QuickBooks Direct Deposit Authorization Form: Fast And Secure Payments

In today's digital age, managing finances and making payments has become more efficient and convenient. For businesses and individuals using QuickBooks, one of the most popular accounting software, direct deposit has become a game-changer. With the QuickBooks Direct Deposit Authorization Form, users can streamline their payment processes, reduce paperwork, and increase productivity. In this article, we will delve into the world of QuickBooks direct deposit, its benefits, and how to use the authorization form to facilitate fast and secure payments.

What is QuickBooks Direct Deposit?

QuickBooks Direct Deposit is a feature that allows users to pay employees, contractors, and vendors directly through the software. This eliminates the need for paper checks, reducing the risk of lost or stolen checks and minimizing the time spent on processing payments. With direct deposit, funds are transferred electronically from the payer's account to the recipient's account, ensuring fast and secure transactions.

Benefits of Using QuickBooks Direct Deposit

The benefits of using QuickBooks Direct Deposit are numerous. Some of the most significant advantages include:

- Increased Efficiency: Direct deposit automates the payment process, reducing the time spent on manual processing and minimizing errors.

- Improved Security: Electronic transactions reduce the risk of lost or stolen checks, ensuring that payments are made securely.

- Reduced Costs: Direct deposit eliminates the need for paper checks, envelopes, and postage, reducing costs associated with traditional payment methods.

- Enhanced Employee Satisfaction: Employees can receive their paychecks faster, improving morale and reducing the likelihood of payroll-related issues.

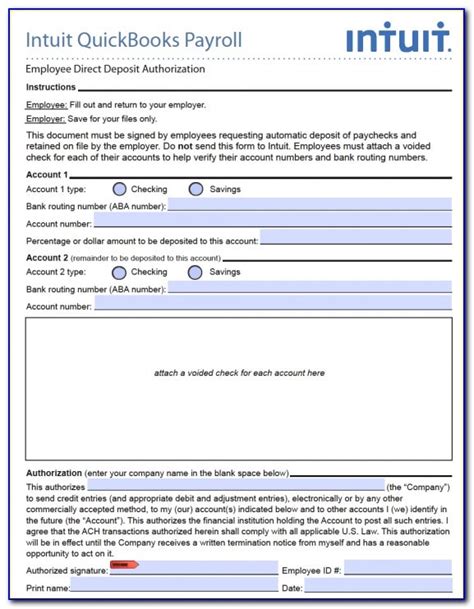

Understanding the QuickBooks Direct Deposit Authorization Form

The QuickBooks Direct Deposit Authorization Form is a document that authorizes the software to initiate direct deposit transactions. The form requires the recipient's bank account information, including the account number, routing number, and account type. This information is used to verify the recipient's account and ensure that funds are transferred correctly.

How to Fill Out the QuickBooks Direct Deposit Authorization Form

To fill out the QuickBooks Direct Deposit Authorization Form, follow these steps:

- Gather Required Information: Collect the recipient's bank account information, including the account number, routing number, and account type.

- Enter Recipient Information: Enter the recipient's name, address, and Social Security number or Employer Identification Number (EIN).

- Select Account Type: Choose the type of account the recipient wants to use for direct deposit (e.g., checking or savings).

- Enter Bank Account Information: Enter the recipient's bank account number, routing number, and account type.

- Authorize Direct Deposit: Sign and date the form to authorize QuickBooks to initiate direct deposit transactions.

Best Practices for Using the QuickBooks Direct Deposit Authorization Form

To ensure smooth and secure transactions, follow these best practices when using the QuickBooks Direct Deposit Authorization Form:

- Verify Recipient Information: Double-check the recipient's bank account information to prevent errors.

- Use Secure Storage: Store completed authorization forms securely to protect sensitive information.

- Establish Clear Communication: Inform recipients about the direct deposit process and provide clear instructions for completing the authorization form.

Common Issues and Troubleshooting

When using the QuickBooks Direct Deposit Authorization Form, you may encounter some common issues. Here are some troubleshooting tips to resolve these issues:

- Invalid Bank Account Information: Verify the recipient's bank account information and re-enter the correct details.

- Incorrect Routing Number: Check the routing number and re-enter the correct details.

- Direct Deposit Not Processing: Check the authorization form for errors and ensure that the recipient's account information is correct.

Conclusion: Streamlining Payments with QuickBooks Direct Deposit Authorization Form

The QuickBooks Direct Deposit Authorization Form is a powerful tool for streamlining payment processes and reducing paperwork. By following the steps outlined in this article and using the authorization form correctly, users can ensure fast and secure payments, improving efficiency and productivity. Whether you're a business owner or an accountant, understanding the benefits and best practices of QuickBooks direct deposit can help you optimize your payment processes and take your financial management to the next level.

We hope this article has been informative and helpful. If you have any questions or comments, please feel free to share them below.

What is the QuickBooks Direct Deposit Authorization Form?

+The QuickBooks Direct Deposit Authorization Form is a document that authorizes the software to initiate direct deposit transactions.

How do I fill out the QuickBooks Direct Deposit Authorization Form?

+To fill out the form, gather the recipient's bank account information, enter the recipient's name and address, select the account type, and authorize direct deposit.

What are the benefits of using QuickBooks Direct Deposit?

+The benefits of using QuickBooks Direct Deposit include increased efficiency, improved security, reduced costs, and enhanced employee satisfaction.