In today's world, tax season can be a daunting time for many individuals and businesses. With the numerous forms and paperwork required, it's easy to get overwhelmed. One such form that often raises questions is the Soc 426a form. If you're wondering what this form is all about and why it's so important, you're in the right place. In this article, we'll delve into six essential facts about the Soc 426a form that you need to know.

What is the Soc 426a Form?

The Soc 426a form is a document required by the California Department of Social Services (CDSS) for individuals who receive in-home supportive services (IHSS). The form is used to report the amount of time worked by IHSS providers and to calculate their pay. The Soc 426a form is a crucial document that ensures providers receive fair compensation for their work.

Who Needs to Fill Out the Soc 426a Form?

The Soc 426a form is required for all IHSS providers who work with recipients in California. This includes family members, friends, and hired caregivers who provide services such as personal care, household chores, and meal preparation. Recipients who hire providers through a home care agency may also need to fill out the form.

How to Fill Out the Soc 426a Form

Filling out the Soc 426a form can seem intimidating, but it's relatively straightforward. Here's a step-by-step guide to help you get started:

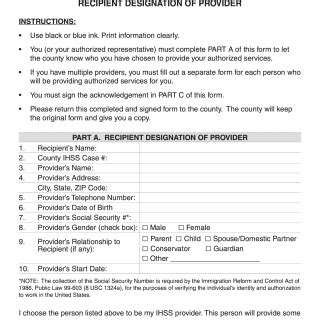

- Begin by filling out the recipient's information, including their name, address, and IHSS case number.

- Next, fill out the provider's information, including their name, address, and Social Security number.

- Report the number of hours worked by the provider during the pay period.

- Calculate the provider's pay based on the number of hours worked and the hourly wage.

Common Mistakes to Avoid When Filling Out the Soc 426a Form

When filling out the Soc 426a form, it's essential to avoid common mistakes that can delay payment or result in errors. Here are a few mistakes to watch out for:

- Inaccurate or missing information, such as the recipient's case number or the provider's Social Security number.

- Failure to report all hours worked by the provider.

- Incorrect calculation of the provider's pay.

Why is the Soc 426a Form Important?

The Soc 426a form is crucial for ensuring that IHSS providers receive fair compensation for their work. By accurately reporting the number of hours worked and calculating pay, providers can ensure they receive the correct amount of money. Additionally, the Soc 426a form helps the CDSS track hours worked and pay providers accurately.

Consequences of Not Filling Out the Soc 426a Form Correctly

Failing to fill out the Soc 426a form correctly can result in delays or errors in payment. This can cause financial hardship for providers who rely on timely payment. In severe cases, failure to comply with the Soc 426a form requirements can result in termination of IHSS services.

How to Submit the Soc 426a Form

Once you've completed the Soc 426a form, you'll need to submit it to the CDSS. Here are the steps to follow:

- Mail the completed form to the CDSS at the address listed on the form.

- Fax the completed form to the CDSS at the fax number listed on the form.

- Submit the form electronically through the CDSS online portal.

Tips for Providers and Recipients

Here are a few tips for providers and recipients to keep in mind when working with the Soc 426a form:

- Keep accurate records of hours worked and pay.

- Review the Soc 426a form carefully before submitting it.

- Contact the CDSS if you have any questions or concerns.

Conclusion

The Soc 426a form is an essential document for IHSS providers and recipients in California. By understanding the purpose of the form, how to fill it out, and the importance of accurate reporting, providers and recipients can ensure timely payment and fair compensation. Remember to avoid common mistakes, submit the form correctly, and keep accurate records to ensure a smooth IHSS experience.

We hope this article has provided you with valuable insights into the Soc 426a form. If you have any questions or comments, please feel free to share them below. Share this article with others who may find it helpful, and don't forget to bookmark our page for more informative articles on topics related to IHSS and more.

What is the purpose of the Soc 426a form?

+The Soc 426a form is used to report the amount of time worked by IHSS providers and to calculate their pay.

Who needs to fill out the Soc 426a form?

+The Soc 426a form is required for all IHSS providers who work with recipients in California.

How do I submit the Soc 426a form?

+You can submit the Soc 426a form by mail, fax, or electronically through the CDSS online portal.