As a homeowner, receiving a Pennymac 1098 form is a crucial part of your tax preparation process. The 1098 form, also known as the Mortgage Interest Statement, is used to report the amount of interest you paid on your mortgage during the tax year. In this article, we will guide you through the process of understanding and using the Pennymac 1098 form to your advantage.

What is the Pennymac 1098 Form?

The Pennymac 1098 form is a statement provided by Pennymac, a leading mortgage lender, to borrowers who have paid more than $600 in interest on their mortgage during the tax year. This form is used to report the amount of interest paid, as well as other mortgage-related expenses, to the Internal Revenue Service (IRS).

Why is the Pennymac 1098 Form Important?

The Pennymac 1098 form is essential for homeowners who want to claim the mortgage interest deduction on their tax return. The mortgage interest deduction is a valuable tax benefit that allows homeowners to deduct the interest paid on their mortgage from their taxable income. This deduction can result in significant tax savings, especially for homeowners with large mortgages.

How to Read and Understand the Pennymac 1098 Form

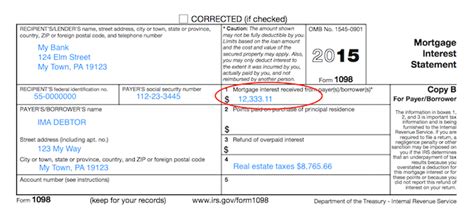

The Pennymac 1098 form is a straightforward document that provides the necessary information to claim the mortgage interest deduction. Here's a breakdown of the information included on the form:

- Box 1: This box shows the total amount of interest paid on your mortgage during the tax year.

- Box 2: This box shows the total amount of points paid on your mortgage during the tax year. Points are fees paid to the lender to secure a lower interest rate.

- Box 3: This box shows the total amount of private mortgage insurance (PMI) premiums paid during the tax year. PMI is insurance that protects the lender in case the borrower defaults on the loan.

- Box 4: This box shows the total amount of mortgage insurance premiums paid during the tax year.

How to Use the Pennymac 1098 Form for Tax Purposes

To use the Pennymac 1098 form for tax purposes, follow these steps:

- Review the form carefully to ensure that the information is accurate.

- Report the interest paid on your mortgage on Schedule A (Itemized Deductions) of your tax return.

- Claim the mortgage interest deduction on Line 8 of Schedule A.

- If you paid points or PMI premiums, report these expenses on Schedule A as well.

Common Questions About the Pennymac 1098 Form

Here are some common questions about the Pennymac 1098 form:

- Q: What is the deadline for receiving the Pennymac 1098 form?

- A: The Pennymac 1098 form is typically mailed to borrowers by January 31st of each year.

- Q: What if I didn't receive my Pennymac 1098 form?

- A: Contact Pennymac customer service to request a replacement form.

- Q: Can I use the Pennymac 1098 form to claim the mortgage interest deduction on my tax return?

- A: Yes, the Pennymac 1098 form provides the necessary information to claim the mortgage interest deduction.

Tips for Managing Your Pennymac 1098 Form

Here are some tips for managing your Pennymac 1098 form:

- Keep accurate records: Keep a copy of your Pennymac 1098 form with your tax documents.

- Review the form carefully: Ensure that the information on the form is accurate before using it for tax purposes.

- Claim the mortgage interest deduction: Don't miss out on this valuable tax benefit – claim the mortgage interest deduction on your tax return.

Conclusion: Taking Control of Your Pennymac 1098 Form

In conclusion, the Pennymac 1098 form is an essential document for homeowners who want to claim the mortgage interest deduction on their tax return. By understanding how to read and use the form, you can take control of your tax preparation process and ensure that you're getting the maximum tax benefit from your mortgage interest payments.

We hope this guide has been helpful in explaining the Pennymac 1098 form and its importance in the tax preparation process. If you have any further questions or concerns, please don't hesitate to reach out to us.

Call to Action: Share your experiences with the Pennymac 1098 form in the comments section below. Have you had any issues with the form or the tax preparation process? Let us know, and we'll do our best to help.

What is the deadline for receiving the Pennymac 1098 form?

+The Pennymac 1098 form is typically mailed to borrowers by January 31st of each year.

Can I use the Pennymac 1098 form to claim the mortgage interest deduction on my tax return?

+Yes, the Pennymac 1098 form provides the necessary information to claim the mortgage interest deduction.

What if I didn't receive my Pennymac 1098 form?

+Contact Pennymac customer service to request a replacement form.