As a taxpayer in Texas, it's essential to understand the process of completing a Texas A&M tax exempt form. The Texas A&M University System is a tax-exempt organization under Section 501(c)(3) of the Internal Revenue Code, and as such, it is exempt from paying sales tax on certain purchases. In this article, we will guide you through the process of completing a Texas A&M tax exempt form and highlight the benefits of tax exemption for the university and its affiliates.

Understanding the Texas A&M Tax Exempt Form

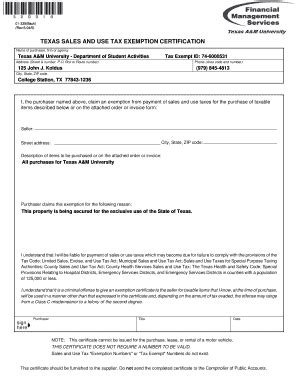

The Texas A&M tax exempt form is a document that must be completed by the university or its affiliates to claim tax exemption on eligible purchases. The form is used to certify that the purchase is for an exempt purpose and that the university or its affiliate is entitled to claim tax exemption.

Benefits of Tax Exemption

Tax exemption provides numerous benefits to Texas A&M University and its affiliates. By exempting certain purchases from sales tax, the university can save money that can be used for other purposes, such as funding research projects or supporting student programs. Additionally, tax exemption can help to reduce the financial burden on the university and its affiliates, allowing them to allocate resources more efficiently.

5 Ways to Complete the Texas A&M Tax Exempt Form

Completing the Texas A&M tax exempt form can seem like a daunting task, but it's actually a straightforward process. Here are five ways to complete the form:

1. Online Submission

The easiest way to complete the Texas A&M tax exempt form is through online submission. The university's website provides an online portal where you can fill out the form and submit it electronically. This method is quick and convenient, and you can track the status of your submission online.

2. Fax Submission

If you prefer to submit the form via fax, you can do so by printing out the form and faxing it to the university's tax office. Make sure to include all required documentation and information to avoid delays in processing.

3. Mail Submission

You can also submit the Texas A&M tax exempt form by mail. Simply print out the form, fill it out, and mail it to the university's tax office. Be sure to include all required documentation and information to avoid delays in processing.

4. In-Person Submission

If you prefer to submit the form in person, you can do so by visiting the university's tax office. Be sure to bring all required documentation and information to avoid delays in processing.

5. Through a Tax Professional

If you are not comfortable completing the Texas A&M tax exempt form yourself, you can hire a tax professional to do it for you. A tax professional can guide you through the process and ensure that the form is completed accurately and efficiently.

Tips for Completing the Texas A&M Tax Exempt Form

Here are some tips to keep in mind when completing the Texas A&M tax exempt form:

- Make sure to read the instructions carefully and fill out the form accurately.

- Include all required documentation and information to avoid delays in processing.

- Use the correct form and follow the correct procedures for submission.

- Keep a copy of the completed form for your records.

Common Mistakes to Avoid

Here are some common mistakes to avoid when completing the Texas A&M tax exempt form:

- Incomplete or inaccurate information

- Failure to include required documentation

- Using the wrong form or following incorrect procedures

- Not keeping a copy of the completed form for your records

Conclusion

Completing the Texas A&M tax exempt form is a straightforward process that can help the university and its affiliates save money on eligible purchases. By following the tips and avoiding common mistakes outlined in this article, you can ensure that the form is completed accurately and efficiently. Remember to keep a copy of the completed form for your records and to follow up with the university's tax office if you have any questions or concerns.

What is the purpose of the Texas A&M tax exempt form?

+The Texas A&M tax exempt form is used to certify that a purchase is for an exempt purpose and that the university or its affiliate is entitled to claim tax exemption.

How do I complete the Texas A&M tax exempt form?

+You can complete the form online, by fax, by mail, or in person. You can also hire a tax professional to do it for you.

What are the benefits of tax exemption for Texas A&M University?

+Tax exemption provides numerous benefits to Texas A&M University, including saving money on eligible purchases and reducing the financial burden on the university and its affiliates.