The world of taxes can be overwhelming, especially when it comes to understanding the various forms and regulations that govern state income tax withholding. In New York State, the NY State Withholding Form is a crucial document that employers must complete and submit to the state tax authority. In this article, we will delve into the details of the NY State Withholding Form, its importance, and provide a step-by-step guide on how to complete it accurately.

What is the NY State Withholding Form?

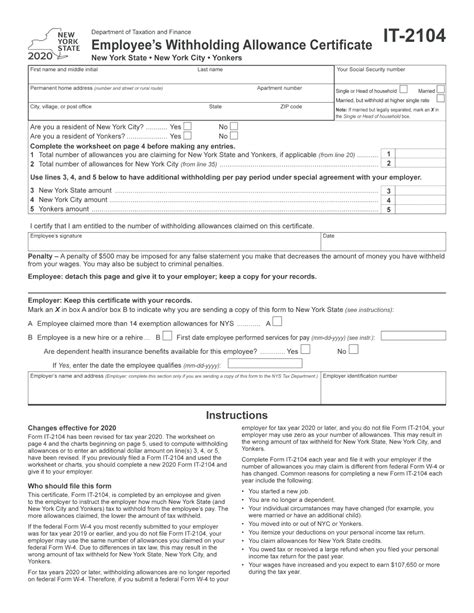

The NY State Withholding Form, also known as Form IT-2104, is a tax form used by employers in New York State to report the state income tax withheld from their employees' wages. The form is used to calculate the amount of state income tax that an employer must withhold from an employee's paycheck and pay to the state tax authority.

Why is the NY State Withholding Form Important?

The NY State Withholding Form is crucial for several reasons:

- It helps employers comply with New York State tax laws and regulations.

- It ensures that employees have the correct amount of state income tax withheld from their wages.

- It helps the state tax authority collect the correct amount of state income tax revenue.

- It provides employers with a record of the state income tax withheld from their employees' wages.

Who Needs to Complete the NY State Withholding Form?

The NY State Withholding Form must be completed by:

- Employers who have employees working in New York State.

- Employers who are required to withhold New York State income tax from their employees' wages.

- Employers who have employees who are subject to New York State income tax withholding.

How to Complete the NY State Withholding Form

To complete the NY State Withholding Form, follow these steps:

- Gather necessary information: Before completing the form, gather the necessary information, including:

- Employee's name and social security number.

- Employee's wages and New York State income tax withheld.

- Employer's name and address.

- Determine the correct withholding rate: Determine the correct withholding rate based on the employee's wages and filing status.

- Complete the form: Complete the form by filling in the required information, including:

- Employee's name and social security number.

- Employee's wages and New York State income tax withheld.

- Employer's name and address.

- Submit the form: Submit the completed form to the New York State Tax Authority by the required deadline.

Common Mistakes to Avoid

When completing the NY State Withholding Form, avoid the following common mistakes:

- Inaccurate information: Ensure that all information is accurate and complete.

- Incorrect withholding rate: Ensure that the correct withholding rate is used.

- Late submission: Ensure that the form is submitted by the required deadline.

Penalties for Non-Compliance

Employers who fail to comply with New York State tax laws and regulations may be subject to penalties, including:

- Fines: Employers may be fined for non-compliance.

- Interest: Employers may be required to pay interest on any unpaid taxes.

- Loss of business license: Employers may lose their business license for non-compliance.

Conclusion

In conclusion, the NY State Withholding Form is a critical document that employers in New York State must complete and submit to the state tax authority. By understanding the importance of the form, who needs to complete it, and how to complete it accurately, employers can ensure compliance with New York State tax laws and regulations.

Call to Action

If you have any questions or concerns about the NY State Withholding Form, we encourage you to comment below or share this article with others who may find it helpful. Additionally, if you need assistance with completing the form or have any other tax-related questions, please don't hesitate to reach out to a tax professional.

What is the NY State Withholding Form used for?

+The NY State Withholding Form is used by employers in New York State to report the state income tax withheld from their employees' wages.

Who needs to complete the NY State Withholding Form?

+Employers who have employees working in New York State and are required to withhold New York State income tax from their employees' wages need to complete the form.

What are the penalties for non-compliance with the NY State Withholding Form?

+Employers who fail to comply with New York State tax laws and regulations may be subject to fines, interest, and loss of business license.