As the deadline for filing taxes approaches, many businesses and individuals are scrambling to ensure they have all the necessary forms and documents in order. One of the most important forms for businesses that hire independent contractors or freelance workers is the Form CT-1096, also known as the Annual Summary and Transmittal of U.S. Information Returns. In this article, we will provide 5 tips for filing Form CT-1096 correctly to avoid any penalties or delays.

The Importance of Filing Form CT-1096 Correctly

Filing Form CT-1096 is a crucial step in the tax filing process for businesses that hire independent contractors or freelance workers. This form is used to report the total amount of money paid to these workers during the tax year, as well as the total amount of taxes withheld. Failing to file this form correctly can result in penalties and fines, which can be costly for businesses.

Tip #1: Understand the Purpose of Form CT-1096

Before we dive into the tips for filing Form CT-1096 correctly, it's essential to understand the purpose of this form. Form CT-1096 is used to report the total amount of money paid to independent contractors or freelance workers during the tax year. This form is also used to report the total amount of taxes withheld from these payments. The form is filed annually with the IRS and is due by January 31st of each year.

Who Needs to File Form CT-1096?

Businesses that hire independent contractors or freelance workers are required to file Form CT-1096. This includes businesses that pay more than $600 to an independent contractor or freelance worker during the tax year. The form is also required for businesses that withhold taxes from these payments.

Tip #2: Gather All Necessary Documents

Before filing Form CT-1096, it's essential to gather all necessary documents. This includes:

- Form 1099-MISC for each independent contractor or freelance worker

- Records of payments made to these workers

- Records of taxes withheld from these payments

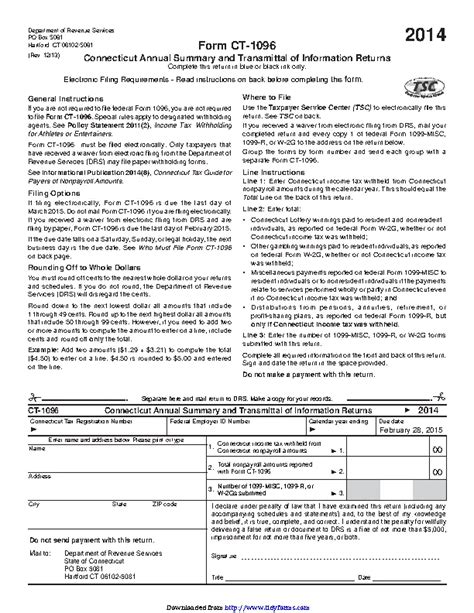

What Information is Required on Form CT-1096?

Form CT-1096 requires the following information:

- Business name and address

- Employer Identification Number (EIN)

- Total amount of money paid to independent contractors or freelance workers

- Total amount of taxes withheld from these payments

Tip #3: Complete Form CT-1096 Accurately

Completing Form CT-1096 accurately is crucial to avoid any penalties or delays. Here are some tips for completing the form:

- Use black ink to complete the form

- Use a separate sheet of paper to calculate the total amount of money paid to independent contractors or freelance workers

- Use a separate sheet of paper to calculate the total amount of taxes withheld from these payments

Common Mistakes to Avoid

Here are some common mistakes to avoid when completing Form CT-1096:

- Failing to sign the form

- Failing to date the form

- Failing to include all necessary information

Tip #4: File Form CT-1096 on Time

Form CT-1096 is due by January 31st of each year. Failing to file the form on time can result in penalties and fines. Here are some tips for filing the form on time:

- File the form electronically to avoid delays

- Use a reputable tax preparation software to ensure accuracy

- Keep a copy of the form for your records

What Happens if I Miss the Deadline?

If you miss the deadline for filing Form CT-1096, you may be subject to penalties and fines. Here are some consequences of missing the deadline:

- A penalty of $50 per form for each 30-day period, up to a maximum of $500,000

- A penalty of $100 per form for each 30-day period, up to a maximum of $1,500,000, if the failure to file is intentional

Tip #5: Seek Professional Help if Needed

Filing Form CT-1096 can be complex and time-consuming. If you're unsure about how to complete the form or need help with the filing process, consider seeking professional help. Here are some tips for seeking professional help:

- Consult with a tax professional or accountant

- Use a reputable tax preparation software

- Contact the IRS for assistance

Filing Form CT-1096 is a crucial step in the tax filing process for businesses that hire independent contractors or freelance workers. By following these 5 tips, you can ensure that you file the form correctly and avoid any penalties or delays. Remember to gather all necessary documents, complete the form accurately, file the form on time, and seek professional help if needed.

What is Form CT-1096?

+Form CT-1096 is an annual summary and transmittal of U.S. information returns, used to report the total amount of money paid to independent contractors or freelance workers during the tax year.

Who needs to file Form CT-1096?

+Businesses that hire independent contractors or freelance workers and pay more than $600 to these workers during the tax year are required to file Form CT-1096.

What is the deadline for filing Form CT-1096?

+Form CT-1096 is due by January 31st of each year.