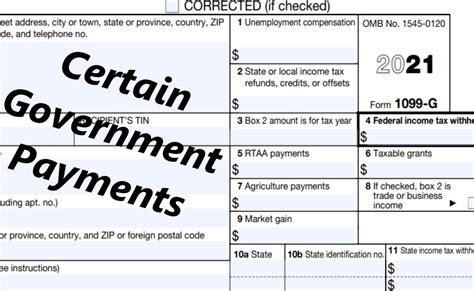

Receiving a Form 1099-G can be a confusing experience for many taxpayers. The form, officially known as the Certain Government Payments form, is used to report various types of government payments to the Internal Revenue Service (IRS). These payments can include unemployment compensation, state and local income tax refunds, and other types of government assistance. In this article, we will provide a comprehensive guide to help taxpayers understand the Form 1099-G, its various boxes, and how to report the income on their tax returns.

Understanding the Form 1099-G

The Form 1099-G is typically issued by government agencies, such as state unemployment offices or state tax departments, to report various types of government payments made to individuals. The form is used to report the total amount of payments made during the calendar year, and it is usually mailed to recipients by January 31st of each year. Taxpayers can expect to receive a Form 1099-G if they received any of the following types of payments:

- Unemployment compensation

- State and local income tax refunds

- Repayment of prior year's taxes

- Government assistance payments

Breaking Down the Form 1099-G

The Form 1099-G is divided into several boxes, each reporting a different type of government payment. The boxes are as follows:

- Box 1: Unemployment compensation

- Box 2: State and local income tax refunds

- Box 3: Repayment of prior year's taxes

- Box 4: Federal income tax withheld

- Box 5: State and local income tax withheld

- Box 6: Other government payments

- Box 7: Medicaid waiver payments

Reporting Form 1099-G Income on Your Tax Return

Taxpayers who receive a Form 1099-G must report the income on their tax return. The type of payment reported on the form will determine where it is reported on the tax return. For example:

- Unemployment compensation is reported on Line 21 of Schedule 1 (Form 1040)

- State and local income tax refunds are reported on Line 25 of Schedule 1 (Form 1040)

- Repayment of prior year's taxes is reported on Line 31 of Schedule 1 (Form 1040)

Other Tax Implications

In addition to reporting the income on their tax return, taxpayers who receive a Form 1099-G should also be aware of the following tax implications:

- Tax withholding: Taxpayers may have federal income tax withheld from their unemployment compensation payments. The amount of tax withheld is reported in Box 4 of the Form 1099-G.

- State and local tax implications: Taxpayers may also have state and local income tax withheld from their government payments. The amount of tax withheld is reported in Box 5 of the Form 1099-G.

- Medicaid waiver payments: Medicaid waiver payments are reported in Box 7 of the Form 1099-G. These payments are not subject to federal income tax, but may be subject to state and local income tax.

Avoiding Common Mistakes

Taxpayers who receive a Form 1099-G should be aware of the following common mistakes to avoid:

- Failing to report the income on their tax return

- Reporting the income in the wrong place on their tax return

- Failing to claim the correct amount of tax withheld

- Not keeping accurate records of their government payments

Conclusion

In conclusion, the Form 1099-G is an important tax document that reports various types of government payments to the IRS. Taxpayers who receive a Form 1099-G must report the income on their tax return and be aware of the tax implications. By following the guidelines outlined in this article, taxpayers can avoid common mistakes and ensure they are in compliance with the IRS.

We encourage you to share your thoughts and questions about the Form 1099-G in the comments below. If you found this article helpful, please share it with others who may benefit from this information.

FAQ Section:

What is the Form 1099-G?

+The Form 1099-G is a tax document used to report various types of government payments to the IRS.

Who issues the Form 1099-G?

+The Form 1099-G is typically issued by government agencies, such as state unemployment offices or state tax departments.

What types of payments are reported on the Form 1099-G?

+The Form 1099-G reports various types of government payments, including unemployment compensation, state and local income tax refunds, and other types of government assistance.