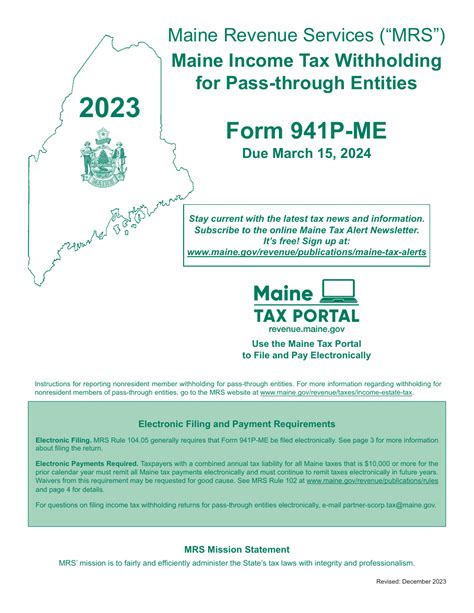

As a business owner in Maine, it's essential to understand the importance of quarterly tax filing. The Maine Form 941p-ME is a crucial document that helps you report your employment taxes and avoid any penalties or fines. In this article, we will delve into the world of Maine Form 941p-ME, explaining its purpose, benefits, and a step-by-step guide on how to file it.

Understanding Maine Form 941p-ME

Maine Form 941p-ME is the quarterly return of income tax withheld and paid by employers in Maine. It's a critical document that requires employers to report the income tax withheld from their employees' wages, as well as the employer's share of taxes. The form is used to reconcile the taxes withheld and paid during the quarter, ensuring that employers are in compliance with Maine's tax laws.

Benefits of Filing Maine Form 941p-ME

Filing Maine Form 941p-ME has several benefits for employers, including:

- Avoiding penalties and fines: By filing the form on time, employers can avoid penalties and fines associated with late or incorrect filing.

- Ensuring compliance: The form helps employers ensure that they are in compliance with Maine's tax laws, reducing the risk of audits and penalties.

- Accurate record-keeping: The form requires employers to maintain accurate records of their employees' wages and taxes, which can help with future tax filings and audits.

Step-by-Step Guide to Filing Maine Form 941p-ME

Filing Maine Form 941p-ME can seem daunting, but it's a straightforward process. Here's a step-by-step guide to help you file the form:

- Gather required information: Before starting the filing process, gather all the necessary information, including:

- Employee wages and taxes withheld

- Employer's share of taxes

- Business name and address

- Federal Employer Identification Number (FEIN)

- Determine the filing frequency: Maine Form 941p-ME is typically filed quarterly, with the following due dates:

- April 30th for the first quarter (January 1 - March 31)

- July 31st for the second quarter (April 1 - June 30)

- October 31st for the third quarter (July 1 - September 30)

- January 31st for the fourth quarter (October 1 - December 31)

- Complete the form: Fill out the form with the required information, making sure to calculate the taxes correctly. You can use the Maine Revenue Services website to access the form and instructions.

- Submit the form: Submit the completed form to the Maine Revenue Services, either electronically or by mail.

Common Mistakes to Avoid

When filing Maine Form 941p-ME, it's essential to avoid common mistakes that can lead to penalties and fines. Here are some mistakes to watch out for:

- Late filing: Failing to file the form on time can result in penalties and fines.

- Inaccurate calculations: Incorrect calculations can lead to underpayment or overpayment of taxes.

- Missing information: Failing to provide required information can delay processing and result in penalties.

Conclusion

Filing Maine Form 941p-ME is a critical step in ensuring compliance with Maine's tax laws. By understanding the purpose and benefits of the form, and following the step-by-step guide, employers can avoid penalties and fines. Remember to avoid common mistakes and seek professional help if needed.

What is Maine Form 941p-ME?

+Maine Form 941p-ME is the quarterly return of income tax withheld and paid by employers in Maine.

When is Maine Form 941p-ME due?

+Maine Form 941p-ME is typically filed quarterly, with the following due dates: April 30th, July 31st, October 31st, and January 31st.

What are the benefits of filing Maine Form 941p-ME?

+Filing Maine Form 941p-ME helps employers avoid penalties and fines, ensures compliance with Maine's tax laws, and promotes accurate record-keeping.