Tax season can be a daunting time for many individuals and businesses, with the numerous forms and regulations to navigate. One of the forms that can be particularly confusing is Tax Form 5564, also known as the Notice of Deficiency. In this article, we will delve into the details of Tax Form 5564, explaining its purpose, how to fill it out, and what to expect if you receive one.

What is Tax Form 5564?

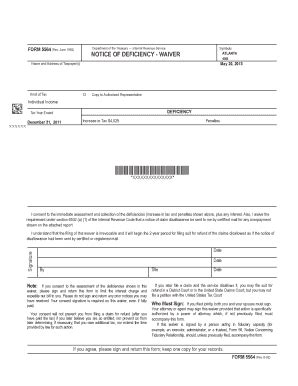

Tax Form 5564 is a notice sent by the Internal Revenue Service (IRS) to taxpayers who have underpaid or owe additional taxes on their tax return. The notice is used to inform the taxpayer of the amount of taxes owed, as well as any penalties and interest that may be due. The form is typically sent after the IRS has audited a tax return and determined that additional taxes are owed.

Why Did I Receive a Tax Form 5564?

There are several reasons why you may receive a Tax Form 5564. Some of the most common reasons include:

- Underreporting income: If you failed to report all of your income on your tax return, the IRS may send you a Tax Form 5564 to inform you of the additional taxes owed.

- Incorrect deductions: If you claimed deductions that you are not eligible for, the IRS may disallow those deductions and send you a Tax Form 5564.

- Failure to file: If you failed to file a tax return, the IRS may send you a Tax Form 5564 to inform you of the taxes owed, as well as any penalties and interest.

How to Fill Out Tax Form 5564

If you receive a Tax Form 5564, it is essential to review the notice carefully and understand the information contained within. The form will include the following information:

- The amount of taxes owed

- Any penalties and interest due

- The tax year(s) affected

- A summary of the changes made to your tax return

To fill out Tax Form 5564, follow these steps:

- Review the notice carefully and make sure you understand the information contained within.

- If you agree with the changes made by the IRS, sign and date the form and return it to the IRS.

- If you disagree with the changes, you can request a hearing or appeal the decision.

What to Expect if You Receive a Tax Form 5564

If you receive a Tax Form 5564, there are several things you can expect to happen:

- You will be required to pay the amount of taxes owed, as well as any penalties and interest due.

- You may be required to provide additional documentation to support your tax return.

- You may be subject to an audit or examination by the IRS.

- You may be able to appeal the decision or request a hearing.

Penalties and Interest

If you receive a Tax Form 5564, you may be subject to penalties and interest on the amount of taxes owed. The penalties and interest can add up quickly, so it is essential to address the issue as soon as possible.

- Penalties: The IRS may impose penalties for failure to file, failure to pay, or accuracy-related penalties.

- Interest: The IRS charges interest on the amount of taxes owed, starting from the original due date of the tax return.

How to Avoid Receiving a Tax Form 5564

While it is not possible to avoid receiving a Tax Form 5564 entirely, there are several steps you can take to minimize the risk:

- File your tax return accurately and on time.

- Report all income and claim only eligible deductions.

- Keep accurate records and documentation to support your tax return.

- Respond promptly to any notices or correspondence from the IRS.

Conclusion: Taking Control of Your Taxes

Receiving a Tax Form 5564 can be a stressful and overwhelming experience. However, by understanding the purpose and process of the form, you can take control of your taxes and minimize the risk of receiving a notice. Remember to file your tax return accurately and on time, report all income, and keep accurate records and documentation. If you do receive a Tax Form 5564, respond promptly and seek professional help if needed.

We encourage you to share your thoughts and experiences with Tax Form 5564 in the comments below. Have you received a notice? How did you handle it? Share your story and help others who may be going through a similar situation.

What is the purpose of Tax Form 5564?

+Tax Form 5564 is a notice sent by the IRS to taxpayers who have underpaid or owe additional taxes on their tax return.

How do I fill out Tax Form 5564?

+To fill out Tax Form 5564, review the notice carefully and understand the information contained within. If you agree with the changes, sign and date the form and return it to the IRS. If you disagree, request a hearing or appeal the decision.

What are the consequences of receiving a Tax Form 5564?

+If you receive a Tax Form 5564, you may be required to pay the amount of taxes owed, as well as any penalties and interest due. You may also be subject to an audit or examination by the IRS.