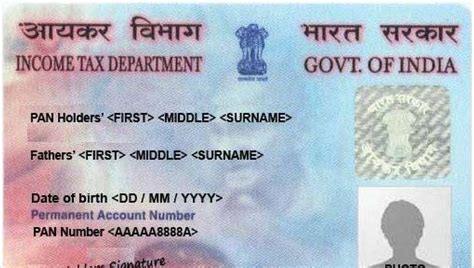

Correcting errors on your Permanent Account Number (PAN) card is a crucial step in ensuring the accuracy of your financial and tax-related information. The Income Tax Department of India has made it possible to correct PAN card errors online, making the process more convenient and efficient. In this article, we will explore the five ways to correct PAN card errors online and provide a step-by-step guide to help you through the process.

Importance of Correcting PAN Card Errors

Ensuring the accuracy of your PAN card information is essential for several reasons. Firstly, a PAN card is a critical document required for various financial transactions, such as opening a bank account, investing in mutual funds, or filing tax returns. Secondly, incorrect information on your PAN card can lead to delays or rejection of your financial transactions. Finally, correcting PAN card errors online is a straightforward process that can be completed from the comfort of your own home.

Benefits of Correcting PAN Card Errors Online

Correcting PAN card errors online offers several benefits, including:

- Convenience: The online process eliminates the need to visit a PAN card office or submit physical documents.

- Time-saving: The online process is faster and more efficient, allowing you to correct errors quickly and easily.

- Accuracy: The online process reduces the likelihood of errors, ensuring that your information is accurate and up-to-date.

- Security: The online process is secure, protecting your sensitive information from unauthorized access.

5 Ways to Correct PAN Card Errors Online

- NSDL Online PAN Correction The National Securities Depository Limited (NSDL) provides an online platform for correcting PAN card errors. To use this service, follow these steps:

- Visit the NSDL website and click on "Apply Online" under the "PAN" section.

- Select "Correction in PAN Card" and fill in the required details.

- Upload the necessary documents, including proof of identity, proof of address, and proof of date of birth.

- Pay the applicable fee using a credit/debit card or net banking.

- Submit the application and receive an acknowledgement receipt.

- UTIITSL Online PAN Correction The UTI Infrastructure Technology and Services Limited (UTIITSL) also provides an online platform for correcting PAN card errors. To use this service, follow these steps:

- Visit the UTIITSL website and click on "PAN Card" under the "Services" section.

- Select "Correction in PAN Card" and fill in the required details.

- Upload the necessary documents, including proof of identity, proof of address, and proof of date of birth.

- Pay the applicable fee using a credit/debit card or net banking.

- Submit the application and receive an acknowledgement receipt.

- PAN Card Online Portal The Income Tax Department has launched an online portal for correcting PAN card errors. To use this service, follow these steps:

- Visit the e-Filing portal of the Income Tax Department and log in to your account.

- Click on "PAN Services" and select "Correction in PAN Card".

- Fill in the required details and upload the necessary documents.

- Pay the applicable fee using a credit/debit card or net banking.

- Submit the application and receive an acknowledgement receipt.

- Aadhaar-Based PAN Correction If you have an Aadhaar card, you can use it to correct PAN card errors online. To use this service, follow these steps:

- Visit the e-Filing portal of the Income Tax Department and log in to your account.

- Click on "PAN Services" and select "Aadhaar-Based PAN Correction".

- Enter your Aadhaar number and OTP to authenticate your identity.

- Fill in the required details and upload the necessary documents.

- Pay the applicable fee using a credit/debit card or net banking.

- Submit the application and receive an acknowledgement receipt.

- TIN-Facilitation Centres The Tax Information Network (TIN) has set up facilitation centres across the country to assist taxpayers with PAN card corrections. To use this service, follow these steps:

- Locate a TIN facilitation centre near you and visit in person.

- Fill in the required details and upload the necessary documents.

- Pay the applicable fee using a credit/debit card or cash.

- Submit the application and receive an acknowledgement receipt.

Documents Required for PAN Card Correction

The following documents are required for correcting PAN card errors online:

- Proof of identity (Aadhaar card, passport, driving license, etc.)

- Proof of address (Aadhaar card, passport, utility bills, etc.)

- Proof of date of birth (Aadhaar card, passport, birth certificate, etc.)

- PAN card copy

- Address proof (utility bills, etc.)

Frequently Asked Questions

-

What is the fee for correcting PAN card errors online? The fee for correcting PAN card errors online is Rs. 93, which includes GST.

-

How long does it take to correct PAN card errors online? The online process typically takes 1-3 working days, depending on the type of correction.

-

Can I correct multiple PAN card errors at once? Yes, you can correct multiple PAN card errors at once using the online process.

-

Do I need to provide proof of identity and address for PAN card correction? Yes, you need to provide proof of identity and address to correct PAN card errors online.

Take Action Today

Don't let PAN card errors hold you back from enjoying smooth financial transactions. Take action today and correct your PAN card errors online using one of the five methods outlined above. If you have any further questions or concerns, please leave a comment below.

What is the difference between NSDL and UTIITSL PAN correction services?

+Both NSDL and UTIITSL are authorized by the Income Tax Department to provide PAN correction services. The main difference lies in the user interface and the document upload process.

Can I correct PAN card errors online if I have a minor error?

+Yes, you can correct minor errors such as spelling mistakes or incorrect date of birth online.

How do I track the status of my PAN card correction application?

+You can track the status of your PAN card correction application using the acknowledgement number provided after submitting the application.