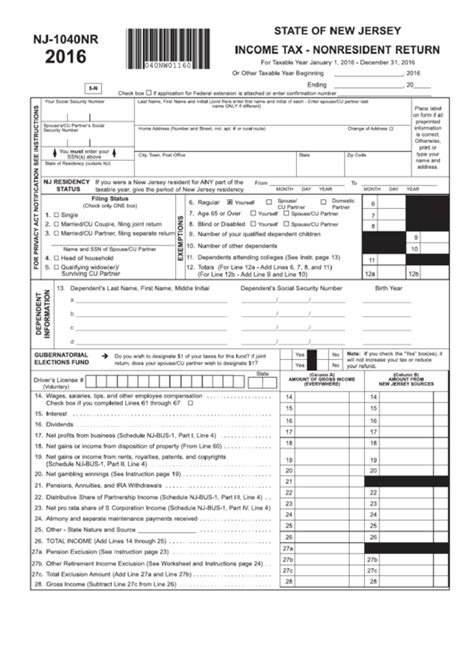

How to Complete NJ Form 1040NR

Completing NJ Form 1040NR requires careful attention to detail and accuracy. Here are the steps to follow:

- Gather all necessary documentation, including W-2 forms, 1099 forms, and any other relevant tax documents.

- Determine which income is reportable on NJ Form 1040NR, using the guidelines outlined above.

- Complete the form by reporting all reportable income and claiming any applicable deductions and credits.

- Calculate the tax owed, using the New Jersey tax rates and brackets.

- Sign and date the form, and attach all required documentation.

Required Documentation

- W-2 forms for all wages earned from New Jersey sources

- 1099 forms for all self-employment income and investment income earned from New Jersey sources

- Other relevant tax documents, such as Schedule C or Schedule E

Tax Rates and Brackets

New Jersey has a progressive tax system, with tax rates ranging from 5.525% to 10.75%. The tax rates and brackets for non-residents are as follows:

- 5.525% on the first $20,000 of taxable income

- 6.37% on taxable income between $20,001 and $35,000

- 6.92% on taxable income between $35,001 and $40,000

- 7.65% on taxable income between $40,001 and $75,000

- 8.25% on taxable income between $75,001 and $500,000

- 10.75% on taxable income over $500,000

Payment Options

Non-residents who owe tax on NJ Form 1040NR have several payment options:

- Electronic payment through the New Jersey Division of Taxation's website

- Check or money order made payable to the State of New Jersey

- Credit card payment through the New Jersey Division of Taxation's website

Penalties and Interest

Non-residents who fail to file NJ Form 1040NR or pay tax owed by the deadline may be subject to penalties and interest. The penalties and interest rates are as follows:

- Late filing penalty: 5% of the tax owed, plus interest

- Late payment penalty: 0.5% of the tax owed, plus interest

- Interest rate: 12% per annum

Conclusion

Filing NJ Form 1040NR can be a complex and time-consuming process, but with the right guidance and support, non-residents can navigate the system with ease. By understanding who needs to file, what income is reportable, and how to complete the form, non-residents can ensure compliance with New Jersey tax laws and avoid penalties and interest.

Who needs to file NJ Form 1040NR?

+NJ Form 1040NR is used by non-residents who have earned income from New Jersey sources, such as wages, self-employment income, or investment income.

What income is reportable on NJ Form 1040NR?

+Only income earned from New Jersey sources is reportable on NJ Form 1040NR, including wages, self-employment income, investment income, and rent or royalty income.

How do I complete NJ Form 1040NR?

+Completing NJ Form 1040NR requires gathering all necessary documentation, determining which income is reportable, and calculating the tax owed using the New Jersey tax rates and brackets.