Losing a loved one is never easy, and navigating the complexities of estate administration can be overwhelming. In Iowa, the Small Estate Affidavit form provides a simplified process for settling small estates, helping to alleviate some of the burden on grieving families. In this article, we will guide you through the process of filling out the Iowa Small Estate Affidavit form, making it easier for you to navigate this challenging time.

Understanding the Iowa Small Estate Affidavit Form

The Iowa Small Estate Affidavit form is a sworn statement used to transfer the assets of a deceased person's estate without the need for probate. This form is typically used when the estate's value is below a certain threshold, currently set at $50,000 in Iowa. By using this form, you can avoid the time-consuming and costly probate process, allowing you to focus on grieving and healing.

Eligibility Requirements

Before filling out the Iowa Small Estate Affidavit form, you must ensure that the estate meets the eligibility requirements. These include:

- The estate's total value is $50,000 or less.

- The deceased person did not have any outstanding debts or liabilities.

- The deceased person did not own any real property.

- The deceased person's assets can be transferred to the beneficiaries without the need for probate.

Step-by-Step Guide to Filling Out the Iowa Small Estate Affidavit Form

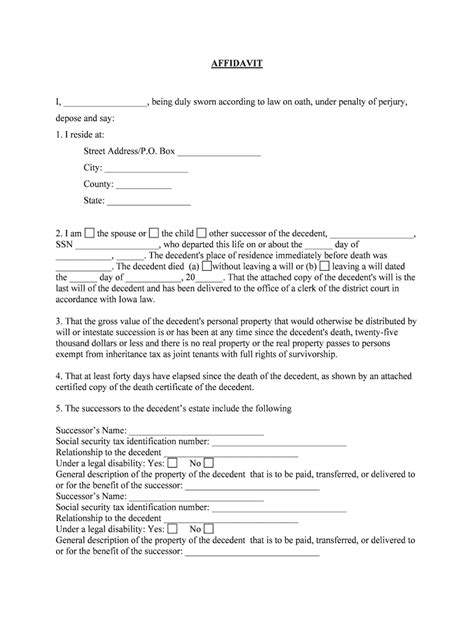

Filling out the Iowa Small Estate Affidavit form requires careful attention to detail. Here's a step-by-step guide to help you complete the form:

- Section 1: Decedent's Information

- Enter the deceased person's name, date of birth, and date of death.

- Provide the deceased person's Social Security number (if applicable).

- Section 2: Estate Information

- List the assets included in the estate, including bank accounts, stocks, bonds, and other personal property.

- Provide the estimated value of each asset.

- Section 3: Beneficiaries

- List the names and addresses of the beneficiaries, including their relationship to the deceased person.

- Specify the percentage of the estate each beneficiary is entitled to.

- Section 4: Affidavit

- Sign and date the affidavit, swearing that the information provided is true and accurate.

- Attach a notarized signature to the affidavit.

Additional Requirements

In addition to completing the Iowa Small Estate Affidavit form, you may need to provide additional documentation, such as:

- A certified copy of the death certificate.

- Proof of the deceased person's identity (e.g., driver's license, passport).

- Documentation of the estate's assets, such as bank statements or stock certificates.

Common Mistakes to Avoid

When filling out the Iowa Small Estate Affidavit form, it's essential to avoid common mistakes that can delay or invalidate the process. These include:

- Inaccurate or incomplete information.

- Failure to sign and notarize the affidavit.

- Insufficient documentation of the estate's assets.

Seeking Professional Help

If you're unsure about filling out the Iowa Small Estate Affidavit form or need help with the estate administration process, consider seeking the advice of a qualified attorney or estate planning professional. They can guide you through the process, ensuring that everything is done correctly and efficiently.

Conclusion: Simplifying the Estate Administration Process

Losing a loved one is never easy, but the Iowa Small Estate Affidavit form can help simplify the estate administration process. By following the steps outlined in this article and avoiding common mistakes, you can ensure a smooth and efficient transfer of the estate's assets to the beneficiaries. Remember to seek professional help if needed, and don't hesitate to reach out to us with any questions or concerns.

We invite you to share your thoughts and experiences with the Iowa Small Estate Affidavit form in the comments section below. Your input can help others navigate this challenging process.

FAQ Section:

What is the Iowa Small Estate Affidavit form used for?

+The Iowa Small Estate Affidavit form is used to transfer the assets of a deceased person's estate without the need for probate.

What are the eligibility requirements for using the Iowa Small Estate Affidavit form?

+The estate's total value must be $50,000 or less, the deceased person must not have had any outstanding debts or liabilities, and the deceased person must not have owned any real property.

Can I use the Iowa Small Estate Affidavit form if the deceased person had outstanding debts or liabilities?

+No, the Iowa Small Estate Affidavit form is only available for estates with no outstanding debts or liabilities.