As a resident of North Carolina, it's essential to understand the state's tax laws and regulations to ensure you're in compliance and taking advantage of the tax credits and deductions available to you. One crucial document for North Carolina taxpayers is Form D-400, also known as the North Carolina Individual Income Tax Return. In this article, we'll delve into the world of Form D-400 NC, explaining its purpose, key components, and how to navigate the filing process.

What is Form D-400 NC?

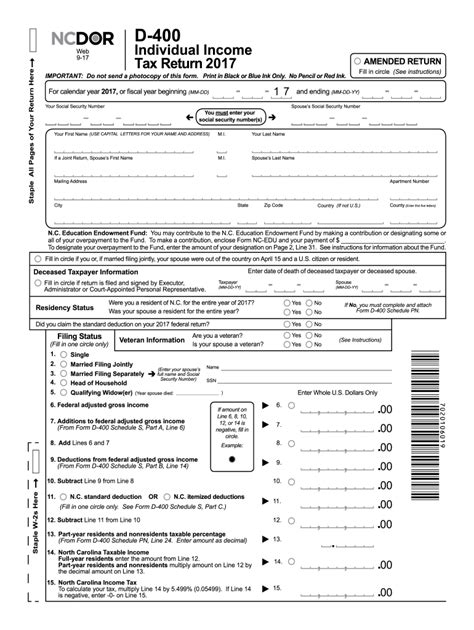

Form D-400 NC is the primary document used by the North Carolina Department of Revenue (NCDOR) to collect individual income tax returns from residents and non-residents who have earned income in the state. The form is used to report income, claim deductions and credits, and calculate the taxpayer's liability or refund.

Key Components of Form D-400 NC

Form D-400 NC is comprised of several sections, each with its own set of instructions and requirements. Here are the key components you'll need to familiarize yourself with:

- Personal Information: This section requires you to provide your name, address, Social Security number, and filing status.

- Income: Report all income earned from various sources, including wages, salaries, tips, and self-employment income.

- Deductions and Credits: Claim deductions for items like mortgage interest, charitable donations, and medical expenses. You may also be eligible for credits like the Earned Income Tax Credit (EITC) or the Child Tax Credit.

- Tax Computation: Calculate your total tax liability or refund based on your income, deductions, and credits.

**Who Needs to File Form D-400 NC?**

You'll need to file Form D-400 NC if you meet any of the following conditions:

- You're a resident of North Carolina and have earned income.

- You're a non-resident with income earned in North Carolina.

- You're a part-year resident with income earned in North Carolina during the time you were a resident.

- You're a North Carolina resident with income earned from sources outside the state.

**Residency Status**

To determine your residency status, you'll need to understand the definitions used by the NCDOR:

- Resident: You're considered a resident if you've lived in North Carolina for at least 183 days during the tax year.

- Non-Resident: You're considered a non-resident if you don't meet the resident criteria.

- Part-Year Resident: You're considered a part-year resident if you've lived in North Carolina for part of the tax year.

**How to File Form D-400 NC**

Filing Form D-400 NC can be done electronically or by mail. Here are the steps to follow:

- Gather Required Documents: Collect all necessary documents, including your W-2 forms, 1099 forms, and any other relevant tax documents.

- Choose a Filing Status: Select your filing status from the options provided on the form.

- Complete the Form: Fill out the form accurately and completely, making sure to report all income, deductions, and credits.

- Submit the Form: File the form electronically through the NCDOR website or mail it to the address provided on the form.

**Deadlines and Penalties**

It's essential to meet the filing deadlines and avoid penalties:

- Filing Deadline: The filing deadline for Form D-400 NC is typically April 15th.

- Late Filing Penalty: A penalty of 5% of the unpaid tax will be assessed for each month or part of a month the return is late.

- Late Payment Penalty: A penalty of 0.5% of the unpaid tax will be assessed for each month or part of a month the payment is late.

**Amended Returns**

If you need to make changes to your original return, you'll need to file an amended return:

- Form D-400X: Use Form D-400X to amend your original return.

- Reason for Amendment: Explain the reason for the amendment on the form.

- Supporting Documentation: Attach supporting documentation to justify the changes.

**Audit and Examination**

The NCDOR may select your return for audit or examination:

- Audit Notice: You'll receive a notice if your return is selected for audit.

- Required Documents: Provide the required documents and information to support your return.

**Tax Credits and Deductions**

Take advantage of the tax credits and deductions available to you:

- Earned Income Tax Credit (EITC): Claim the EITC if you meet the eligibility criteria.

- Child Tax Credit: Claim the Child Tax Credit if you have qualifying children.

- Mortgage Interest Deduction: Claim the mortgage interest deduction if you itemize deductions.

**Common Mistakes to Avoid**

Avoid common mistakes that can delay your refund or result in penalties:

- Math Errors: Double-check your calculations to avoid math errors.

- Incomplete Information: Ensure you provide complete and accurate information.

- Missing Documentation: Attach all required documentation to support your return.

**Frequently Asked Questions**

Here are some frequently asked questions about Form D-400 NC:

- Q: What is the deadline for filing Form D-400 NC? A: The filing deadline is typically April 15th.

- Q: Can I file Form D-400 NC electronically? A: Yes, you can file electronically through the NCDOR website.

- Q: What is the penalty for late filing? A: A penalty of 5% of the unpaid tax will be assessed for each month or part of a month the return is late.

What is the difference between a resident and a non-resident?

+A resident is someone who has lived in North Carolina for at least 183 days during the tax year. A non-resident is someone who doesn't meet the resident criteria.

Can I claim the Earned Income Tax Credit (EITC) if I'm a non-resident?

+No, you can't claim the EITC if you're a non-resident. The EITC is only available to residents.

How do I amend my original return?

+Use Form D-400X to amend your original return. Explain the reason for the amendment on the form and attach supporting documentation to justify the changes.

In conclusion, understanding Form D-400 NC is crucial for North Carolina taxpayers. By following the guidelines outlined in this article, you'll be able to navigate the filing process with ease and take advantage of the tax credits and deductions available to you. Remember to avoid common mistakes and seek professional help if you're unsure about any aspect of the filing process.