The California Board of Equalization (BOE) Form BOE-266, also known as the "Claim for Refund" form, is a document used by businesses to claim a refund for overpaid sales and use taxes. Filling out this form correctly is crucial to ensure that your refund is processed efficiently. Here are five ways to fill out Form BOE-266 accurately.

Understanding the Form BOE-266

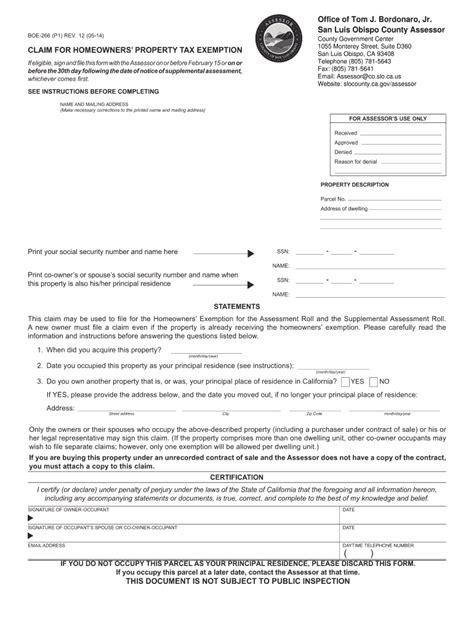

Before we dive into the ways to fill out the form, it's essential to understand the purpose and layout of the Form BOE-266. The form consists of multiple sections, each requiring specific information. The sections include:

- Claimant information

- Period(s) of overpayment

- Type of tax

- Overpayment details

- Certification

1. Gather Required Information

To fill out the Form BOE-266 accurately, you need to gather all the required information beforehand. This includes:

- Business name and address

- BOE account number

- Period(s) of overpayment (including start and end dates)

- Type of tax (sales or use tax)

- Amount of overpayment

- Reason for overpayment

Having all the necessary information readily available will help you fill out the form efficiently and accurately.

Filling Out the Form

Now that you have gathered all the required information, let's move on to the actual filling out of the form.

2. Fill Out the Claimant Information Section

The first section of the form requires you to provide claimant information. This includes:

- Business name and address

- BOE account number

- Contact person's name and title

- Phone number and email address

Make sure to fill out this section accurately, as any errors may delay the processing of your refund.

3. Complete the Period(s) of Overpayment Section

In this section, you need to provide the period(s) of overpayment, including the start and end dates. You can claim overpayments for multiple periods on the same form. Make sure to list each period separately and provide the corresponding dates.

4. Identify the Type of Tax and Overpayment Details

In this section, you need to identify the type of tax (sales or use tax) and provide overpayment details. This includes:

- Type of tax

- Amount of overpayment

- Reason for overpayment

Be as specific as possible when explaining the reason for overpayment. This will help the BOE process your refund more efficiently.

5. Certify the Form

The final step is to certify the form. This involves signing and dating the form, confirming that the information provided is accurate and true. Make sure to read the certification statement carefully before signing the form.

Tips for Filling Out Form BOE-266

Here are some additional tips to keep in mind when filling out Form BOE-266:

- Use black ink to fill out the form

- Make sure to sign and date the form

- Keep a copy of the form for your records

- Submit the form to the BOE electronically or by mail

- Follow up with the BOE if you haven't received your refund within 30 days

By following these tips and the five ways to fill out Form BOE-266, you can ensure that your refund is processed efficiently and accurately.

Common Mistakes to Avoid

When filling out Form BOE-266, it's essential to avoid common mistakes that can delay the processing of your refund. Here are some mistakes to watch out for:

- Incomplete or inaccurate information

- Missing or incorrect BOE account number

- Incorrect period(s) of overpayment

- Failure to sign and date the form

By avoiding these common mistakes, you can ensure that your refund is processed quickly and efficiently.

We hope this article has provided you with valuable information on how to fill out Form BOE-266 accurately. If you have any further questions or concerns, please don't hesitate to reach out to us.

Call to Action

Have you recently filled out Form BOE-266 and have questions about the process? Share your experiences and ask your questions in the comments section below. Our team of experts is here to help you navigate the process and ensure that you receive your refund promptly.

What is Form BOE-266?

+Form BOE-266 is a document used by businesses to claim a refund for overpaid sales and use taxes.

How do I fill out Form BOE-266?

+To fill out Form BOE-266, gather all the required information, including business name and address, BOE account number, period(s) of overpayment, type of tax, and amount of overpayment. Fill out the form accurately, sign and date it, and submit it to the BOE electronically or by mail.

What are common mistakes to avoid when filling out Form BOE-266?

+Common mistakes to avoid include incomplete or inaccurate information, missing or incorrect BOE account number, incorrect period(s) of overpayment, and failure to sign and date the form.