The SBA Form 1201, also known as the Borrower Payment Form, is a crucial document for small business owners who have received loans from the Small Business Administration (SBA). This form is used to make payments on SBA loans, and it's essential to fill it out accurately to avoid any delays or issues with your loan repayment. In this article, we'll guide you through the 5 easy steps to fill out the SBA 1201 Borrower Payment Form.

Why is the SBA 1201 Borrower Payment Form important?

Before we dive into the steps, let's understand the significance of the SBA 1201 Borrower Payment Form. This form is used to make payments on SBA loans, which are designed to support small businesses in various ways, such as expanding operations, purchasing equipment, or refinancing debt. By filling out this form correctly, you ensure that your loan payments are processed efficiently, and you avoid any potential penalties or fees.

Step 1: Gather necessary information and documents

To fill out the SBA 1201 Borrower Payment Form, you'll need to gather some essential information and documents. These include:

- Your SBA loan number

- Your business name and address

- The payment amount and due date

- Your bank account information (if you're setting up automatic payments)

Make sure you have all the required information and documents before proceeding to the next step.

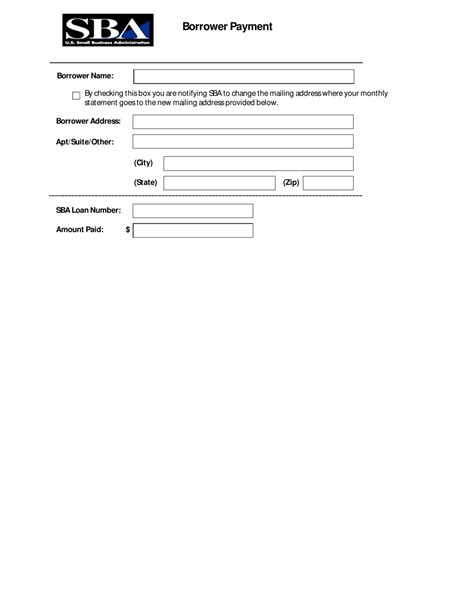

Step 2: Fill out the borrower information section

The first section of the SBA 1201 Borrower Payment Form requires you to provide your borrower information. This includes:

- Your SBA loan number

- Your business name and address

- Your tax identification number (EIN or SSN)

Fill out this section accurately, ensuring that all information matches your loan documents.

Borrower Information Section

- SBA Loan Number: _____________________________________

- Business Name: _______________________________________

- Business Address: ______________________________________

- Tax Identification Number (EIN or SSN): _______________________

Step 3: Fill out the payment information section

The next section requires you to provide your payment information. This includes:

- The payment amount

- The payment due date

- The payment method (check, electronic funds transfer, or automatic payment)

Fill out this section carefully, ensuring that you're making the correct payment amount and selecting the right payment method.

Payment Information Section

- Payment Amount: $____________________________________

- Payment Due Date: ______________________________________

- Payment Method: _______________________________________

Step 4: Fill out the payment method section (if applicable)

If you're setting up automatic payments, you'll need to fill out the payment method section. This includes:

- Your bank account information (routing number and account number)

- The payment frequency (monthly, quarterly, etc.)

Fill out this section accurately, ensuring that your bank account information is correct.

Payment Method Section (if applicable)

- Bank Account Information:

- Routing Number: ______________________________________

- Account Number: ______________________________________

- Payment Frequency: _______________________________________

Step 5: Review and submit the form

The final step is to review the SBA 1201 Borrower Payment Form carefully, ensuring that all information is accurate and complete. Once you're satisfied, submit the form to the SBA or your loan servicer.

Tips and Reminders

- Make sure to keep a copy of the completed form for your records.

- If you're having trouble filling out the form, contact the SBA or your loan servicer for assistance.

- Ensure that you're making timely payments to avoid any penalties or fees.

By following these 5 easy steps, you'll be able to fill out the SBA 1201 Borrower Payment Form accurately and efficiently. Remember to review the form carefully and submit it on time to avoid any issues with your loan repayment.

What's next?

Now that you've filled out the SBA 1201 Borrower Payment Form, you can focus on managing your SBA loan and growing your business. Remember to stay on top of your loan payments and communicate with the SBA or your loan servicer if you have any questions or concerns.

Share your experience

Have you filled out the SBA 1201 Borrower Payment Form before? Share your experience in the comments below! If you have any questions or need further assistance, don't hesitate to ask.

FAQ Section

What is the SBA 1201 Borrower Payment Form used for?

+The SBA 1201 Borrower Payment Form is used to make payments on SBA loans.

Where can I find the SBA 1201 Borrower Payment Form?

+You can find the SBA 1201 Borrower Payment Form on the SBA website or by contacting your loan servicer.

What happens if I don't fill out the SBA 1201 Borrower Payment Form correctly?

+If you don't fill out the SBA 1201 Borrower Payment Form correctly, you may experience delays or issues with your loan repayment.