In today's complex global economy, multinational corporations and individuals with foreign business interests often find themselves navigating a labyrinth of tax regulations and reporting requirements. One such requirement is the Form 5471 Schedule J filing, which can be a daunting task for even the most experienced tax professionals. In this article, we will delve into the world of Form 5471 Schedule J, exploring its purpose, benefits, and step-by-step filing requirements.

The Importance of Accurate Form 5471 Schedule J Filing

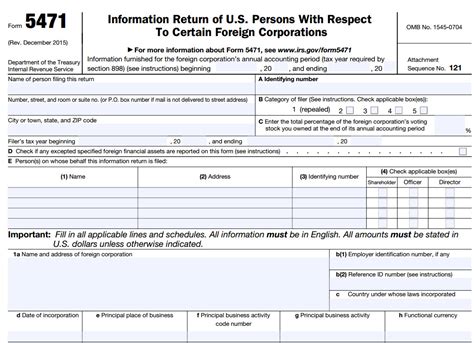

Form 5471, also known as the Information Return of U.S. Persons with Respect to Certain Foreign Corporations, is a critical tax form used by the Internal Revenue Service (IRS) to collect information about U.S. persons with interests in foreign corporations. Schedule J, a component of Form 5471, specifically focuses on the Accumulated Earnings and Profits (AE&P) of Controlled Foreign Corporations (CFCs). Accurate and timely filing of Form 5471 Schedule J is essential to avoid penalties, interest, and potential audits.

Benefits of Form 5471 Schedule J Filing

While the Form 5471 Schedule J filing process may seem arduous, it provides several benefits to taxpayers:

- Compliance with IRS regulations: By filing Form 5471 Schedule J, taxpayers demonstrate their commitment to transparency and compliance with IRS regulations, reducing the risk of penalties and audits.

- Accurate calculation of AE&P: Schedule J helps taxpayers accurately calculate the AE&P of their CFCs, ensuring they meet their tax obligations and avoid potential errors.

- Streamlined tax planning: By understanding the AE&P of their CFCs, taxpayers can engage in informed tax planning, optimizing their global tax strategies and minimizing tax liabilities.

Step-by-Step Guide to Form 5471 Schedule J Filing

To ensure accurate and timely filing, follow these steps:

Step 1: Determine Filing Requirements

- Identify the type of foreign corporation: CFC, Foreign Personal Holding Company (FPHC), or Foreign Investment Company (FIC).

- Determine the category of filer: Category 1, 2, 3, 4, or 5.

- Review the IRS instructions for Form 5471 to determine if Schedule J is required.

Step 2: Gather Necessary Information

- Obtain the CFC's financial statements, including balance sheets and income statements.

- Collect information about the CFC's shareholders, including ownership percentages.

- Determine the CFC's E&P for the tax year.

Step 3: Complete Schedule J

- Complete Part I: Accumulated Earnings and Profits (AE&P).

- Complete Part II: Adjustments to AE&P.

- Complete Part III: Calculation of AE&P.

Step 4: File Form 5471 and Schedule J

- Attach Schedule J to Form 5471.

- File Form 5471 and Schedule J with the IRS by the required deadline.

Practical Tips for Form 5471 Schedule J Filing

To ensure a smooth filing process:

- Consult the IRS instructions: Review the IRS instructions for Form 5471 and Schedule J to ensure accurate completion.

- Seek professional guidance: Engage a qualified tax professional or attorney to assist with the filing process.

- Maintain accurate records: Keep detailed records of the CFC's financial statements, shareholder information, and E&P calculations.

By following these steps and tips, taxpayers can master the Form 5471 Schedule J filing requirements, ensuring compliance with IRS regulations and accurate calculation of AE&P.

Conclusion

Mastering Form 5471 Schedule J filing requirements is crucial for taxpayers with interests in foreign corporations. By understanding the benefits and step-by-step filing process, taxpayers can ensure compliance with IRS regulations, accurate calculation of AE&P, and streamlined tax planning. Remember to consult the IRS instructions, seek professional guidance, and maintain accurate records to ensure a smooth filing process.

Share Your Thoughts

We'd love to hear from you! Share your experiences with Form 5471 Schedule J filing in the comments below. What challenges have you faced, and how have you overcome them? Your insights can help others navigate this complex tax requirement.

What is the purpose of Form 5471 Schedule J?

+Form 5471 Schedule J is used to report the Accumulated Earnings and Profits (AE&P) of Controlled Foreign Corporations (CFCs).

Who is required to file Form 5471 Schedule J?

+U.S. persons with interests in foreign corporations, including CFCs, FPHCs, and FICs, are required to file Form 5471 and Schedule J.

What are the consequences of failing to file Form 5471 Schedule J?

+Failing to file Form 5471 Schedule J can result in penalties, interest, and potential audits.