The NY Form IT-370-PF is a crucial document for New York State residents who are filing their personal income tax returns. It's essential to understand the ins and outs of this form to ensure accuracy and avoid any potential errors. In this article, we'll break down the process of mastering the NY Form IT-370-PF into 5 easy steps.

Understanding the Importance of NY Form IT-370-PF

Before we dive into the steps, it's crucial to understand the significance of the NY Form IT-370-PF. This form is used to report and pay the Metropolitan Commuter Transportation Mobility Tax (MCTMT), which is a tax imposed on certain employers and self-employed individuals who work in the Metropolitan Commuter Transportation District (MCTD). The MCTD includes the five boroughs of New York City, as well as several surrounding counties.

Step 1: Determine If You Need to File

The first step in mastering the NY Form IT-370-PF is to determine if you need to file. You'll need to file this form if you're an employer or self-employed individual who meets the following criteria:

- You're required to pay the MCTMT

- You have employees who work in the MCTD and earn more than $50,000 per year

- You're a self-employed individual who earns more than $50,000 per year and works in the MCTD

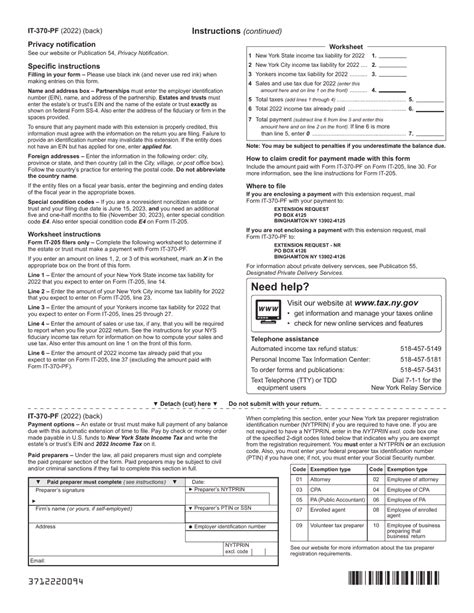

Step 2: Gather Required Documents and Information

Gathering Required Documents and Information

To complete the NY Form IT-370-PF, you'll need to gather several documents and pieces of information, including:

- Your employer identification number (EIN)

- Your business name and address

- The number of employees you have who work in the MCTD

- The total wages paid to those employees

- Your business income and expenses

Step 3: Calculate Your MCTMT Liability

Calculating Your MCTMT Liability

The next step is to calculate your MCTMT liability. This involves determining the amount of tax you owe based on the number of employees you have and their wages. You can use the following formula to calculate your liability:

MCTMT Liability = (Number of Employees x Wages Paid) x MCTMT Rate

The MCTMT rate is currently 0.034% of wages paid.

Step 4: Complete the Form

Completing the NY Form IT-370-PF

Once you've calculated your MCTMT liability, it's time to complete the NY Form IT-370-PF. This involves filling out the form with the required information, including:

- Your business name and address

- Your EIN

- The number of employees you have who work in the MCTD

- The total wages paid to those employees

- Your MCTMT liability

Step 5: File and Pay

Filing and Paying Your MCTMT Liability

The final step is to file and pay your MCTMT liability. You can file the NY Form IT-370-PF electronically or by mail. If you're filing electronically, you'll need to use the New York State Department of Taxation and Finance's online filing system. If you're filing by mail, you'll need to send the completed form to the address listed on the form.

Tips and Reminders

- Make sure to file and pay your MCTMT liability on time to avoid penalties and interest

- Keep accurate records of your business income and expenses, as well as your employee wages and payroll taxes

- Consult with a tax professional if you're unsure about how to complete the NY Form IT-370-PF or calculate your MCTMT liability

By following these 5 easy steps, you can master the NY Form IT-370-PF and ensure that you're in compliance with New York State tax laws.

We'd Love to Hear from You!

If you have any questions or comments about the NY Form IT-370-PF, please don't hesitate to reach out. Share this article with your colleagues and friends who may find it helpful. Join the conversation on social media using the hashtag #NYFormIT370PF.