Wine production and taxation can be a complex and intricate process, with numerous regulations and requirements that must be adhered to. One crucial aspect of this process is the completion and submission of the TTB Form 5120.17, also known as the Report of Wine Premises Operations. This form is used by wineries, bonded wine cellars, and taxpaid wine bottling houses to report their wine premises operations to the Alcohol and Tobacco Tax and Trade Bureau (TTB).

Understanding the TTB Form 5120.17

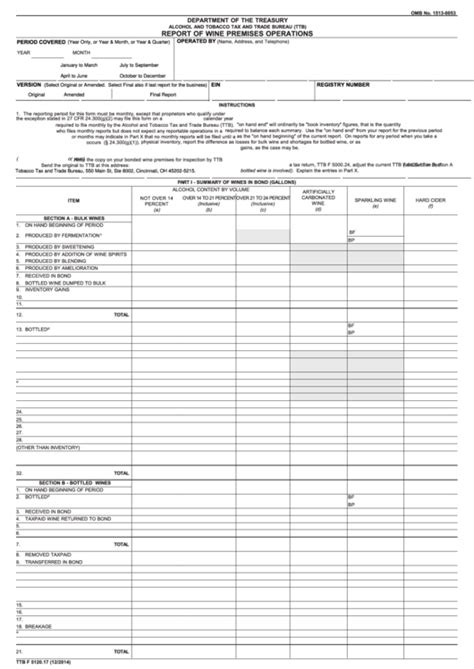

The TTB Form 5120.17 is a quarterly report that must be submitted by all wine premises operations, including wineries, bonded wine cellars, and taxpaid wine bottling houses. The form is used to report the receipt, storage, and disposition of wine, as well as the taxpaid removals of wine from the premises. The information reported on this form is used by the TTB to monitor and regulate the wine industry, and to ensure compliance with federal laws and regulations.

Who Must File the TTB Form 5120.17?

The TTB Form 5120.17 must be filed by all wine premises operations, including:

- Wineries

- Bonded wine cellars

- Taxpaid wine bottling houses

These operations must file the form on a quarterly basis, with the following due dates:

- January 15th for the quarter ending December 31st

- April 15th for the quarter ending March 31st

- July 15th for the quarter ending June 30th

- October 15th for the quarter ending September 30th

Completing the TTB Form 5120.17

Completing the TTB Form 5120.17 requires careful attention to detail and a thorough understanding of the reporting requirements. The form is divided into several sections, each of which must be completed accurately and thoroughly.

- Section 1: Identification and Address of Premises

- Section 2: Wine Receipts

- Section 3: Wine Storage

- Section 4: Taxpaid Removals of Wine

- Section 5: Disposition of Wine

- Section 6: Additional Information

Section 1: Identification and Address of Premises

This section requires the identification and address of the wine premises operations. This includes the name, address, and permit number of the premises.

Section 2: Wine Receipts

This section requires the reporting of wine receipts, including the type and quantity of wine received.

Section 3: Wine Storage

This section requires the reporting of wine storage, including the type and quantity of wine stored.

Section 4: Taxpaid Removals of Wine

This section requires the reporting of taxpaid removals of wine from the premises.

Section 5: Disposition of Wine

This section requires the reporting of the disposition of wine, including sales, transfers, and other dispositions.

Section 6: Additional Information

This section requires the reporting of any additional information, including changes in ownership or operation.

Tips for Filing the TTB Form 5120.17

Filing the TTB Form 5120.17 can be a complex and time-consuming process. Here are some tips to help ensure accurate and timely filing:

- Review the form carefully before submitting

- Ensure all sections are completed accurately and thoroughly

- Use the correct reporting period and due date

- Keep accurate and detailed records of wine premises operations

- Seek professional advice if necessary

Common Mistakes to Avoid

Filing the TTB Form 5120.17 requires careful attention to detail. Here are some common mistakes to avoid:

- Inaccurate or incomplete reporting

- Failure to file on time

- Failure to report taxpaid removals of wine

- Failure to report changes in ownership or operation

Penalties for Non-Compliance

Failure to file the TTB Form 5120.17 or failure to comply with the reporting requirements can result in penalties, including:

- Fines and penalties

- Revocation of permit

- Suspension of operations

Conclusion

The TTB Form 5120.17 is a crucial reporting requirement for wine premises operations. Failure to file the form or failure to comply with the reporting requirements can result in penalties and fines. By understanding the reporting requirements and following the tips and guidelines outlined above, wine premises operations can ensure accurate and timely filing of the TTB Form 5120.17.

If you have any questions or concerns about the TTB Form 5120.17 or wine premises operations, please don't hesitate to comment below. We'd be happy to help.

What is the TTB Form 5120.17?

+The TTB Form 5120.17 is a quarterly report used by wine premises operations to report their wine premises operations to the Alcohol and Tobacco Tax and Trade Bureau (TTB).

Who must file the TTB Form 5120.17?

+The TTB Form 5120.17 must be filed by all wine premises operations, including wineries, bonded wine cellars, and taxpaid wine bottling houses.

What is the due date for filing the TTB Form 5120.17?

+The due date for filing the TTB Form 5120.17 is the 15th day of the month following the end of the quarter.