Understanding the ST-12 Form: A Guide to Sales Tax Exemption

In many states, businesses and organizations can take advantage of sales tax exemptions on certain purchases. To claim this exemption, a form must be completed and submitted to the vendor. In this article, we will explore the ST-12 form, a common document used for sales tax exemption, and provide a step-by-step guide on how to fill it out.

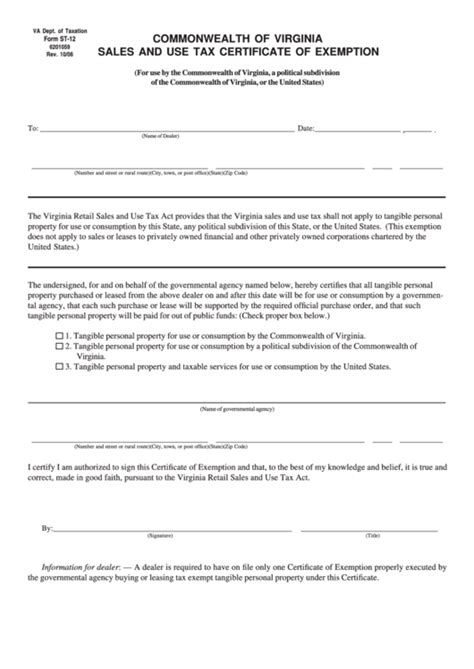

What is the ST-12 Form?

The ST-12 form is a certificate of exemption that allows eligible businesses and organizations to purchase goods and services without paying sales tax. This form is typically used in states that have a sales tax exemption program in place. The form serves as a declaration that the purchaser is exempt from paying sales tax on the specific transaction.

Who is Eligible for Sales Tax Exemption?

Not all businesses and organizations are eligible for sales tax exemption. To qualify, the purchaser must meet specific requirements, which vary by state. Common exemptions include:

- Non-profit organizations

- Government agencies

- Educational institutions

- Hospitals and healthcare organizations

- Charitable organizations

How to Fill Out the ST-12 Form

Filling out the ST-12 form requires accurate and complete information. Here's a step-by-step guide to help you complete the form:

- Purchaser's Information: Enter the name and address of the business or organization claiming the exemption.

- Vendor's Information: Provide the name and address of the vendor selling the goods or services.

- Exemption Type: Select the type of exemption being claimed (e.g., non-profit, government, educational).

- Description of Goods or Services: Describe the goods or services being purchased.

- Reason for Exemption: Explain why the purchaser is exempt from paying sales tax.

- Certification: Sign and date the form, certifying that the information provided is accurate and true.

Common Mistakes to Avoid When Filling Out the ST-12 Form

When filling out the ST-12 form, it's essential to avoid common mistakes that can lead to delays or rejection of the exemption claim. Here are some mistakes to watch out for:

- Incomplete or inaccurate information

- Failure to sign and date the form

- Incorrect exemption type or description

- Insufficient documentation or supporting evidence

Benefits of Using the ST-12 Form

Using the ST-12 form can help businesses and organizations save money on sales tax. Here are some benefits of using the form:

- Reduced costs: Exempting sales tax can result in significant cost savings.

- Simplified purchasing process: The ST-12 form streamlines the purchasing process, eliminating the need for multiple forms or paperwork.

- Increased efficiency: The form helps vendors quickly identify exempt transactions, reducing the risk of errors or delays.

Best Practices for Managing ST-12 Forms

To ensure effective management of ST-12 forms, follow these best practices:

- Maintain accurate and up-to-date records

- Keep forms organized and easily accessible

- Verify vendor information and exemption types

- Regularly review and update exemption certificates

Common FAQs About the ST-12 Form

Here are some frequently asked questions about the ST-12 form:

- Q: Who is eligible to use the ST-12 form? A: Businesses and organizations that meet specific exemption requirements, such as non-profit organizations or government agencies.

- Q: What is the purpose of the ST-12 form? A: The form certifies that the purchaser is exempt from paying sales tax on a specific transaction.

- Q: How often do I need to update the ST-12 form? A: The form should be updated whenever there are changes to the purchaser's information or exemption status.

Conclusion

The ST-12 form is a valuable tool for businesses and organizations that qualify for sales tax exemption. By understanding the form's purpose, eligibility requirements, and best practices for management, you can ensure accurate and efficient processing of exempt transactions. Remember to fill out the form carefully, avoiding common mistakes and keeping records up-to-date.

We hope this article has provided you with a comprehensive guide to the ST-12 form. If you have any further questions or would like to share your experiences with the form, please comment below.

FAQ Section

What is the ST-12 form used for?

+The ST-12 form is used to certify that a business or organization is exempt from paying sales tax on a specific transaction.

Who is eligible to use the ST-12 form?

+Businesses and organizations that meet specific exemption requirements, such as non-profit organizations or government agencies, are eligible to use the ST-12 form.

How often do I need to update the ST-12 form?

+The ST-12 form should be updated whenever there are changes to the purchaser's information or exemption status.