The concept of In Forma Pauperis (IFP) has been a cornerstone of the United States' justice system, ensuring that individuals who cannot afford legal fees are not denied access to the courts. In Forma Pauperis, which translates to "in the manner of a pauper," is a Latin term that refers to the procedure by which a person who is unable to pay court fees can request a waiver of those fees. In this article, we will delve into the world of IFP, exploring its history, benefits, and the process of applying for a fee waiver.

History of In Forma Pauperis

The concept of IFP dates back to the early days of the American colonies, where it was recognized that the poor had a right to access the courts, just like the wealthy. Over time, the federal government and individual states have established laws and procedures to ensure that those who cannot afford legal fees are not denied justice. The current federal law governing IFP is 28 U.S.C. § 1915, which was enacted in 1934.

Benefits of In Forma Pauperis

The benefits of IFP are numerous, and they are designed to ensure that all individuals, regardless of their financial situation, have access to the courts. Some of the benefits include:

• Waiver of filing fees: IFP applicants are exempt from paying filing fees, which can be substantial, especially in federal court. • Waiver of other court costs: IFP applicants may also be exempt from paying other court costs, such as fees for serving process, filing motions, and obtaining transcripts. • Access to court-appointed counsel: In some cases, IFP applicants may be entitled to court-appointed counsel, which can be a significant benefit for those who cannot afford to hire an attorney.

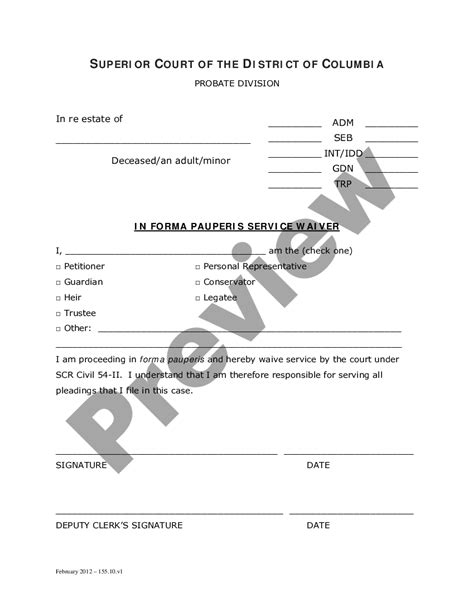

The IFP Application Process

The IFP application process is relatively straightforward, but it does require some effort and documentation. Here are the steps involved:

- Obtain the IFP application form: The IFP application form is usually available on the court's website or can be obtained from the court clerk's office.

- Complete the application form: The applicant must provide detailed information about their financial situation, including income, expenses, assets, and debts.

- Attach supporting documentation: The applicant must attach supporting documentation, such as tax returns, pay stubs, and bank statements, to verify their financial situation.

- File the application: The completed application and supporting documentation must be filed with the court.

Eligibility Requirements

To be eligible for IFP, an applicant must meet certain financial requirements. The court will consider the applicant's:

• Income: The applicant's income must be below a certain threshold, which varies depending on the court and the applicant's family size. • Expenses: The applicant's expenses, such as rent/mortgage, utilities, and food, will be taken into account. • Assets: The applicant's assets, such as bank accounts, investments, and real property, will be considered. • Debts: The applicant's debts, such as credit card debt, loans, and mortgages, will be taken into account.

Common Mistakes to Avoid

When applying for IFP, it is essential to avoid common mistakes that can result in the application being denied. Here are some common mistakes to avoid:

• Inaccurate or incomplete information: The application must be complete and accurate, with all required documentation attached. • Failure to disclose financial information: The applicant must disclose all financial information, including income, expenses, assets, and debts. • Failure to sign the application: The application must be signed by the applicant, under penalty of perjury.

IFP in State Courts

While the federal IFP statute is uniform, each state has its own laws and procedures governing IFP. Some states have more generous IFP laws than others, and some may have different eligibility requirements or application procedures. It is essential to familiarize yourself with the specific IFP laws and procedures in your state.

State-Specific IFP Laws

Here are a few examples of state-specific IFP laws:

• California: California has a relatively generous IFP law, which allows applicants to qualify for IFP if their income is below 125% of the federal poverty level. • New York: New York has a more restrictive IFP law, which requires applicants to demonstrate that they are " unable to pay" court fees.

IFP in Bankruptcy Court

In bankruptcy court, IFP is governed by a separate set of rules and procedures. The Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) of 2005 introduced significant changes to the IFP rules in bankruptcy court.

BAPCPA and IFP

Under BAPCPA, IFP applicants in bankruptcy court must meet more stringent eligibility requirements, including:

• Means test: IFP applicants must pass a means test, which assesses their income and expenses to determine whether they can afford to pay court fees. • Disposable income: IFP applicants must demonstrate that they have little or no disposable income available to pay court fees.

Conclusion

In conclusion, In Forma Pauperis is an essential aspect of the United States' justice system, ensuring that individuals who cannot afford legal fees are not denied access to the courts. By understanding the IFP application process, eligibility requirements, and common mistakes to avoid, individuals can navigate the system with confidence. Whether in federal or state court, or in bankruptcy court, IFP is a vital tool for ensuring that justice is accessible to all.

What's Next?

If you are considering applying for IFP, we encourage you to:

• Consult with an attorney: An attorney can help you navigate the IFP application process and ensure that you meet the eligibility requirements. • Gather supporting documentation: Make sure you have all required documentation, including financial records and proof of income. • Submit your application: Once you have completed the application and gathered supporting documentation, submit your application to the court.

By taking these steps, you can ensure that you receive the justice you deserve, regardless of your financial situation.

What is In Forma Pauperis?

+In Forma Pauperis (IFP) is a Latin term that refers to the procedure by which a person who is unable to pay court fees can request a waiver of those fees.

How do I apply for IFP?

+To apply for IFP, you must obtain the IFP application form, complete it, and attach supporting documentation, such as financial records and proof of income.

What are the eligibility requirements for IFP?

+To be eligible for IFP, you must meet certain financial requirements, including income, expenses, assets, and debts.