As the tax season approaches, it's essential to ensure that you're in compliance with all tax regulations. In Pennsylvania, the PA Form 40-ES is a crucial document for individuals who need to make estimated tax payments throughout the year. Filing this form correctly can help you avoid penalties and interest. In this article, we will explore five ways to file PA Form 40-ES correctly.

Understanding PA Form 40-ES

Before we dive into the five ways to file PA Form 40-ES correctly, it's essential to understand what this form is and who needs to file it. PA Form 40-ES is the estimated income tax voucher for individuals who need to make estimated tax payments throughout the year. This form is typically filed by self-employed individuals, freelancers, and those who receive income that is not subject to withholding.

Who Needs to File PA Form 40-ES?

You need to file PA Form 40-ES if you expect to owe more than $500 in taxes for the year and you're not having taxes withheld from your income. This includes:

- Self-employed individuals

- Freelancers

- Individuals who receive income from rents, royalties, or investments

- Individuals who receive income from a business or partnership

1. Determine Your Filing Status

Before you start filing PA Form 40-ES, you need to determine your filing status. Your filing status will affect the amount of taxes you need to pay and the number of allowances you can claim. The following are the common filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

How to Determine Your Filing Status

To determine your filing status, you can use the following steps:

- Check your marital status as of December 31st of the tax year

- Check if you have dependents

- Check if you're eligible for head of household status

2. Calculate Your Estimated Tax Liability

To file PA Form 40-ES correctly, you need to calculate your estimated tax liability. You can use the following steps to calculate your estimated tax liability:

- Estimate your total income for the year

- Calculate your total deductions and exemptions

- Calculate your tax liability using the tax tables or tax calculator

How to Calculate Your Estimated Tax Liability

You can use the following formula to calculate your estimated tax liability:

- Estimated tax liability = (Total income - Total deductions and exemptions) x Tax rate

For example, if your total income is $100,000, your total deductions and exemptions are $20,000, and your tax rate is 20%, your estimated tax liability would be:

- Estimated tax liability = ($100,000 - $20,000) x 20% = $16,000

3. Complete the Form Correctly

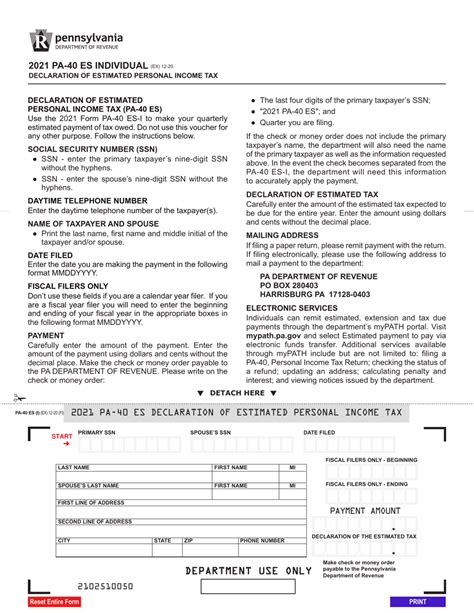

Once you've calculated your estimated tax liability, you can complete PA Form 40-ES. Make sure to follow the instructions carefully and complete all the required fields. You'll need to provide the following information:

- Your name and address

- Your social security number or employer identification number

- Your filing status

- Your estimated tax liability

- The amount of tax you're paying with the voucher

Tips for Completing PA Form 40-ES

- Make sure to use black ink and print clearly

- Use the correct form version for the tax year

- Attach any required documentation, such as proof of income or deductions

4. Make Timely Payments

To avoid penalties and interest, it's essential to make timely payments. PA Form 40-ES is due on a quarterly basis, with the following due dates:

- April 15th for the first quarter (January 1 - March 31)

- June 15th for the second quarter (April 1 - May 31)

- September 15th for the third quarter (June 1 - August 31)

- January 15th of the following year for the fourth quarter (September 1 - December 31)

Consequences of Late Payments

If you fail to make timely payments, you may be subject to penalties and interest. The penalty for late payment is 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%. Additionally, you'll be charged interest on the unpaid tax, which can range from 3% to 14% per annum.

5. Keep Accurate Records

Finally, it's essential to keep accurate records of your estimated tax payments. You'll need to keep records of:

- Your estimated tax liability

- The amount of tax you paid with each voucher

- The date you made each payment

Why Accurate Records Are Important

Accurate records are essential for several reasons:

- You'll need to report your estimated tax payments on your annual tax return

- You may need to provide proof of payment if you're audited

- You'll need to keep track of your payments to ensure you're not overpaying or underpaying your taxes

By following these five steps, you can file PA Form 40-ES correctly and avoid penalties and interest. Remember to determine your filing status, calculate your estimated tax liability, complete the form correctly, make timely payments, and keep accurate records.

What is PA Form 40-ES?

+PA Form 40-ES is the estimated income tax voucher for individuals who need to make estimated tax payments throughout the year.

Who needs to file PA Form 40-ES?

+You need to file PA Form 40-ES if you expect to owe more than $500 in taxes for the year and you're not having taxes withheld from your income.

What is the due date for PA Form 40-ES?

+PA Form 40-ES is due on a quarterly basis, with the following due dates: April 15th, June 15th, September 15th, and January 15th of the following year.