The Claim of Exemption from Withholding on Form W-4V is a crucial document for recipients of certain government payments, including Social Security benefits, Supplemental Security Income (SSI), and certain other government benefits. Understanding the Claim ID on Form W-4V is essential for individuals who need to certify their exemption from federal income tax withholding.

What is Form W-4V?

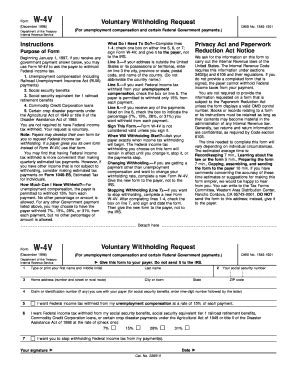

Form W-4V, also known as the Voluntary Withholding Request, is a document that allows recipients of certain government payments to elect voluntary federal income tax withholding. This form is used to request withholding from government payments, which can help individuals avoid a large tax bill when filing their tax return.

What is the Claim ID on Form W-4V?

The Claim ID on Form W-4V is a unique identifier assigned to the individual claiming exemption from withholding. It is typically an alphanumeric code that consists of a combination of letters and numbers. The Claim ID is used to identify the individual's claim of exemption and to track their withholding status.

How to complete the Claim ID section on Form W-4V

When completing Form W-4V, individuals must provide their Claim ID in the designated section. The Claim ID can be found on the notice or award letter received from the Social Security Administration (SSA) or other government agency. If the individual does not have a Claim ID, they should leave the section blank.

Why is the Claim ID important?

The Claim ID is essential because it helps the government agency and the IRS to verify the individual's exemption from withholding. Without a valid Claim ID, the agency may not be able to process the individual's request for exemption, which could result in withholding from their government payments.

Tips for completing Form W-4V

When completing Form W-4V, individuals should keep the following tips in mind:

- Use the correct Claim ID to avoid delays or errors in processing the request.

- Make sure to sign and date the form to ensure its validity.

- Keep a copy of the completed form for their records.

- If unsure about the Claim ID or any other section of the form, contact the SSA or other government agency for assistance.

Common mistakes to avoid

When completing Form W-4V, individuals should avoid the following common mistakes:

- Providing an incorrect or invalid Claim ID.

- Failing to sign and date the form.

- Not keeping a copy of the completed form for their records.

- Not understanding the implications of electing voluntary withholding.

Conclusion

In conclusion, the Claim ID on Form W-4V is a critical piece of information that helps individuals certify their exemption from federal income tax withholding on certain government payments. By understanding the importance of the Claim ID and following the tips outlined above, individuals can ensure that their request for exemption is processed correctly and avoid any potential errors or delays.

What's Next?

If you have any further questions about Form W-4V or the Claim ID, we encourage you to share them in the comments section below. Additionally, if you found this article helpful, please share it with others who may benefit from this information.

FAQ Section

What is the purpose of Form W-4V?

+Form W-4V is used to request voluntary federal income tax withholding from certain government payments, such as Social Security benefits and Supplemental Security Income (SSI).

Where can I find my Claim ID?

+Your Claim ID can be found on the notice or award letter received from the Social Security Administration (SSA) or other government agency.

What happens if I don't provide a valid Claim ID?

+If you don't provide a valid Claim ID, the agency may not be able to process your request for exemption, which could result in withholding from your government payments.