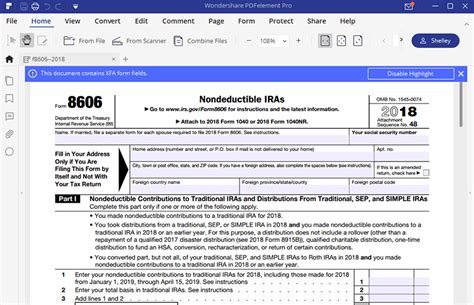

The world of tax forms can be a daunting one, especially for those who are not familiar with the process. One form that can be particularly tricky is Form 8606, also known as the Nondeductible IRAs and Coverdell ESAs form. This form is used to report nondeductible contributions to individual retirement accounts (IRAs) and Coverdell education savings accounts (ESAs). In this article, we will break down the 7 steps to fill out Form 8606 with ease, making the process less overwhelming and more manageable.

Understanding the Importance of Form 8606

Before we dive into the steps, it's essential to understand why Form 8606 is necessary. The form helps the IRS keep track of nondeductible contributions to IRAs and ESAs, which are subject to specific rules and regulations. By accurately completing Form 8606, you can ensure that you're in compliance with these rules and avoid any potential penalties or fines.

Step 1: Gather Required Information

To fill out Form 8606, you'll need to gather some essential information. This includes:

- Your name and social security number

- The type of account you're reporting (IRA or ESA)

- The account number and name of the account holder

- The amount of nondeductible contributions made to the account

- The fair market value of the account as of December 31st of the tax year

Having this information readily available will make the process much smoother.

Step 2: Determine the Type of Account

Form 8606 is used to report nondeductible contributions to both IRAs and ESAs. You'll need to determine which type of account you're reporting. If you're reporting an IRA, you'll need to check the box on Line 1. If you're reporting an ESA, you'll need to check the box on Line 2.

Step 3: Report Nondeductible Contributions

On Line 3, you'll need to report the total amount of nondeductible contributions made to the account. This includes contributions made by you, your spouse, or anyone else who contributed to the account. You'll also need to report any recharacterized contributions, which are contributions that were initially made to a traditional IRA but were later converted to a Roth IRA.

Step 4: Calculate the Fair Market Value

On Line 4, you'll need to report the fair market value of the account as of December 31st of the tax year. This is the total value of the account, including any earnings or gains. You can find this information on your account statement or by contacting your account custodian.

Step 5: Report Distributions

If you took a distribution from the account during the tax year, you'll need to report it on Line 5. This includes any withdrawals, rollovers, or conversions. You'll also need to report any recharacterized distributions, which are distributions that were initially made from a traditional IRA but were later converted to a Roth IRA.

Step 6: Calculate the Net Investment Income

On Line 6, you'll need to calculate the net investment income from the account. This includes any interest, dividends, or capital gains earned on the account. You can find this information on your account statement or by contacting your account custodian.

Step 7: Review and Sign

Finally, review Form 8606 to ensure that all information is accurate and complete. Sign and date the form, and attach it to your tax return. If you're filing electronically, you'll need to attach the form to your electronic return.

By following these 7 steps, you can fill out Form 8606 with ease and confidence. Remember to gather all required information, determine the type of account, report nondeductible contributions, calculate the fair market value, report distributions, calculate the net investment income, and review and sign the form.

Stay Ahead of the Game

Form 8606 can be a complex form, but by understanding the steps and requirements, you can stay ahead of the game. Take the time to review the form and instructions carefully, and don't hesitate to seek professional help if you need it. By doing so, you can ensure that you're in compliance with the IRS regulations and avoid any potential penalties or fines.

What's Next?

Now that you've filled out Form 8606, it's time to move on to the next step. If you have any questions or concerns, feel free to comment below. We'd love to hear from you and help you navigate the world of tax forms.

What is Form 8606 used for?

+Form 8606 is used to report nondeductible contributions to individual retirement accounts (IRAs) and Coverdell education savings accounts (ESAs).

What information do I need to gather to fill out Form 8606?

+You'll need to gather your name and social security number, the type of account you're reporting, the account number and name of the account holder, the amount of nondeductible contributions made to the account, and the fair market value of the account as of December 31st of the tax year.

How do I report distributions on Form 8606?

+You'll need to report any distributions taken from the account during the tax year on Line 5. This includes any withdrawals, rollovers, or conversions.