Ohio residents who sell their primary residence or investment properties may be eligible for a capital gains exemption on their Ohio income tax return. To claim this exemption, individuals must file Ohio Form 534a, which is used to report the sale of a primary residence or investment property and calculate the exempt amount of capital gain. In this article, we will discuss the requirements for claiming the capital gains exemption, how to complete Form 534a, and provide examples of how the exemption works.

Understanding the Capital Gains Exemption

The capital gains exemption is a tax benefit that allows Ohio residents to exclude a portion of the capital gain from the sale of their primary residence or investment property from their Ohio taxable income. The exemption is limited to $250,000 ($500,000 for married couples filing jointly) per year, and it can only be claimed for the sale of a primary residence or investment property that meets certain requirements.

Eligibility Requirements

To be eligible for the capital gains exemption, the property being sold must meet the following requirements:

- The property must be a primary residence or an investment property (such as rental property or a vacation home).

- The property must have been owned and used by the taxpayer for at least two of the five years preceding the sale.

- The taxpayer must have lived in the property as their primary residence for at least two of the five years preceding the sale (if the property is a primary residence).

Completing Form 534a

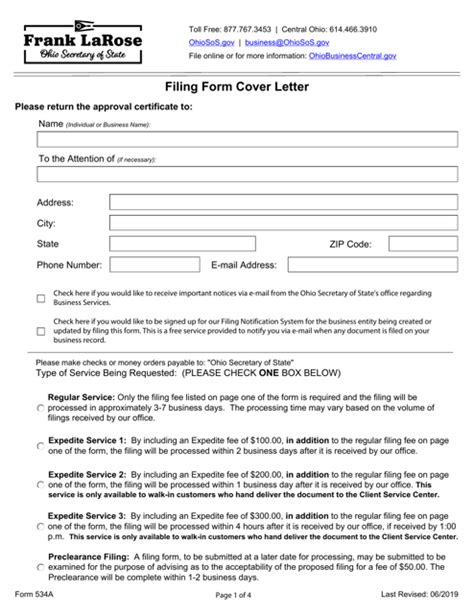

To claim the capital gains exemption, taxpayers must complete Form 534a and attach it to their Ohio income tax return (Form IT 1040). The form requires the taxpayer to provide information about the sale of the property, including the date of sale, the sale price, and the adjusted basis of the property.

The form also requires the taxpayer to calculate the exempt amount of capital gain, which is the amount of capital gain that is excluded from Ohio taxable income. The exempt amount is calculated by subtracting the adjusted basis of the property from the sale price, and then multiplying the result by the exemption percentage (which is 100% for primary residences and 50% for investment properties).

Examples of the Capital Gains Exemption

Here are a few examples of how the capital gains exemption works:

- Example 1: John sells his primary residence for $300,000, which he purchased 10 years ago for $200,000. John's adjusted basis in the property is $220,000 (including improvements and depreciation). John's capital gain is $80,000 ($300,000 - $220,000), which is fully exempt from Ohio taxable income.

- Example 2: Jane sells her rental property for $250,000, which she purchased 5 years ago for $200,000. Jane's adjusted basis in the property is $210,000 (including improvements and depreciation). Jane's capital gain is $40,000 ($250,000 - $210,000), which is 50% exempt from Ohio taxable income (since it is an investment property).

Benefits of the Capital Gains Exemption

The capital gains exemption can provide significant tax savings for Ohio residents who sell their primary residence or investment properties. By excluding a portion of the capital gain from Ohio taxable income, taxpayers can reduce their state income tax liability and keep more of their hard-earned money.

Conclusion

In conclusion, the capital gains exemption is a valuable tax benefit that can provide significant tax savings for Ohio residents who sell their primary residence or investment properties. By understanding the eligibility requirements and completing Form 534a, taxpayers can claim the exemption and reduce their state income tax liability. If you are considering selling a property and want to claim the capital gains exemption, consult with a tax professional to ensure you meet the requirements and complete the form correctly.

How to Claim the Capital Gains Exemption

To claim the capital gains exemption, follow these steps:

- Determine if you meet the eligibility requirements.

- Gather the necessary documents, including the sale agreement, deed, and records of improvements and depreciation.

- Complete Form 534a, including the calculation of the exempt amount of capital gain.

- Attach Form 534a to your Ohio income tax return (Form IT 1040).

- Submit your tax return and supporting documents to the Ohio Department of Taxation.

Common Mistakes to Avoid

When claiming the capital gains exemption, avoid the following common mistakes:

- Failing to meet the eligibility requirements.

- Incorrectly calculating the exempt amount of capital gain.

- Failing to attach Form 534a to your tax return.

- Not keeping accurate records of improvements and depreciation.

By avoiding these common mistakes, you can ensure that you claim the capital gains exemption correctly and receive the tax savings you are eligible for.

FAQ Section:

What is the capital gains exemption?

+The capital gains exemption is a tax benefit that allows Ohio residents to exclude a portion of the capital gain from the sale of their primary residence or investment property from their Ohio taxable income.

How do I claim the capital gains exemption?

+To claim the capital gains exemption, complete Form 534a and attach it to your Ohio income tax return (Form IT 1040). You must also meet the eligibility requirements and calculate the exempt amount of capital gain correctly.

What are the eligibility requirements for the capital gains exemption?

+The property being sold must be a primary residence or an investment property, and the taxpayer must have owned and used the property for at least two of the five years preceding the sale.