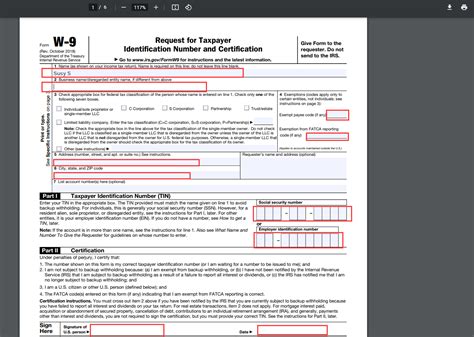

The Black W9 form, officially known as the "Request for Taxpayer Identification Number and Certification," is a crucial document used by the United States Internal Revenue Service (IRS) to collect information from freelancers, independent contractors, and businesses. In this comprehensive guide, we will delve into the world of the Black W9 form, exploring its importance, benefits, and step-by-step instructions on how to fill it out.

Why is the Black W9 Form Important?

The Black W9 form is essential for several reasons:

- It helps the IRS to verify the identity of freelancers and businesses, ensuring that they are compliant with tax laws.

- It provides a standardized way for clients to collect necessary information from vendors, making it easier to process payments and complete tax returns.

- It helps to prevent identity theft and ensures that individuals and businesses are not misrepresenting themselves.

Benefits of Using the Black W9 Form

Using the Black W9 form offers several benefits, including:

- Simplified tax compliance: The form provides a clear and concise way to collect necessary information, making it easier to file taxes and avoid errors.

- Reduced administrative burden: Clients can use the form to collect information from vendors, reducing the need for additional paperwork and administrative tasks.

- Enhanced security: The form helps to prevent identity theft by verifying the identity of freelancers and businesses.

Step-by-Step Guide to Filling Out the Black W9 Form

Filling out the Black W9 form is a straightforward process. Here's a step-by-step guide to help you get started:

- Download the Form: You can download the Black W9 form from the IRS website or obtain it from your client.

- Provide Your Business Name: Enter your business name as it appears on your tax return.

- Provide Your Business Address: Enter your business address, including the street address, city, state, and ZIP code.

- Provide Your Taxpayer Identification Number: Enter your taxpayer identification number, which is usually your Employer Identification Number (EIN) or Social Security Number (SSN).

- Certify Your Information: Sign and date the form, certifying that the information provided is accurate and true.

Common Mistakes to Avoid When Filling Out the Black W9 Form

When filling out the Black W9 form, it's essential to avoid common mistakes, including:

- Inaccurate Information: Ensure that the information provided is accurate and true, as incorrect information can lead to delays and penalties.

- Incomplete Information: Make sure to complete all sections of the form, as incomplete information can cause delays and errors.

- Invalid Signatures: Ensure that the form is signed and dated correctly, as invalid signatures can render the form invalid.

FAQs About the Black W9 Form

Here are some frequently asked questions about the Black W9 form:

- What is the purpose of the Black W9 form?: The Black W9 form is used to collect information from freelancers and businesses, verifying their identity and ensuring compliance with tax laws.

- Who needs to fill out the Black W9 form?: Freelancers, independent contractors, and businesses that provide services to clients need to fill out the Black W9 form.

- How often do I need to fill out the Black W9 form?: You typically need to fill out the Black W9 form once, when you start working with a new client. However, you may need to update the form if your information changes.

What is the deadline for submitting the Black W9 form?

+The deadline for submitting the Black W9 form varies, but it's typically required before payment can be made. It's essential to check with your client for specific deadlines and requirements.

Can I submit the Black W9 form electronically?

+Yes, you can submit the Black W9 form electronically. Many clients and accounting software programs allow for electronic submission of the form.

What happens if I don't submit the Black W9 form?

+If you don't submit the Black W9 form, you may face delays in payment, penalties, and even tax withholding. It's essential to submit the form on time to avoid these consequences.

In conclusion, the Black W9 form is an essential document for freelancers, independent contractors, and businesses. By understanding the importance of the form, its benefits, and how to fill it out correctly, you can ensure compliance with tax laws and avoid common mistakes. If you have any further questions or concerns, don't hesitate to reach out to your client or a tax professional.