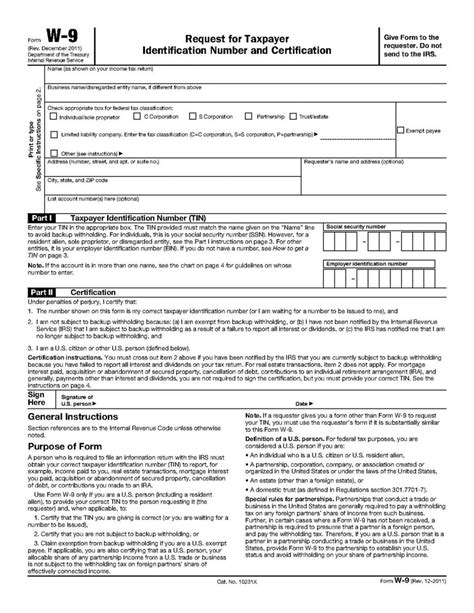

As a taxpayer, it's essential to stay up-to-date with the latest changes to tax forms, including the W-9 form. The W-9 form, also known as the Request for Taxpayer Identification Number and Certification, is a crucial document used by the Internal Revenue Service (IRS) to verify an individual's or business's identity and taxpayer identification number (TIN). In this article, we'll explore the latest updates on the newest W-9 form, ensuring you're compliant and aware of the changes.

What's New in the 2022 W-9 Form?

The IRS released the newest W-9 form in 2022, which includes several updates and changes. Here are the key takeaways:

New Layout and Format

The 2022 W-9 form features a new layout and format, designed to improve readability and reduce errors. The updated form is easier to navigate, with clear headings and concise instructions.

Additional Certification Requirements

The new W-9 form includes additional certification requirements for individuals and businesses. Specifically, Section 2 of the form now requires individuals to certify their identity and TIN, while Section 3 requires businesses to certify their identity, TIN, and business type.

Foreign Account Tax Compliance Act (FATCA) Certification

The 2022 W-9 form includes a new section (Section 5) for Foreign Account Tax Compliance Act (FATCA) certification. This section is required for foreign entities, including individuals and businesses, to certify their compliance with FATCA regulations.

Cryptocurrency and Virtual Currency Reporting

The IRS has added a new section (Section 6) to the W-9 form to report cryptocurrency and virtual currency transactions. This section is optional, but individuals and businesses that engage in cryptocurrency transactions must complete this section to comply with IRS regulations.

Penalties for Inaccurate or Incomplete Forms

The IRS has increased penalties for inaccurate or incomplete W-9 forms. As of 2022, individuals and businesses that fail to provide accurate or complete information on the W-9 form may face penalties of up to $250 per form.

Who Needs to Complete the W-9 Form?

The W-9 form is required for various individuals and businesses, including:

Independent Contractors

Independent contractors, freelancers, and consultants must complete the W-9 form to provide their TIN and certification to clients.

Businesses

Businesses, including corporations, partnerships, and limited liability companies (LLCs), must complete the W-9 form to provide their TIN and certification to vendors, suppliers, and other business partners.

Individuals with Multiple Sources of Income

Individuals with multiple sources of income, including rental income, dividends, and interest, must complete the W-9 form to provide their TIN and certification to payers.

How to Complete the W-9 Form

Completing the W-9 form is a straightforward process. Here's a step-by-step guide:

- Download the W-9 form: Visit the IRS website to download the latest W-9 form.

- Fill out Section 1: Provide your name, address, and TIN (Social Security number or Employer Identification Number).

- Fill out Section 2: Certify your identity and TIN.

- Fill out Section 3: Certify your business type (if applicable).

- Fill out Section 5: Certify your compliance with FATCA regulations (if applicable).

- Fill out Section 6: Report cryptocurrency and virtual currency transactions (if applicable).

- Sign and date the form: Sign and date the form to certify the information is accurate.

Common Mistakes to Avoid When Completing the W-9 Form

When completing the W-9 form, it's essential to avoid common mistakes that can lead to penalties and delays. Here are some common mistakes to avoid:

Inaccurate or Incomplete Information

Ensure you provide accurate and complete information on the W-9 form, including your name, address, and TIN.

Incorrect Certification

Ensure you certify your identity and TIN correctly, as well as your business type (if applicable).

Failure to Report Cryptocurrency Transactions

If you engage in cryptocurrency transactions, ensure you report them on the W-9 form to comply with IRS regulations.

Unsigned or Undated Form

Ensure you sign and date the W-9 form to certify the information is accurate.

FAQs

Here are some frequently asked questions about the W-9 form:

Q: What is the purpose of the W-9 form? A: The W-9 form is used by the IRS to verify an individual's or business's identity and taxpayer identification number (TIN).

Q: Who needs to complete the W-9 form? A: Independent contractors, businesses, and individuals with multiple sources of income must complete the W-9 form.

Q: What are the penalties for inaccurate or incomplete W-9 forms? A: The IRS may impose penalties of up to $250 per form for inaccurate or incomplete W-9 forms.

Q: How do I report cryptocurrency transactions on the W-9 form? A: You can report cryptocurrency transactions on Section 6 of the W-9 form.

What is the deadline for submitting the W-9 form?

+The deadline for submitting the W-9 form varies depending on the payer's requirements. Typically, the payer will request the W-9 form at the beginning of the tax year or when establishing a new business relationship.

Can I submit the W-9 form electronically?

+Yes, you can submit the W-9 form electronically through the IRS website or through a third-party provider.

What if I need to make changes to my W-9 form?

+If you need to make changes to your W-9 form, you can submit a revised form to the payer. Ensure you provide accurate and complete information to avoid penalties.

In conclusion, the W-9 form is an essential document for individuals and businesses to provide their taxpayer identification number (TIN) and certification to payers. With the latest updates to the form, it's crucial to stay informed and compliant with IRS regulations. By following the guidelines and avoiding common mistakes, you can ensure accurate and complete W-9 forms that meet the requirements of the IRS.