As a self-employed individual or small business owner, you're likely familiar with the complexities of filing taxes. One of the most important tax forms for self-employed individuals is Schedule C (Form 1040), which reports your business income and expenses. In this article, we'll break down the ins and outs of Schedule C and explore how using TurboTax can simplify the process.

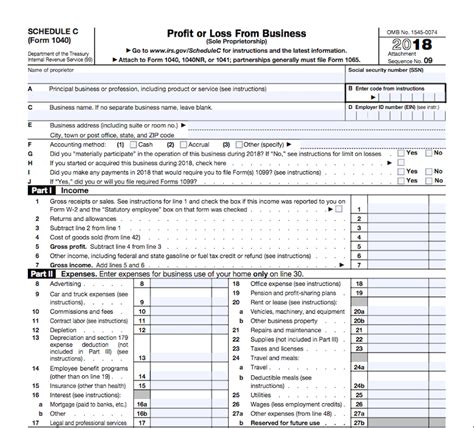

Whether you're a freelancer, independent contractor, or small business owner, Schedule C is a critical part of your tax return. It's used to calculate your business's net profit or loss, which is then reported on your personal tax return (Form 1040). The form is divided into several sections, including income, cost of goods sold, operating expenses, and other expenses.

Understanding Schedule C Sections

To accurately complete Schedule C, it's essential to understand each section and what types of income and expenses are reported.

Part I: Income

In this section, you'll report your business's gross income from various sources, such as:

- Sales of goods or services

- Rent or royalty income

- Interest income

- Dividend income

Part II: Cost of Goods Sold

If your business sells products, you'll need to calculate the cost of goods sold (COGS). This includes the direct costs of producing or purchasing the products you sell.

Part III: Operating Expenses

This section is where you'll report your business's operating expenses, such as:

- Salaries and wages

- Rent or utilities

- Insurance premiums

- Advertising expenses

Part IV: Other Expenses

In this section, you'll report any other business expenses not included in Part III, such as:

- Travel expenses

- Meals and entertainment

- Professional fees (e.g., accounting or legal fees)

Benefits of Using TurboTax for Schedule C

While Schedule C can be complex, using TurboTax can make the process much easier. Here are some benefits of using TurboTax:

- Easy data entry: TurboTax guides you through the Schedule C form, making it easy to enter your business income and expenses.

- Accurate calculations: TurboTax performs the calculations for you, reducing the risk of errors and ensuring you get the maximum refund you're eligible for.

- Industry-specific expenses: TurboTax provides a list of industry-specific expenses to help you identify deductions you may have missed.

- Audit support: If you're audited, TurboTax provides free audit support and guidance to help you navigate the process.

How to Use TurboTax for Schedule C

Using TurboTax for Schedule C is straightforward. Here's a step-by-step guide:

- Gather your business documents: Collect all your business income and expense records, including receipts, invoices, and bank statements.

- Create a TurboTax account: If you don't already have a TurboTax account, create one and choose the self-employed version.

- Follow the TurboTax prompts: Answer the questions and follow the prompts to enter your business income and expenses.

- Review and submit: Review your Schedule C form for accuracy and submit it to the IRS along with your Form 1040.

Common Schedule C Mistakes to Avoid

When completing Schedule C, it's essential to avoid common mistakes that can lead to errors or even an audit. Here are some mistakes to watch out for:

- Inaccurate income reporting: Make sure to report all your business income, including cash and credit transactions.

- Insufficient expense documentation: Keep accurate records of all your business expenses, including receipts and invoices.

- Incorrect expense categorization: Ensure you're categorizing your expenses correctly to avoid errors or audit flags.

By understanding Schedule C and using TurboTax, you can simplify the tax filing process and ensure you're taking advantage of all the deductions and credits you're eligible for. Remember to avoid common mistakes and keep accurate records to avoid errors or audit issues.

What is Schedule C, and who needs to file it?

+Schedule C is a tax form used to report business income and expenses. Self-employed individuals and small business owners need to file Schedule C as part of their personal tax return (Form 1040).

Can I use TurboTax for Schedule C if I have a complex business?

+Yes, TurboTax can handle complex businesses, including multiple income streams, expenses, and deductions. However, if you have a very complex business, you may want to consider consulting a tax professional or accountant.

What are some common deductions I can claim on Schedule C?

+Common deductions on Schedule C include business use of your home, business use of your car, travel expenses, meals and entertainment, and professional fees. Consult with a tax professional or accountant to ensure you're taking advantage of all the deductions you're eligible for.