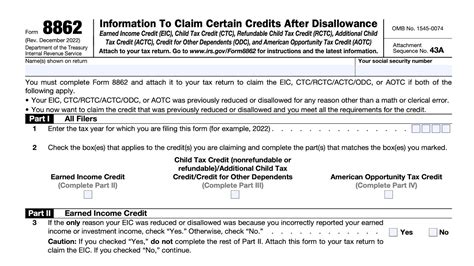

The Earned Income Tax Credit (EITC) is a valuable tax benefit for low-to-moderate-income working individuals and families. To claim the EITC, taxpayers must complete and submit Form 8862, Information To Claim Earned Income Tax Credit, along with their tax return. In this article, we will delve into the details of Form 8862, its importance, and the steps to complete it accurately.

Why is Form 8862 necessary?

The IRS requires Form 8862 to verify the eligibility of taxpayers claiming the EITC. The form ensures that only those who meet the necessary requirements receive the credit. By completing Form 8862, taxpayers provide the IRS with essential information to determine their eligibility and calculate the correct amount of the EITC.

Who needs to complete Form 8862?

Taxpayers who claim the EITC on their tax return must complete and submit Form 8862. This includes:

- Individuals and families with low-to-moderate incomes

- Workers with qualifying children

- Workers without qualifying children, but meet certain income and age requirements

- Self-employed individuals

- Taxpayers who receive certain types of income, such as tips or freelance work

How to complete Form 8862

Completing Form 8862 requires attention to detail and accuracy. Here's a step-by-step guide to help you fill out the form correctly:

- Gather necessary documents: Before starting Form 8862, ensure you have the required documents, including:

- Your tax return (Form 1040 or 1040-SR)

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your employer's name, address, and Employer Identification Number (EIN)

- Your child's Social Security number or ITIN (if claiming the EITC with children)

- Section 1: Eligibility

- Answer the questions in Section 1 to determine your eligibility for the EITC.

- Provide your name, address, and Social Security number or ITIN.

- Section 2: Income

- Report your income from all sources, including wages, tips, and self-employment income.

- Include any income from investments, such as interest, dividends, or capital gains.

- Section 3: Qualifying Children

- If claiming the EITC with children, provide their names, Social Security numbers or ITINs, and dates of birth.

- Answer the questions to determine if your children meet the qualifying child requirements.

- Section 4: Residency and Filing Status

- Provide your residency status and filing status (single, married filing jointly, etc.).

- Answer the questions to determine if you meet the residency and filing status requirements for the EITC.

- Section 5: Sign and Date

- Sign and date the form, ensuring you have accurately completed all sections.

Tips and reminders

- Complete Form 8862 carefully, as errors may delay or disallow your EITC claim.

- Keep a copy of your completed Form 8862 with your tax records.

- If you're unsure about any part of the form, consult the IRS instructions or seek help from a tax professional.

Benefits of completing Form 8862 accurately

Completing Form 8862 accurately is crucial to ensure you receive the correct amount of the EITC. By providing the required information, you'll:

- Avoid delays or disallowance of your EITC claim

- Receive the maximum EITC amount you're eligible for

- Reduce the risk of audits or penalties

Common mistakes to avoid

When completing Form 8862, avoid the following common mistakes:

- Inaccurate or incomplete information

- Failure to sign and date the form

- Not reporting all income sources

- Claiming the EITC with incorrect or ineligible children

IRS resources and support

If you need help with Form 8862 or have questions about the EITC, visit the IRS website (irs.gov) or contact the IRS directly:

- Phone: 1-800-829-1040 (individuals) or 1-800-829-4933 (businesses)

- Email:

- Local IRS offices: Find your nearest IRS office using the IRS Office Locator tool

Additional resources

For more information on the EITC and Form 8862, refer to the following resources:

- IRS Publication 596, Earned Income Credit (EIC)

- IRS Form 8862 Instructions

- IRS EITC webpage

By understanding the importance of Form 8862 and following the steps outlined above, you'll be able to complete the form accurately and claim the EITC you're eligible for.

Share your experience

Have you completed Form 8862 before? Share your experience and any tips you have for others in the comments below.

Stay informed

Stay up-to-date with the latest tax news and updates by following us on social media or subscribing to our newsletter.

What is the purpose of Form 8862?

+Form 8862 is used to verify the eligibility of taxpayers claiming the Earned Income Tax Credit (EITC). It ensures that only those who meet the necessary requirements receive the credit.

Who needs to complete Form 8862?

+Taxpayers who claim the EITC on their tax return must complete and submit Form 8862. This includes individuals and families with low-to-moderate incomes, workers with qualifying children, and self-employed individuals.

What documents do I need to complete Form 8862?

+To complete Form 8862, you'll need your tax return (Form 1040 or 1040-SR), Social Security number or ITIN, employer's name, address, and EIN, and your child's Social Security number or ITIN (if claiming the EITC with children).