The healthcare industry is one of the most heavily regulated sectors in the United States, with numerous laws and regulations governing every aspect of healthcare services, including those provided by federal contractors. For these contractors, compliance with federal regulations is crucial to avoid penalties, fines, and reputational damage. One critical aspect of compliance is the HHS 690 form, which plays a significant role in ensuring that federal contractors meet the necessary standards. In this article, we will delve into the world of HHS 690 forms, exploring their purpose, requirements, and the steps federal contractors must take to ensure compliance.

What is the HHS 690 Form?

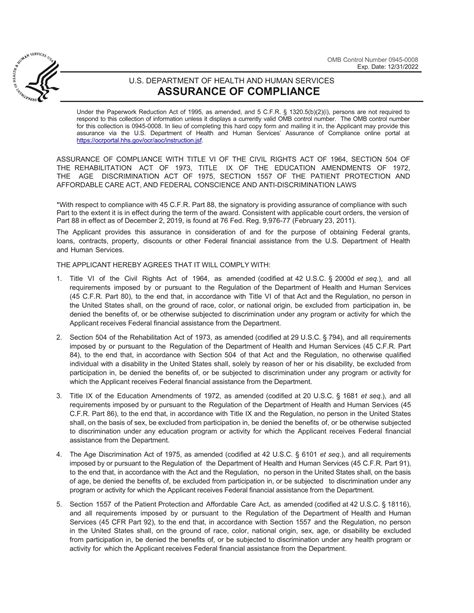

The HHS 690 form, also known as the "Federal Contractor Compliance Form," is a document required by the U.S. Department of Health and Human Services (HHS) for all federal contractors who provide healthcare services to beneficiaries of federal healthcare programs. The form is designed to ensure that these contractors comply with the requirements of the Federal Acquisition Regulation (FAR) and the HHS Acquisition Regulation (HHSAR).

The HHS 690 form is a critical component of the federal contracting process, as it allows contractors to certify their compliance with various federal regulations, including those related to healthcare fraud, waste, and abuse. By signing the form, contractors acknowledge their understanding of and commitment to complying with these regulations.

Requirements for Completing the HHS 690 Form

To complete the HHS 690 form, federal contractors must provide detailed information about their organization, including their name, address, and contact information. They must also certify their compliance with various federal regulations, including:

- Health Insurance Portability and Accountability Act (HIPAA): Contractors must certify that they comply with HIPAA regulations, including the protection of patient health information.

- Health Care Fraud and Abuse Control Program: Contractors must certify that they have implemented policies and procedures to prevent and detect healthcare fraud and abuse.

- Federal Acquisition Regulation (FAR): Contractors must certify that they comply with FAR regulations, including those related to procurement integrity and contractor business ethics.

- HHS Acquisition Regulation (HHSAR): Contractors must certify that they comply with HHSAR regulations, including those related to contract administration and procurement.

Contractors must also provide information about their organization's compliance program, including:

- Compliance officer: Contractors must identify their compliance officer and provide contact information.

- Compliance policies: Contractors must describe their compliance policies and procedures.

- Training programs: Contractors must describe their training programs for employees and contractors.

Consequences of Non-Compliance

Failure to comply with the requirements of the HHS 690 form can have serious consequences for federal contractors, including:

- Penalties and fines: Contractors who fail to comply with federal regulations may be subject to penalties and fines.

- Contract termination: Contractors who fail to comply with federal regulations may have their contracts terminated.

- Reputational damage: Contractors who fail to comply with federal regulations may suffer reputational damage, which can impact their ability to secure future contracts.

Best Practices for Completing the HHS 690 Form

To ensure compliance with the HHS 690 form, federal contractors should follow these best practices:

- Develop a compliance program: Contractors should develop a comprehensive compliance program that includes policies, procedures, and training programs.

- Designate a compliance officer: Contractors should designate a compliance officer who is responsible for overseeing the compliance program.

- Provide regular training: Contractors should provide regular training to employees and contractors on compliance policies and procedures.

- Conduct regular audits: Contractors should conduct regular audits to ensure compliance with federal regulations.

Conclusion

The HHS 690 form is a critical component of federal contractor compliance, and contractors who fail to comply with its requirements may face serious consequences. By developing a comprehensive compliance program, designating a compliance officer, providing regular training, and conducting regular audits, contractors can ensure compliance with federal regulations and avoid penalties, fines, and reputational damage.

We encourage readers to share their experiences and best practices for completing the HHS 690 form in the comments section below. Additionally, readers can share this article with their colleagues and peers to promote awareness and understanding of federal contractor compliance.

FAQ Section

What is the purpose of the HHS 690 form?

+The HHS 690 form is designed to ensure that federal contractors comply with federal regulations, including those related to healthcare fraud, waste, and abuse.

What are the consequences of non-compliance with the HHS 690 form?

+Failure to comply with the HHS 690 form can result in penalties, fines, contract termination, and reputational damage.

How often should federal contractors conduct audits to ensure compliance with federal regulations?

+Federal contractors should conduct regular audits to ensure compliance with federal regulations. The frequency of audits will depend on the contractor's specific needs and risk assessment.