Transferring property in Texas can be a complex and daunting task, especially when it comes to ensuring that the process is done correctly and legally. However, with the right tools and knowledge, property owners can navigate this process with ease. One of the most important documents required for property transfer in Texas is the gift deed form. In this article, we will delve into the world of Texas gift deed forms, exploring what they are, how they work, and what benefits they offer.

What is a Texas Gift Deed Form?

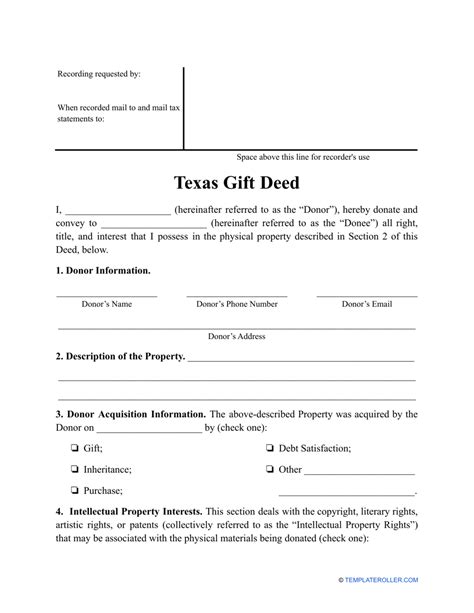

A Texas gift deed form is a legal document used to transfer ownership of real property from one party to another without receiving any compensation or payment. This type of deed is often used when property is being transferred between family members, friends, or charitable organizations. The gift deed form must be signed by the grantor (the party transferring the property) and acknowledged by a notary public.

Types of Gift Deeds in Texas

There are several types of gift deeds that can be used in Texas, including:

- Warranty Deed: This type of deed guarantees that the grantor has clear title to the property and is responsible for any defects or encumbrances.

- Special Warranty Deed: This type of deed guarantees that the grantor has not created any defects or encumbrances during their ownership of the property.

- Quitclaim Deed: This type of deed transfers the grantor's interest in the property, but does not guarantee clear title.

Benefits of Using a Texas Gift Deed Form

Using a Texas gift deed form offers several benefits, including:

- Simplified Transfer Process: A gift deed form simplifies the process of transferring property, eliminating the need for a sales contract or other documentation.

- Tax Benefits: Transferring property through a gift deed can help minimize tax liabilities, as the recipient is not required to pay taxes on the property.

- Flexibility: Gift deeds can be used to transfer property to anyone, including family members, friends, or charitable organizations.

How to Fill Out a Texas Gift Deed Form

Filling out a Texas gift deed form requires careful attention to detail to ensure that the document is valid and effective. Here are the steps to follow:

- Identify the Parties: Identify the grantor (the party transferring the property) and the grantee (the party receiving the property).

- Describe the Property: Provide a detailed description of the property being transferred, including the address, county, and any other relevant information.

- Sign and Acknowledge: Sign the deed in the presence of a notary public, who will acknowledge the signature.

- File the Deed: File the deed with the county recorder's office to record the transfer of ownership.

Common Mistakes to Avoid

When filling out a Texas gift deed form, it is essential to avoid common mistakes, including:

- Incorrect Party Information: Ensure that the grantor and grantee information is accurate and up-to-date.

- Insufficient Property Description: Provide a detailed description of the property to avoid any confusion or disputes.

- Failure to Sign and Acknowledge: Sign the deed in the presence of a notary public and ensure that the signature is acknowledged.

Conclusion

Transferring property in Texas can be a complex process, but using a gift deed form can simplify the process and ensure that the transfer is done correctly and legally. By understanding the benefits and requirements of a Texas gift deed form, property owners can navigate the process with ease and confidence. Whether you are transferring property to a family member, friend, or charitable organization, a gift deed form is an essential tool to ensure a smooth and successful transfer.

We hope this article has provided you with valuable information and insights into the world of Texas gift deed forms. If you have any further questions or would like to share your experiences, please leave a comment below.

What is the difference between a warranty deed and a quitclaim deed?

+A warranty deed guarantees that the grantor has clear title to the property and is responsible for any defects or encumbrances, while a quitclaim deed transfers the grantor's interest in the property, but does not guarantee clear title.

Do I need to file the gift deed with the county recorder's office?

+Yes, it is essential to file the gift deed with the county recorder's office to record the transfer of ownership.

Can I use a gift deed to transfer property to a charity?

+Yes, a gift deed can be used to transfer property to a charity, and it may provide tax benefits to the grantor.