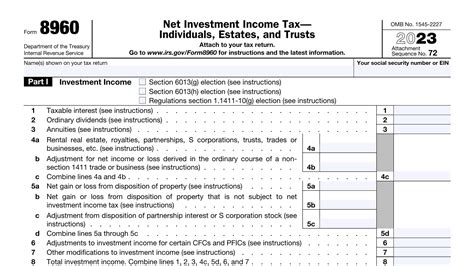

As the tax season approaches, individuals and businesses are gearing up to file their tax returns. One of the essential tax forms for certain taxpayers is Form 8960, also known as the Net Investment Income Tax (NIIT). In this article, we will discuss the importance of Form 8960, who needs to file it, and how to file it accurately using TurboTax.

Understanding Form 8960: Net Investment Income Tax

The Net Investment Income Tax (NIIT) is a 3.8% tax on certain types of investment income. It was introduced as part of the Affordable Care Act (ACA) to help fund healthcare reform. The NIIT applies to individuals, estates, and trusts with net investment income above certain thresholds.

Who Needs to File Form 8960?

You need to file Form 8960 if you have net investment income and your modified adjusted gross income (MAGI) exceeds the following thresholds:

- Single filers: $200,000

- Joint filers: $250,000

- Estates and trusts: $12,950

Net investment income includes:

- Interest, dividends, and capital gains

- Rent and royalty income

- Income from businesses involved in trading of financial instruments or commodities

Filing Form 8960 with TurboTax

TurboTax is a popular tax preparation software that makes it easy to file Form 8960 accurately. Here's a step-by-step guide to filing Form 8960 with TurboTax:

- Gather necessary documents: Collect all your tax-related documents, including your W-2s, 1099s, and investment statements.

- Create a TurboTax account: If you don't already have a TurboTax account, create one and sign in.

- Select the correct form: Choose Form 8960 from the list of available forms in TurboTax.

- Enter your investment income: Report your net investment income from various sources, such as interest, dividends, and capital gains.

- Calculate your NIIT: TurboTax will calculate your NIIT based on your net investment income and MAGI.

- Complete the form: Answer the questions and provide the required information to complete Form 8960.

- Review and submit: Review your form for accuracy and submit it to the IRS.

Tips for Filing Form 8960 with TurboTax

- Ensure accurate reporting: Report all your investment income accurately to avoid errors and potential penalties.

- Take advantage of deductions: Claim deductions for investment expenses, such as investment management fees, to reduce your NIIT.

- Keep records: Maintain records of your investment income and expenses to support your tax return.

Common Errors to Avoid When Filing Form 8960

When filing Form 8960, avoid the following common errors:

- Incorrect MAGI calculation: Ensure you calculate your MAGI correctly to determine if you need to file Form 8960.

- Incomplete reporting: Report all your investment income, including income from partnerships and S corporations.

- Incorrect NIIT calculation: Use the correct formula to calculate your NIIT to avoid errors.

Penalties for Failing to File Form 8960

Failing to file Form 8960 or paying the NIIT can result in penalties and interest. The IRS may impose:

- Late filing penalty: 5% of the unpaid tax for each month or part of a month, up to 25%

- Late payment penalty: 0.5% of the unpaid tax for each month or part of a month, up to 25%

- Interest: Interest on the unpaid tax, starting from the original due date

Conclusion

Filing Form 8960 can be a complex process, but using TurboTax can make it easier and more accurate. By following the steps outlined in this article and avoiding common errors, you can ensure you file your Form 8960 correctly and avoid penalties.

Share Your Experience

Have you filed Form 8960 with TurboTax? Share your experience and tips in the comments below.

What is the Net Investment Income Tax (NIIT)?

+The Net Investment Income Tax (NIIT) is a 3.8% tax on certain types of investment income, introduced as part of the Affordable Care Act (ACA) to help fund healthcare reform.

Who needs to file Form 8960?

+You need to file Form 8960 if you have net investment income and your modified adjusted gross income (MAGI) exceeds certain thresholds: $200,000 for single filers, $250,000 for joint filers, and $12,950 for estates and trusts.

How do I file Form 8960 with TurboTax?

+Follow the steps outlined in this article, including gathering necessary documents, creating a TurboTax account, selecting the correct form, entering your investment income, calculating your NIIT, completing the form, and reviewing and submitting it to the IRS.