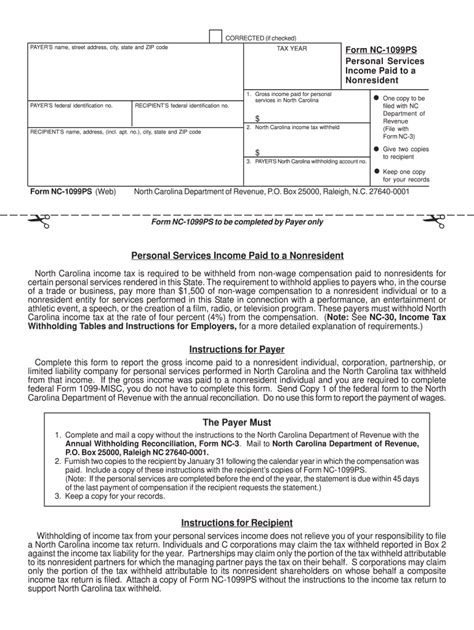

The 1099 form is a crucial document for freelancers, independent contractors, and businesses that pay non-employee compensation. It's used to report various types of income, such as freelance work, rent, and royalties, to the Internal Revenue Service (IRS). If you're looking for a printable NC 1099 form, you've come to the right place. In this article, we'll provide you with a downloadable and printable NC 1099 form, as well as guide you through the process of filling it out and submitting it to the IRS.

What is a 1099 Form?

A 1099 form is a tax document used to report various types of income to the IRS. It's typically used by businesses and payers to report non-employee compensation, such as freelance work, rent, and royalties. The form is usually filed annually, and it's used to report income earned by individuals who are not employees of the payer.

Types of 1099 Forms

There are several types of 1099 forms, each used to report different types of income. Some of the most common types of 1099 forms include:

- 1099-MISC: Used to report miscellaneous income, such as freelance work, rent, and royalties.

- 1099-INT: Used to report interest income.

- 1099-DIV: Used to report dividend income.

- 1099-B: Used to report capital gains and losses.

NC 1099 Form Printable: Download and Print Easily

If you're looking for a printable NC 1099 form, you can download and print the form from the IRS website. The form is available in PDF format, and you can fill it out using a PDF editor or by hand.

To download and print the NC 1099 form, follow these steps:

- Visit the IRS website at .

- Click on the "Forms and Publications" tab.

- Search for "1099-MISC" or the specific type of 1099 form you need.

- Click on the "PDF" link to download the form.

- Open the form using a PDF editor, such as Adobe Acrobat.

- Fill out the form using a pen or pencil.

- Print the form on plain paper.

Filling Out the 1099 Form

Filling out the 1099 form is a straightforward process. Here are the steps to follow:

- Enter the payer's information, including their name, address, and taxpayer identification number (TIN).

- Enter the recipient's information, including their name, address, and TIN.

- Report the type and amount of income earned by the recipient.

- Enter any state or local tax withheld.

- Sign and date the form.

Submitting the 1099 Form to the IRS

Once you've filled out the 1099 form, you'll need to submit it to the IRS. Here are the steps to follow:

- Make a copy of the form for your records.

- Mail the original form to the IRS address listed on the form.

- File the form by the due date, which is usually January 31st.

Penalties for Not Filing the 1099 Form

If you fail to file the 1099 form or file it late, you may be subject to penalties and fines. The penalties can range from $30 to $100 per form, depending on the circumstances.

Common Mistakes to Avoid When Filing the 1099 Form

Here are some common mistakes to avoid when filing the 1099 form:

- Failing to report all income earned by the recipient.

- Failing to include the recipient's TIN.

- Failing to sign and date the form.

- Filing the form late.

Conclusion

The 1099 form is an important tax document that's used to report non-employee compensation to the IRS. By following the steps outlined in this article, you can download and print the NC 1099 form, fill it out accurately, and submit it to the IRS on time. Remember to avoid common mistakes and penalties by filing the form correctly and on time.

We hope this article has been helpful in guiding you through the process of downloading and printing the NC 1099 form. If you have any further questions or concerns, please don't hesitate to comment below.

What is the deadline for filing the 1099 form?

+The deadline for filing the 1099 form is usually January 31st.

Do I need to file a 1099 form for every recipient?

+No, you only need to file a 1099 form for recipients who earned more than $600 in non-employee compensation.

Can I file the 1099 form electronically?

+Yes, you can file the 1099 form electronically through the IRS website.