Filling out IRS Form 433-F can be a daunting task, especially for those who are not familiar with the process. The form is used to determine a taxpayer's ability to pay their tax debt, and it requires providing detailed financial information. In this article, we will guide you through the process of filling out IRS Form 433-F correctly, highlighting the key sections and providing tips to help you avoid common mistakes.

Understanding the Purpose of IRS Form 433-F

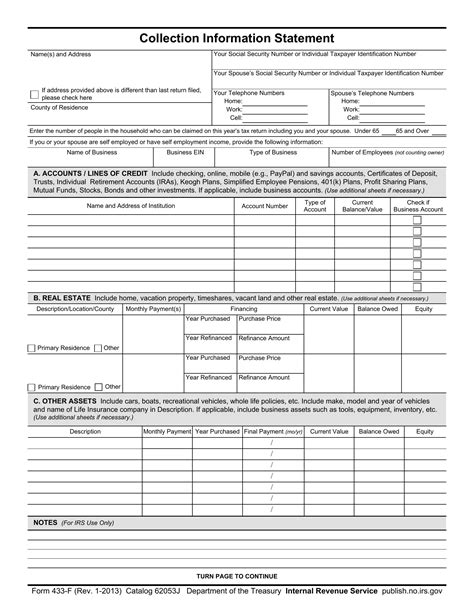

IRS Form 433-F is a Collection Information Statement used by the IRS to evaluate a taxpayer's financial situation and determine their ability to pay their tax debt. The form is typically requested when a taxpayer owes back taxes and is unable to pay the full amount at once. By filling out the form, taxpayers can provide the IRS with a clear picture of their financial situation, which can help to determine a suitable payment plan.

Gathering Required Documents and Information

Before filling out IRS Form 433-F, it's essential to gather all required documents and information. This includes:

- Pay stubs

- Bank statements

- Investment statements

- Loan documents

- Credit card statements

- Mortgage or rent statements

- Utility bills

Having all the necessary documents will help you to accurately complete the form and provide a comprehensive picture of your financial situation.

Section 1: Personal and Business Information

The first section of the form requires you to provide personal and business information, including your name, address, social security number, and employer identification number (if applicable).

Section 2: Income and Expenses

In this section, you will need to provide detailed information about your income and expenses. This includes:

- Gross income from all sources

- Net income from self-employment

- Total monthly expenses

- Essential expenses, such as rent/mortgage, utilities, and food

- Non-essential expenses, such as entertainment and hobbies

It's essential to accurately complete this section, as it will help the IRS to determine your ability to pay your tax debt.

Section 3: Assets and Liabilities

In this section, you will need to list all your assets, including:

- Bank accounts

- Investments

- Retirement accounts

- Vehicles

- Real estate

You will also need to list all your liabilities, including:

- Credit card debt

- Loans

- Mortgages

Section 4: Business Information (If Applicable)

If you are self-employed or own a business, you will need to provide additional information, including:

- Business income and expenses

- Business assets and liabilities

- Business tax returns

Section 5: Payment Proposal

In this section, you will need to propose a payment plan that you believe is realistic based on your financial situation. This may include a lump-sum payment or a monthly payment plan.

Section 6: Certification and Signature

The final section requires you to certify that the information provided is accurate and complete. You will also need to sign and date the form.

Tips for Filling Out IRS Form 433-F Correctly

Here are some tips to help you fill out IRS Form 433-F correctly:

- Be accurate and honest when providing financial information

- Use the correct forms and schedules

- Attach all required supporting documents

- Keep a copy of the completed form for your records

- Seek professional help if you are unsure about any part of the process

By following these tips and carefully completing each section of the form, you can ensure that you fill out IRS Form 433-F correctly and avoid any potential delays or complications.

Common Mistakes to Avoid

Here are some common mistakes to avoid when filling out IRS Form 433-F:

- Inaccurate or incomplete financial information

- Failure to attach required supporting documents

- Incorrect or missing payment proposal

- Failure to sign and date the form

By avoiding these common mistakes, you can ensure that your form is processed quickly and efficiently.

What Happens After Submitting IRS Form 433-F

After submitting IRS Form 433-F, the IRS will review your financial information and determine a suitable payment plan. If your proposal is accepted, you will be required to make regular payments until your tax debt is paid in full.

If your proposal is rejected, you may be required to provide additional financial information or negotiate a different payment plan.

Conclusion

Filling out IRS Form 433-F can be a complex and time-consuming process. However, by understanding the purpose of the form, gathering required documents and information, and avoiding common mistakes, you can ensure that you fill out the form correctly and take the first step towards resolving your tax debt. If you are unsure about any part of the process, it's always best to seek professional help.

What is IRS Form 433-F used for?

+IRS Form 433-F is used to determine a taxpayer's ability to pay their tax debt. It requires providing detailed financial information, which is used to determine a suitable payment plan.

What documents do I need to fill out IRS Form 433-F?

+You will need to gather all required documents and information, including pay stubs, bank statements, investment statements, loan documents, credit card statements, and utility bills.

How long does it take to process IRS Form 433-F?

+The processing time for IRS Form 433-F can vary depending on the complexity of the case and the workload of the IRS. It's best to check with the IRS for an estimated processing time.