In today's fast-paced business environment, managing finances efficiently is crucial for success. One of the most popular accounting software used by small businesses and entrepreneurs is QuickBooks. It offers a wide range of features, including Automated Clearing House (ACH) payment processing, which enables businesses to easily manage their transactions. However, to use this feature, you need to obtain an ACH authorization form from your customers or clients. In this article, we will explore the QuickBooks ACH authorization form in detail and provide you with a comprehensive guide on how to make it easy for your customers to authorize ACH payments.

What is an ACH Authorization Form?

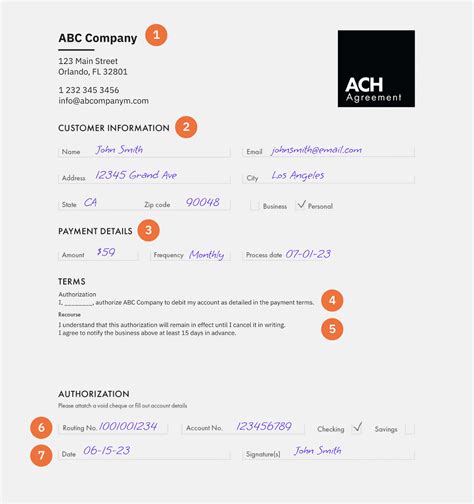

An ACH authorization form is a document that allows a business to electronically debit or credit a customer's checking or savings account. This form is required by the National Automated Clearing House Association (NACHA) and is typically used for recurring payments, such as subscription services or utility bills. The form must include specific information, including the customer's name, account number, routing number, and authorization for the business to debit or credit their account.

Why is an ACH Authorization Form Necessary?

An ACH authorization form is necessary to protect both the business and the customer. It ensures that the customer has authorized the business to access their account and prevents unauthorized transactions. Additionally, the form provides a record of the customer's authorization, which can help resolve any disputes or issues that may arise.

Benefits of Using an ACH Authorization Form in QuickBooks

Using an ACH authorization form in QuickBooks offers several benefits, including:

- Efficient payment processing: ACH payments are faster and more efficient than traditional payment methods, such as checks or credit cards.

- Reduced errors: ACH payments are less prone to errors, such as lost or stolen checks, or declined credit card transactions.

- Increased security: ACH payments are more secure than traditional payment methods, as they are encrypted and transmitted electronically.

- Improved customer satisfaction: ACH payments can help improve customer satisfaction by providing a convenient and efficient way to make payments.

How to Create an ACH Authorization Form in QuickBooks

Creating an ACH authorization form in QuickBooks is a relatively straightforward process. Here are the steps to follow:

- Go to the "Customers" menu and select "Create Invoices."

- Click on the "ACH" button and select "Create ACH Authorization Form."

- Enter the customer's information, including their name, account number, and routing number.

- Specify the authorization details, including the payment amount, frequency, and duration.

- Save the form and print or email it to the customer for signature.

Best Practices for Obtaining an ACH Authorization Form

Obtaining an ACH authorization form requires careful attention to detail and compliance with NACHA regulations. Here are some best practices to follow:

- Use a clear and concise form: Ensure that the form is easy to understand and includes all required information.

- Obtain written authorization: Require customers to sign and date the form to confirm their authorization.

- Store the form securely: Keep the signed form on file for at least two years, as required by NACHA regulations.

- Provide a copy to the customer: Give the customer a copy of the signed form for their records.

Common Mistakes to Avoid When Using an ACH Authorization Form

Using an ACH authorization form can be complex, and mistakes can result in failed transactions or compliance issues. Here are some common mistakes to avoid:

- Incomplete or inaccurate information: Ensure that the form includes all required information, including the customer's name, account number, and routing number.

- Insufficient authorization: Ensure that the customer has provided written authorization for the business to debit or credit their account.

- Failure to store the form securely: Keep the signed form on file for at least two years, as required by NACHA regulations.

Conclusion

In conclusion, an ACH authorization form is a necessary document for businesses that use QuickBooks to manage their finances. By following the best practices outlined in this article, you can ensure that you obtain the necessary authorization from your customers and comply with NACHA regulations. Remember to use a clear and concise form, obtain written authorization, store the form securely, and provide a copy to the customer.

What is an ACH authorization form?

+An ACH authorization form is a document that allows a business to electronically debit or credit a customer's checking or savings account.

Why is an ACH authorization form necessary?

+An ACH authorization form is necessary to protect both the business and the customer. It ensures that the customer has authorized the business to access their account and prevents unauthorized transactions.

How do I create an ACH authorization form in QuickBooks?

+To create an ACH authorization form in QuickBooks, go to the "Customers" menu and select "Create Invoices." Click on the "ACH" button and select "Create ACH Authorization Form." Enter the customer's information, including their name, account number, and routing number. Specify the authorization details, including the payment amount, frequency, and duration. Save the form and print or email it to the customer for signature.