Living and working in New York State comes with its own set of tax regulations. As a resident, you're required to file an income tax return with the New York State Department of Taxation and Finance. The IT-201 form is the standard form used for personal income tax returns. In this article, we'll guide you through the process of navigating the NY Form IT-201, explaining the benefits, working mechanisms, and steps involved.

Understanding the NY Form IT-201

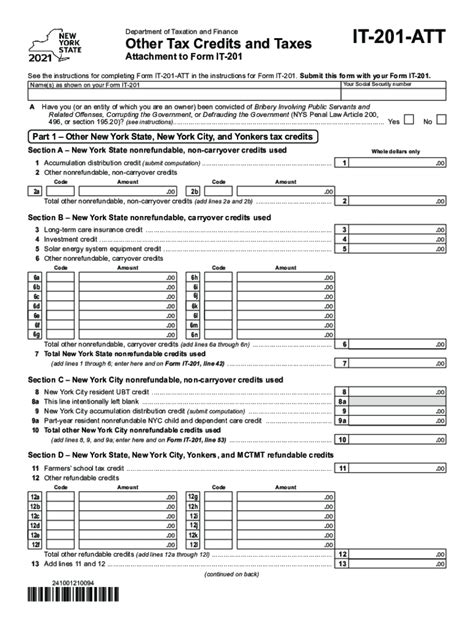

The IT-201 form is used to report your income, claim deductions and credits, and calculate your tax liability. The form is divided into several sections, each requiring specific information. As a taxpayer, it's essential to understand the different sections and how to fill them out accurately.

Who Needs to File IT-201?

You'll need to file Form IT-201 if you're a resident of New York State and have income that's subject to state taxation. This includes:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividends

- Capital gains

- Retirement income

Even if you don't have a tax liability, you may still need to file a return if you have taxes withheld or if you're eligible for a refund.

Benefits of Filing IT-201

Filing your IT-201 form on time comes with several benefits:

- Avoid penalties and interest on late payments

- Claim your refund, if eligible

- Take advantage of tax credits and deductions

- Ensure compliance with state tax regulations

Working Mechanism of IT-201

The IT-201 form works by requiring you to report your income, claim deductions and credits, and calculate your tax liability. The form is divided into several sections:

- Section 1: Income

- Section 2: Deductions

- Section 3: Credits

- Section 4: Tax Liability

You'll need to fill out each section accurately, using the instructions provided.

Steps to Fill Out IT-201

Filling out the IT-201 form can seem daunting, but breaking it down into steps makes it more manageable. Here's a step-by-step guide to help you navigate the form:

- Gather necessary documents, including:

- W-2 forms

- 1099 forms

- Interest and dividend statements

- Charitable donation receipts

- Fill out Section 1: Income

- Report your income from all sources

- Include wages, salaries, tips, and self-employment income

- Fill out Section 2: Deductions

- Claim standard deductions or itemize deductions

- Include charitable donations, medical expenses, and mortgage interest

- Fill out Section 3: Credits

- Claim tax credits for education expenses, child care, and more

- Calculate your total credits

- Fill out Section 4: Tax Liability

- Calculate your total tax liability

- Apply tax credits to reduce your liability

Tips and Reminders

- File your IT-201 form on time to avoid penalties and interest

- Take advantage of tax credits and deductions to reduce your liability

- Keep accurate records of your income and expenses

- Consider consulting a tax professional if you're unsure about any part of the process

Common Mistakes to Avoid

- Failing to report all income

- Claiming incorrect deductions and credits

- Failing to sign and date the form

- Missing the filing deadline

By avoiding these common mistakes, you can ensure a smooth and successful filing process.

Additional Resources

If you need more information or assistance with filing your IT-201 form, consider the following resources:

- New York State Department of Taxation and Finance website

- Tax professionals and accountants

- Tax preparation software

Wrapping Up

Navigating the NY Form IT-201 requires attention to detail and a understanding of the tax regulations. By following the steps outlined in this article, you can ensure a successful filing process and take advantage of the benefits that come with it. Remember to file on time, claim your deductions and credits, and keep accurate records.

We encourage you to share your experiences and tips for filing the IT-201 form in the comments below. Don't forget to share this article with friends and family who may be navigating the same process.

Who needs to file the IT-201 form?

+Residents of New York State with income subject to state taxation need to file the IT-201 form.

What is the deadline for filing the IT-201 form?

+The deadline for filing the IT-201 form is typically April 15th, but may vary depending on the tax year.

Can I file the IT-201 form electronically?

+Yes, you can file the IT-201 form electronically through the New York State Department of Taxation and Finance website.