Managing delinquent accounts and non-payment can be a daunting task for businesses, especially when it comes to navigating the complexities of credit reporting. One crucial tool in this process is the Acrsi Non-Payment Form. In this article, we will delve into the world of credit reporting, explore the importance of the Acrsi Non-Payment Form, and provide a comprehensive guide on how to use it effectively.

Understanding Credit Reporting and Non-Payment

Credit reporting plays a vital role in the financial ecosystem, enabling lenders to assess the creditworthiness of borrowers. When a borrower fails to make payments, it can significantly impact their credit score. Non-payment can occur due to various reasons, such as financial difficulties, disputes, or simply forgetting to make a payment. As a creditor, it is essential to handle non-payment situations efficiently and effectively.

The Consequences of Non-Payment

Non-payment can have severe consequences for both the borrower and the creditor. For borrowers, non-payment can lead to:

- Negative credit reporting

- Decreased credit score

- Higher interest rates

- Collection agency involvement

For creditors, non-payment can result in:

- Financial losses

- Increased administrative burden

- Damage to reputation

The Acrsi Non-Payment Form: An Overview

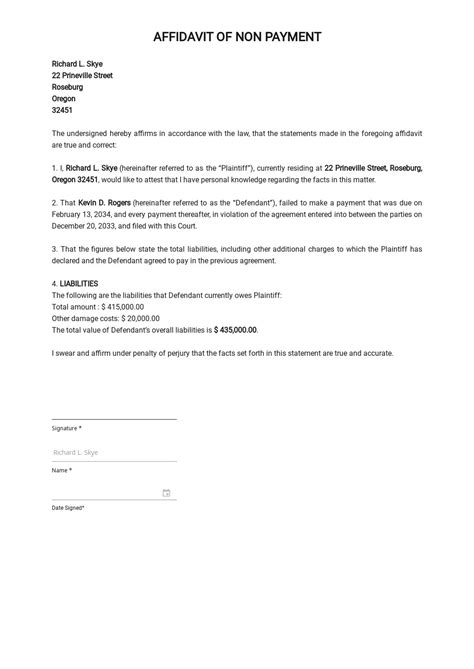

The Acrsi Non-Payment Form is a standardized document used to report non-payment to credit bureaus. The form provides a structured format for creditors to report delinquent accounts, ensuring that all necessary information is included. The Acrsi Non-Payment Form typically includes:

- Borrower's personal and contact information

- Account details, including account number and balance

- Payment history, including missed payments and dates

- Reason for non-payment (if known)

Benefits of Using the Acrsi Non-Payment Form

Using the Acrsi Non-Payment Form offers several benefits for creditors, including:

- Streamlined reporting process

- Improved accuracy and consistency

- Enhanced credit reporting compliance

- Simplified dispute resolution

How to Complete the Acrsi Non-Payment Form

To complete the Acrsi Non-Payment Form, follow these steps:

- Gather required information, including borrower's personal and account details.

- Determine the reason for non-payment (if known).

- Complete the form accurately and thoroughly, ensuring all required fields are filled.

- Review the form for errors or omissions.

- Submit the form to the credit bureau(s) as required.

Common Mistakes to Avoid

When completing the Acrsi Non-Payment Form, be aware of common mistakes to avoid:

- Inaccurate or incomplete information

- Failure to include required documentation

- Inconsistent or contradictory information

- Delayed or untimely submission

Best Practices for Managing Non-Payment

Effective non-payment management is crucial for minimizing financial losses and maintaining a positive reputation. Best practices include:

- Establishing clear payment terms and conditions

- Regularly reviewing and updating credit reporting information

- Implementing a fair and consistent dispute resolution process

- Maintaining accurate and detailed records

Technology Solutions for Non-Payment Management

Technology can play a significant role in streamlining non-payment management. Consider implementing:

- Automated credit reporting software

- Online payment portals and reminders

- Customer relationship management (CRM) systems

- Data analytics tools for tracking and predicting non-payment

Conclusion and Next Steps

In conclusion, the Acrsi Non-Payment Form is a valuable tool for creditors to report non-payment and maintain accurate credit reporting. By understanding the importance of credit reporting, completing the form accurately, and implementing best practices for non-payment management, creditors can minimize financial losses and maintain a positive reputation.

Take the next step by:

- Reviewing and updating your credit reporting processes

- Implementing technology solutions for non-payment management

- Establishing clear payment terms and conditions

- Providing excellent customer service to prevent disputes and non-payment

By following these steps and utilizing the Acrsi Non-Payment Form effectively, you can improve your credit reporting and non-payment management processes, ultimately benefiting your business and customers.

What is the purpose of the Acrsi Non-Payment Form?

+The Acrsi Non-Payment Form is used to report non-payment to credit bureaus, providing a standardized format for creditors to report delinquent accounts.

How do I complete the Acrsi Non-Payment Form?

+To complete the Acrsi Non-Payment Form, gather required information, determine the reason for non-payment (if known), complete the form accurately, and review for errors or omissions.

What are the consequences of non-payment for creditors?

+Non-payment can result in financial losses, increased administrative burden, and damage to reputation for creditors.