Requesting a loan from Lincoln Financial can be a straightforward process if you have the necessary information and follow the correct steps. Here's a comprehensive guide to help you complete the Lincoln Financial loan request form in 5 easy steps.

Understanding the Importance of a Loan Request Form

Before we dive into the steps, it's essential to understand the significance of a loan request form. A loan request form is a document that outlines your loan requirements, personal and financial information, and repayment plans. It serves as a formal request to Lincoln Financial to consider your loan application.

Step 1: Gather Required Documents and Information

To complete the loan request form, you'll need to gather the following documents and information:

- Personal identification documents (driver's license, passport, or state ID)

- Proof of income (pay stubs, W-2 forms, or tax returns)

- Proof of employment (letter from employer or business license)

- Bank statements and account information

- Loan amount and repayment term requirements

- Credit score and history (if applicable)

Why is this information necessary?

Lincoln Financial requires this information to assess your creditworthiness, loan repayment capacity, and overall financial stability. Providing accurate and complete information will help facilitate the loan approval process.

Step 2: Choose the Right Loan Type and Amount

Lincoln Financial offers various loan types, including personal loans, mortgage loans, and business loans. You'll need to choose the right loan type and amount that suits your needs.

- Consider your loan purpose, repayment capacity, and financial goals

- Check the loan interest rates, fees, and repayment terms

- Determine the loan amount and repayment period that works best for you

How to choose the right loan type?

You can visit the Lincoln Financial website or consult with a financial advisor to determine the best loan type for your needs. Consider factors like loan interest rates, fees, and repayment terms to make an informed decision.

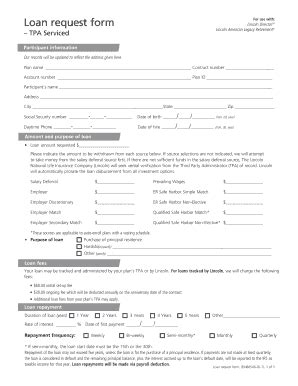

Step 3: Fill Out the Loan Request Form

Once you've gathered the required documents and information, it's time to fill out the loan request form.

- Log in to your Lincoln Financial account or create a new one

- Fill out the online loan request form or download a printable version

- Provide accurate and complete information, including personal and financial details

- Review and submit the form

What to expect after submitting the form?

After submitting the loan request form, Lincoln Financial will review your application and may request additional information or documentation. You can expect to receive a loan decision within a few business days.

Step 4: Review and Sign the Loan Agreement

If your loan application is approved, you'll receive a loan agreement outlining the loan terms, interest rates, and repayment conditions.

- Review the loan agreement carefully, ensuring you understand the terms and conditions

- Sign and return the agreement to Lincoln Financial

- Receive the loan funds and begin making repayments

What to do if you have questions or concerns?

If you have questions or concerns about the loan agreement, don't hesitate to contact Lincoln Financial customer support. They'll be happy to address your queries and provide clarification.

Step 5: Make Timely Repayments and Monitor Your Loan

The final step is to make timely repayments and monitor your loan.

- Set up automatic payments to ensure timely repayments

- Monitor your loan balance and repayment schedule

- Make extra payments or adjustments as needed

Why is timely repayment important?

Timely repayment is crucial to maintaining a good credit score and avoiding late fees or penalties. By making regular repayments, you'll be able to pay off your loan efficiently and achieve your financial goals.

By following these 5 steps, you can complete the Lincoln Financial loan request form and take the first step towards achieving your financial objectives. Remember to gather required documents, choose the right loan type, fill out the form accurately, review and sign the loan agreement, and make timely repayments.

What is the minimum credit score required for a Lincoln Financial loan?

+The minimum credit score required for a Lincoln Financial loan varies depending on the loan type and amount. However, a good credit score is typically considered 700 or higher.

How long does it take to process a Lincoln Financial loan application?

+The loan processing time may vary depending on the complexity of the application and the speed of providing required documentation. However, you can expect to receive a loan decision within a few business days.

Can I apply for a Lincoln Financial loan if I have a poor credit history?

+While a poor credit history may affect your loan eligibility, it's not necessarily a barrier to approval. Lincoln Financial considers various factors, including income, employment history, and loan repayment capacity. You may still be eligible for a loan, but with less favorable terms.

We hope this article has provided you with a comprehensive guide to completing the Lincoln Financial loan request form. If you have any further questions or concerns, feel free to comment below or share this article with others who may find it helpful.