Filing taxes can be a daunting task, especially for those who are new to the process or are unsure of the specific requirements for their state. As a resident of Virginia, it's essential to understand the ins and outs of the Virginia Tax Form 760, which is the state's individual income tax return form. In this article, we will provide a step-by-step guide on how to file the Virginia Tax Form 760, making the process smoother and less overwhelming.

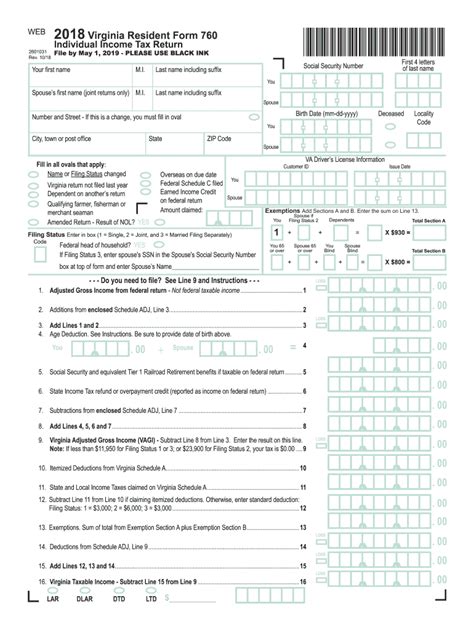

The Virginia Tax Form 760 is a crucial document that requires attention to detail and accuracy. It's used to report an individual's income, deductions, and credits, and to calculate the amount of tax owed to the state. Failure to file the form correctly or on time can result in penalties and interest, so it's essential to get it right.

Who Needs to File the Virginia Tax Form 760?

Before we dive into the step-by-step guide, it's essential to determine if you need to file the Virginia Tax Form 760. If you're a resident of Virginia and have earned income from any source, you're required to file a state tax return. This includes:

- Residents with taxable income exceeding $11,950 (single filers) or $23,900 (joint filers)

- Residents with Virginia Adjusted Gross Income (VAGI) exceeding $11,950 (single filers) or $23,900 (joint filers)

- Residents who want to claim a refund

- Residents who have made estimated tax payments

- Residents who have tax withheld from any source

What You'll Need to File the Virginia Tax Form 760

To ensure a smooth filing process, gather the following documents and information:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's Social Security number or ITIN (if filing jointly)

- Your dependents' Social Security numbers or ITINs (if claiming)

- Your W-2 forms from all employers

- Your 1099 forms for freelance work, self-employment income, or other income

- Your interest statements from banks and investments (1099-INT)

- Your dividend statements from investments (1099-DIV)

- Your capital gains statements from investments (1099-B)

- Your charitable donation receipts

- Your medical expense receipts

- Your mortgage interest statements (1098)

- Your property tax statements

Step-by-Step Guide to Filing the Virginia Tax Form 760

Now that you have all the necessary documents, it's time to start filing the Virginia Tax Form 760. Follow these steps:

Step 1: Determine Your Filing Status

Your filing status affects your tax rates, deductions, and credits. Choose from the following filing statuses:

- Single

- Married Filing Jointly

- Married Filing Separately

- Head of Household

- Qualifying Widow(er)

Step 2: Complete the Header Information

Enter your name, address, and Social Security number or ITIN in the header section of the form. If filing jointly, enter your spouse's information as well.

Step 3: Report Your Income

Report all your income from various sources, including:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividends

- Capital gains

- Other income (such as alimony, prizes, and awards)

Step 4: Claim Your Deductions and Credits

Claim your deductions and credits to reduce your taxable income. Some common deductions and credits include:

- Standard deduction

- Itemized deductions (such as mortgage interest, property taxes, and charitable donations)

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits

Step 5: Calculate Your Tax Liability

Calculate your tax liability by multiplying your taxable income by the applicable tax rate. You can use the Virginia tax tables or tax calculator to determine your tax liability.

Step 6: Pay Any Tax Due or Claim a Refund

If you owe tax, pay it by the deadline to avoid penalties and interest. If you're due a refund, choose from the following options:

- Direct deposit into your bank account

- Paper check

- Prepaid debit card

Additional Tips and Reminders

- File your return on time to avoid penalties and interest.

- Keep a copy of your return and supporting documents for at least three years.

- Consider hiring a tax professional or using tax software to ensure accuracy and maximize your refund.

- Take advantage of free filing options, such as the Virginia Free File program, if you meet the eligibility requirements.

By following this step-by-step guide, you'll be able to file the Virginia Tax Form 760 with confidence and accuracy. Remember to stay organized, take your time, and seek help if needed.

What is the deadline for filing the Virginia Tax Form 760?

+The deadline for filing the Virginia Tax Form 760 is May 1st. However, if you need more time, you can file for an automatic six-month extension by submitting Form 760IP by the original deadline.

Can I e-file the Virginia Tax Form 760?

+Yes, you can e-file the Virginia Tax Form 760 through the Virginia Tax Authority's website or through tax software providers.

What is the penalty for late filing the Virginia Tax Form 760?

+The penalty for late filing the Virginia Tax Form 760 is 6% of the unpaid tax due, plus interest and any applicable fees.

We hope this article has provided you with a comprehensive guide on how to file the Virginia Tax Form 760. Remember to stay informed, and don't hesitate to reach out to a tax professional or the Virginia Tax Authority if you have any questions or concerns. Share your experiences or ask questions in the comments below!