When dealing with the loss of a loved one, navigating the complexities of inheritance tax can be overwhelming. In Pennsylvania, the Pa 40v form is a crucial document that plays a significant role in the inheritance tax return process. In this article, we will delve into the world of Pennsylvania's inheritance tax return, exploring the intricacies of the Pa 40v form, its importance, and the steps involved in filing it.

Understanding Pennsylvania's Inheritance Tax

Pennsylvania is one of the few states in the US that still levies an inheritance tax. The tax is imposed on the transfer of property from a deceased person to their beneficiaries. The tax rate varies depending on the relationship between the deceased and the beneficiary, ranging from 4.5% to 15%. The Pa 40v form is used to report the transfer of property and calculate the inheritance tax due.

What is the Pa 40v Form?

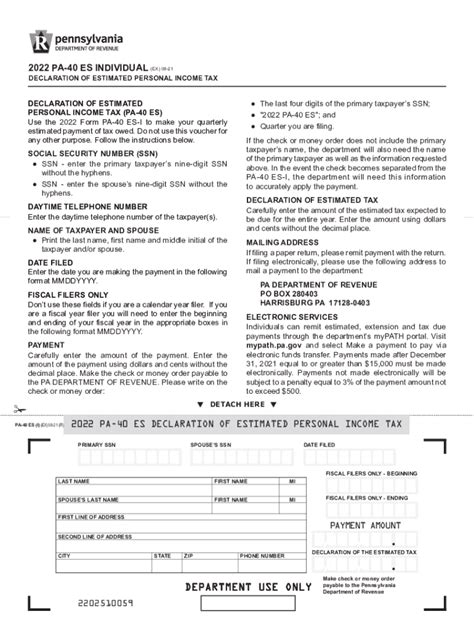

The Pa 40v form, also known as the "Inheritance Tax Return," is a document used to report the transfer of property from a deceased person to their beneficiaries. The form is filed with the Pennsylvania Department of Revenue and is used to calculate the inheritance tax due. The Pa 40v form is typically filed by the executor or administrator of the estate.

Importance of the Pa 40v Form

The Pa 40v form is a critical document in the inheritance tax return process. It serves as a record of the transfer of property and is used to calculate the inheritance tax due. Failure to file the Pa 40v form or underreporting the value of the estate can result in penalties and fines.

Steps Involved in Filing the Pa 40v Form

Filing the Pa 40v form involves several steps:

- Gathering Information: The executor or administrator of the estate must gather information about the deceased person's assets, including real estate, stocks, bonds, and other personal property.

- Determining the Value of the Estate: The value of the estate must be determined, including the value of each asset.

- Calculating the Inheritance Tax: The inheritance tax due is calculated based on the value of the estate and the relationship between the deceased and the beneficiary.

- Filing the Pa 40v Form: The Pa 40v form is filed with the Pennsylvania Department of Revenue, along with any supporting documentation.

How to Calculate Inheritance Tax

Calculating inheritance tax can be complex, but it involves the following steps:

- Determine the Taxable Estate: The taxable estate includes all property that is subject to inheritance tax.

- Calculate the Taxable Value: The taxable value is determined by subtracting any deductions and exemptions from the taxable estate.

- Apply the Tax Rate: The tax rate is applied to the taxable value to determine the inheritance tax due.

Who is Responsible for Filing the Pa 40v Form?

The executor or administrator of the estate is typically responsible for filing the Pa 40v form. If there is no executor or administrator, the beneficiary may be responsible for filing the form.

What is the Deadline for Filing the Pa 40v Form?

The Pa 40v form must be filed within nine months of the deceased person's date of death. Failure to file the form on time can result in penalties and fines.

Tips for Filing the Pa 40v Form

Here are some tips for filing the Pa 40v form:

- Seek Professional Help: Filing the Pa 40v form can be complex, so it's recommended to seek the help of a professional, such as an attorney or accountant.

- Gather All Necessary Information: Make sure to gather all necessary information, including the value of the estate and the relationship between the deceased and the beneficiary.

- File on Time: File the Pa 40v form on time to avoid penalties and fines.

Common Mistakes to Avoid

Here are some common mistakes to avoid when filing the Pa 40v form:

- Underreporting the Value of the Estate: Underreporting the value of the estate can result in penalties and fines.

- Failing to File on Time: Failing to file the Pa 40v form on time can result in penalties and fines.

- Not Seeking Professional Help: Not seeking professional help can result in errors and mistakes.

Conclusion

Filing the Pa 40v form is a critical step in the inheritance tax return process. By understanding the importance of the Pa 40v form and following the steps involved in filing it, individuals can ensure that they comply with Pennsylvania's inheritance tax laws. Remember to seek professional help, gather all necessary information, and file on time to avoid penalties and fines.

Take Action

If you are responsible for filing the Pa 40v form, don't hesitate to seek professional help. Gather all necessary information and file the form on time to avoid penalties and fines. Share this article with others who may be responsible for filing the Pa 40v form, and leave a comment below if you have any questions or concerns.

What is the Pa 40v form?

+The Pa 40v form is a document used to report the transfer of property from a deceased person to their beneficiaries.

Who is responsible for filing the Pa 40v form?

+The executor or administrator of the estate is typically responsible for filing the Pa 40v form.

What is the deadline for filing the Pa 40v form?

+The Pa 40v form must be filed within nine months of the deceased person's date of death.