Understanding the Form 1120 Worksheet: Unlocking 5 Key Deductions for Corporate Tax Returns

The Form 1120 worksheet is a crucial tool for corporations to calculate their taxable income and claim essential deductions. As a corporation, it's vital to stay up-to-date on the latest tax laws and regulations to ensure you're taking advantage of all eligible deductions. In this article, we'll delve into five key deductions that can significantly impact your corporate tax return.

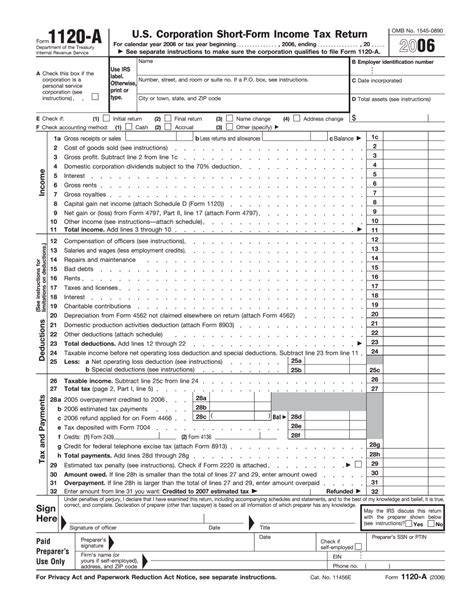

What is the Form 1120 Worksheet?

The Form 1120 worksheet is a supplementary document used to calculate a corporation's taxable income. It's typically attached to the Form 1120, U.S. Corporation Income Tax Return, and helps corporations claim various deductions and credits. The worksheet is divided into different sections, each focusing on specific types of income, deductions, and credits.

1. Business Expense Deductions

Business expense deductions are a crucial aspect of the Form 1120 worksheet. These deductions include expenses related to the operation of the business, such as salaries, rent, utilities, and supplies. To qualify as a business expense deduction, the expense must be:

- Ordinary and necessary for the business

- Paid or incurred during the tax year

- Not a personal expense

Some common examples of business expense deductions include:

- Employee salaries and benefits

- Rent and utilities for business premises

- Advertising and marketing expenses

- Travel expenses for business purposes

- Insurance premiums for business-related risks

How to Claim Business Expense Deductions

To claim business expense deductions, you'll need to complete the following steps:

- Identify eligible expenses: Review your business records and identify expenses that meet the criteria for business expense deductions.

- Calculate the total amount: Add up the total amount of eligible expenses.

- Complete Form 1125: Complete Form 1125, Cost of Goods Sold, and report the total amount of business expense deductions.

- Attach to Form 1120: Attach Form 1125 to your Form 1120 and submit it with your tax return.

2. Depreciation and Amortization Deductions

Depreciation and amortization deductions allow corporations to recover the cost of tangible and intangible assets over time. These deductions can significantly reduce taxable income and lower tax liability.

Types of Depreciation and Amortization Deductions

There are two primary types of depreciation and amortization deductions:

- Depreciation: This type of deduction applies to tangible assets, such as buildings, equipment, and vehicles.

- Amortization: This type of deduction applies to intangible assets, such as patents, copyrights, and trademarks.

How to Claim Depreciation and Amortization Deductions

To claim depreciation and amortization deductions, you'll need to:

- Identify eligible assets: Identify tangible and intangible assets that are eligible for depreciation and amortization deductions.

- Calculate the depreciation and amortization amount: Use the Modified Accelerated Cost Recovery System (MACRS) to calculate the depreciation and amortization amount for each asset.

- Complete Form 4562: Complete Form 4562, Depreciation and Amortization, and report the total amount of depreciation and amortization deductions.

- Attach to Form 1120: Attach Form 4562 to your Form 1120 and submit it with your tax return.

3. Research and Development (R&D) Expenses

Research and development (R&D) expenses are eligible for deduction on the Form 1120 worksheet. These expenses include costs related to the development of new products, processes, and technologies.

Types of R&D Expenses

The following types of R&D expenses are eligible for deduction:

- Salaries and wages for R&D employees

- Materials and supplies used in R&D activities

- Rent and utilities for R&D facilities

- Consulting fees for R&D services

How to Claim R&D Expenses

To claim R&D expenses, you'll need to:

- Identify eligible expenses: Identify R&D expenses that meet the criteria for deduction.

- Calculate the total amount: Add up the total amount of eligible R&D expenses.

- Complete Form 6765: Complete Form 6765, Credit for Increasing Research Activities, and report the total amount of R&D expenses.

- Attach to Form 1120: Attach Form 6765 to your Form 1120 and submit it with your tax return.

4. Net Operating Loss (NOL) Deductions

Net operating loss (NOL) deductions allow corporations to carry forward or carry back losses to offset taxable income in future or past years.

How to Claim NOL Deductions

To claim NOL deductions, you'll need to:

- Calculate the NOL: Calculate the net operating loss for the current tax year.

- Complete Form 1139: Complete Form 1139, Corporation Application for Tentative Refund, to claim a refund for prior years.

- Attach to Form 1120: Attach Form 1139 to your Form 1120 and submit it with your tax return.

5. Charitable Contributions

Charitable contributions are eligible for deduction on the Form 1120 worksheet. These contributions include donations to qualified charitable organizations.

Types of Charitable Contributions

The following types of charitable contributions are eligible for deduction:

- Cash donations

- Property donations, such as real estate or securities

- Goods and services donations

How to Claim Charitable Contributions

To claim charitable contributions, you'll need to:

- Identify eligible contributions: Identify charitable contributions that meet the criteria for deduction.

- Calculate the total amount: Add up the total amount of eligible charitable contributions.

- Complete Form 8283: Complete Form 8283, Noncash Charitable Contributions, and report the total amount of charitable contributions.

- Attach to Form 1120: Attach Form 8283 to your Form 1120 and submit it with your tax return.

What is the purpose of the Form 1120 worksheet?

+The Form 1120 worksheet is used to calculate a corporation's taxable income and claim essential deductions.

What types of business expenses are eligible for deduction on the Form 1120 worksheet?

+Business expense deductions include expenses related to the operation of the business, such as salaries, rent, utilities, and supplies.

How do I claim depreciation and amortization deductions on the Form 1120 worksheet?

+To claim depreciation and amortization deductions, you'll need to identify eligible assets, calculate the depreciation and amortization amount using the Modified Accelerated Cost Recovery System (MACRS), and complete Form 4562.

We hope this article has provided you with a comprehensive understanding of the five key deductions on the Form 1120 worksheet. Remember to carefully review your business records and consult with a tax professional to ensure you're taking advantage of all eligible deductions. Don't hesitate to reach out to us if you have any further questions or need assistance with your corporate tax return. Share your thoughts and comments below, and don't forget to share this article with your colleagues and friends who may benefit from this information.