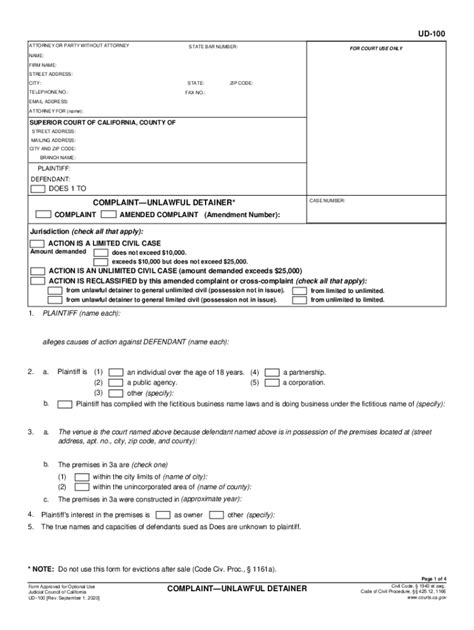

Filing taxes can be a daunting task, especially for Californians who need to navigate the state's unique tax laws. One crucial document that California residents need to be familiar with is the California Form UD-100, also known as the "Affidavit for Transfer of Personal Property without Probate." This form is used to transfer personal property, such as vehicles, boats, and trailers, without going through the probate process.

In this article, we will provide a step-by-step guide on how to file the California UD-100 form, including the requirements, benefits, and potential pitfalls to avoid. Whether you are a executor, administrator, or beneficiary of an estate, understanding the UD-100 form is essential to ensure a smooth transfer of personal property.

What is the California UD-100 Form?

The California UD-100 form is a sworn statement that is used to transfer personal property without probate. The form is typically used when the deceased person did not leave a will, or when the estate is small enough to qualify for a simplified probate process. The UD-100 form is usually filed with the county recorder's office where the property is located.

Benefits of Using the California UD-100 Form

Using the California UD-100 form offers several benefits, including:

- Avoiding the probate process, which can be time-consuming and costly

- Transferring personal property quickly and efficiently

- Reducing the risk of disputes among beneficiaries

- Providing a clear and documented record of the property transfer

Who Can File the California UD-100 Form?

The California UD-100 form can be filed by:

- The executor or administrator of the estate

- The beneficiary of the estate

- The heir of the deceased person

- The personal representative of the estate

Requirements for Filing the California UD-100 Form

To file the California UD-100 form, you will need to provide the following information:

- The name and address of the deceased person

- The name and address of the beneficiary or heir

- A description of the personal property being transferred

- The value of the personal property being transferred

- The signature of the person filing the form

Step-by-Step Guide to Filing the California UD-100 Form

Here is a step-by-step guide to filing the California UD-100 form:

- Download and complete the form: You can download the California UD-100 form from the California Department of Motor Vehicles (DMV) website or obtain a copy from your local county recorder's office.

- Gather required documents: You will need to provide proof of the deceased person's death, such as a death certificate, and proof of your identity, such as a driver's license.

- Fill out the form: Complete the form by providing the required information, including the name and address of the deceased person, the name and address of the beneficiary or heir, and a description of the personal property being transferred.

- Sign the form: Sign the form in front of a notary public.

- File the form: File the form with the county recorder's office where the property is located.

- Pay the filing fee: Pay the filing fee, which varies depending on the county.

Potential Pitfalls to Avoid

When filing the California UD-100 form, there are several potential pitfalls to avoid:

- Incorrect information: Make sure to provide accurate and complete information on the form.

- Missing signatures: Ensure that all required signatures are obtained.

- Filing delays: File the form promptly to avoid delays in the transfer of personal property.

Common Mistakes to Avoid When Filing the California UD-100 Form

Here are some common mistakes to avoid when filing the California UD-100 form:

- Failing to provide required documents: Make sure to provide all required documents, including proof of the deceased person's death and proof of your identity.

- Failing to sign the form: Ensure that all required signatures are obtained.

- Filing the form in the wrong county: File the form in the county where the property is located.

Conclusion

Filing the California UD-100 form can be a complex process, but by following the steps outlined in this guide, you can ensure a smooth transfer of personal property. Remember to provide accurate and complete information, obtain all required signatures, and file the form promptly. If you are unsure about any aspect of the process, it is recommended that you consult with an attorney or a qualified professional.

We hope this article has been helpful in providing a comprehensive guide to filing the California UD-100 form. If you have any questions or comments, please feel free to leave them below.

What is the California UD-100 form used for?

+The California UD-100 form is used to transfer personal property without probate.

Who can file the California UD-100 form?

+The executor or administrator of the estate, the beneficiary of the estate, the heir of the deceased person, or the personal representative of the estate can file the form.

What are the requirements for filing the California UD-100 form?

+The form requires the name and address of the deceased person, the name and address of the beneficiary or heir, a description of the personal property being transferred, the value of the personal property being transferred, and the signature of the person filing the form.