As the world grapples with economic uncertainty, many individuals have found themselves facing unemployment. Losing a job can be a daunting experience, but fortunately, there are systems in place to provide financial support during these difficult times. In the United States, the unemployment benefits system helps individuals who have lost their jobs through no fault of their own. However, navigating the process of claiming these benefits can be complex, especially when it comes to tax implications. This is where Form 8919 and TurboTax come into play.

Unemployment benefits are taxable, which means recipients must report them on their tax returns. The IRS requires employers to provide a Form 1099-G to each recipient by January 31st of each year, detailing the total amount of unemployment compensation paid during the previous tax year. However, some individuals may not receive this form, or they may have received unemployment benefits as a result of a previous employment dispute. In these situations, Form 8919, Uncollected Social Security and Medicare Tax on Wages, can be used to claim the unreported unemployment benefits.

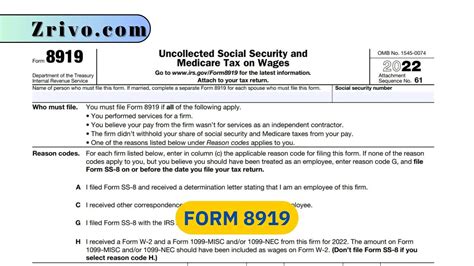

Understanding Form 8919

Form 8919 is typically used by workers who have been misclassified as independent contractors instead of employees. However, it can also be used by individuals who have received unemployment benefits and did not receive a Form 1099-G. This form allows individuals to report their uncollected Social Security and Medicare taxes, as well as any unreported unemployment benefits.

To complete Form 8919, individuals will need to gather certain information, including:

- The amount of unemployment benefits received

- The amount of Social Security and Medicare taxes that should have been withheld

- The employer's name and address

Once this information is gathered, individuals can complete Form 8919 and attach it to their tax return.

Using TurboTax to File Form 8919

TurboTax is a popular tax preparation software that can help individuals navigate the process of claiming unemployment benefits with Form 8919. With TurboTax, users can easily import their Form 1099-G information and complete Form 8919. The software will guide users through the process, ensuring that all necessary information is included and that the form is completed accurately.

TurboTax also offers additional benefits, including:

- Accurate calculations: TurboTax ensures that calculations are accurate, reducing the risk of errors or audits.

- Maximum refund: TurboTax helps users claim the maximum refund they are eligible for.

- Expert support: TurboTax offers expert support, providing users with help and guidance throughout the tax preparation process.

Steps to Claim Unemployment Benefits with Form 8919 on TurboTax

Claiming unemployment benefits with Form 8919 on TurboTax is a straightforward process. Here are the steps to follow:

- Gather necessary information: Collect the necessary information, including the amount of unemployment benefits received and the employer's name and address.

- Sign in to TurboTax: Sign in to TurboTax and select the tax return for the year in which the unemployment benefits were received.

- Import Form 1099-G: Import the Form 1099-G information into TurboTax.

- Complete Form 8919: Complete Form 8919, following the prompts and guidance provided by TurboTax.

- Review and submit: Review the completed Form 8919 and submit it along with the tax return.

Additional Tips

- Keep accurate records: Keep accurate records of unemployment benefits received, including the amount and date of each payment.

- Seek expert help: If unsure about the process or have complex tax situations, seek expert help from a tax professional.

- File on time: File the tax return on time to avoid penalties and interest.

Claiming unemployment benefits with Form 8919 on TurboTax can seem daunting, but with the right guidance, it can be a straightforward process. By following the steps outlined above and seeking expert help when needed, individuals can ensure they receive the benefits they are eligible for.

Conclusion: Claim Your Unemployment Benefits with Confidence

Losing a job can be a challenging experience, but with the right support, individuals can navigate the process of claiming unemployment benefits with confidence. Form 8919 and TurboTax provide a convenient and accurate way to report uncollected Social Security and Medicare taxes, as well as unreported unemployment benefits. By following the steps outlined above and seeking expert help when needed, individuals can ensure they receive the benefits they are eligible for.

We encourage you to share your experiences and tips for claiming unemployment benefits in the comments below. Your insights can help others who may be facing similar challenges.

What is Form 8919?

+Form 8919 is a tax form used to report uncollected Social Security and Medicare taxes, as well as unreported unemployment benefits.

Do I need to file Form 8919 if I received a Form 1099-G?

+No, if you received a Form 1099-G, you do not need to file Form 8919. However, if you did not receive a Form 1099-G, you may need to file Form 8919 to report your unemployment benefits.

Can I use TurboTax to file Form 8919?

+Yes, TurboTax can help you file Form 8919. The software will guide you through the process and ensure that your form is completed accurately.