The DD Form 2656, also known as the "Data for Payment of Retired Personnel", is a crucial document for military personnel transitioning to retirement. In this article, we will delve into the top 5 facts about the DD Form 2656, providing you with a comprehensive understanding of its significance, uses, and implications.

What is the DD Form 2656?

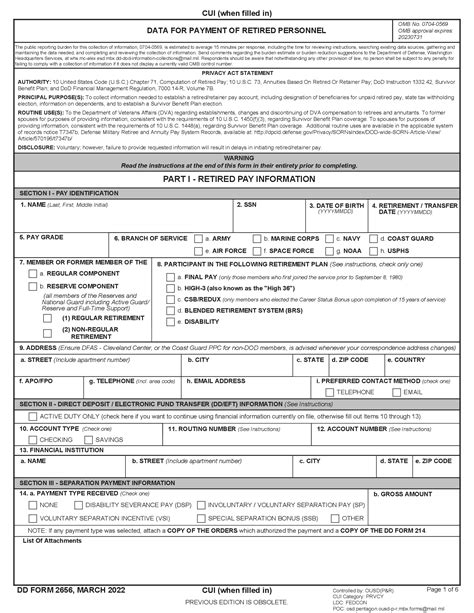

The DD Form 2656 is a standardized form used by the United States Department of Defense (DoD) to collect data necessary for the payment of retired personnel. The form is typically completed by military members who are separating from service and are eligible for retirement benefits. The information provided on the form is used to determine the individual's retirement pay, as well as to establish their eligibility for other benefits.

Who Needs to Complete the DD Form 2656?

Not all military personnel need to complete the DD Form 2656. The form is specifically designed for those who are separating from service and are eligible for retirement benefits. This typically includes:

- Military members who have completed 20 years of service and are eligible for retirement

- Military members who are medically retired

- Military members who are retiring due to a service-connected disability

What Information is Collected on the DD Form 2656?

The DD Form 2656 collects a wide range of information necessary for the payment of retired personnel. Some of the key data points collected on the form include:

- Personal identifying information (e.g., name, date of birth, social security number)

- Military service history (e.g., dates of service, branch of service, rank)

- Retirement eligibility information (e.g., years of service, type of retirement)

- Pay and allowance information (e.g., basic pay, allowances, special pays)

- Benefit information (e.g., life insurance, health insurance, survivor benefits)

How is the DD Form 2656 Used?

The DD Form 2656 is used by the Defense Finance and Accounting Service (DFAS) to process retirement pay and benefits for eligible military personnel. The form is typically completed and submitted to the DFAS prior to the individual's separation from service. The information collected on the form is used to:

- Determine the individual's retirement pay rate

- Establish eligibility for other benefits (e.g., life insurance, health insurance, survivor benefits)

- Process the individual's retirement claim

What are the Implications of the DD Form 2656?

The DD Form 2656 has significant implications for military personnel transitioning to retirement. Some of the key implications include:

- Accurate determination of retirement pay and benefits

- Timely processing of retirement claims

- Eligibility for other benefits (e.g., life insurance, health insurance, survivor benefits)

Common Mistakes to Avoid When Completing the DD Form 2656

When completing the DD Form 2656, it is essential to avoid common mistakes that can delay or affect the processing of retirement pay and benefits. Some of the most common mistakes to avoid include:

- Inaccurate or incomplete information

- Failure to sign and date the form

- Failure to submit the form prior to separation from service

Conclusion

The DD Form 2656 is a critical document for military personnel transitioning to retirement. Understanding the top 5 facts about the DD Form 2656 can help ensure a smooth transition to retirement and accurate determination of retirement pay and benefits. By avoiding common mistakes and submitting the form prior to separation from service, military personnel can ensure timely processing of their retirement claims.

If you have any questions or comments about the DD Form 2656, please feel free to share them below.

What is the purpose of the DD Form 2656?

+The DD Form 2656 is used to collect data necessary for the payment of retired personnel.

Who needs to complete the DD Form 2656?

+Military personnel who are separating from service and are eligible for retirement benefits need to complete the DD Form 2656.

What information is collected on the DD Form 2656?

+The DD Form 2656 collects personal identifying information, military service history, retirement eligibility information, pay and allowance information, and benefit information.