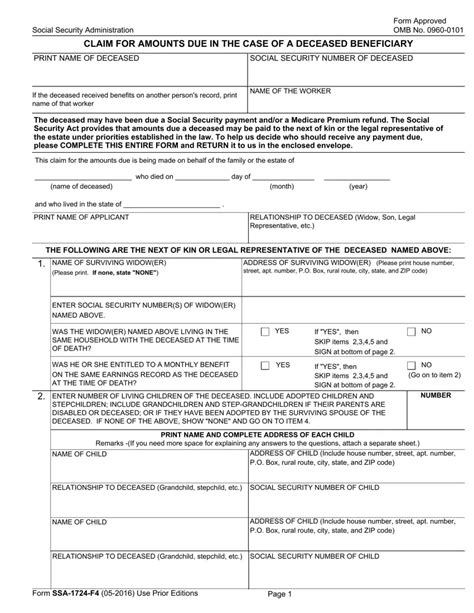

Applying for disability benefits can be a daunting task, but with the right guidance, you can navigate the process with ease. One crucial step in this journey is filling out Form SSA-1724, also known as the "Claim for Amounts Due in the Case of a Deceased Beneficiary" form. In this article, we will break down the process into manageable steps, ensuring you have a clear understanding of what to expect.

The SSA-1724 form is used to claim benefits due to a deceased beneficiary's Social Security account. This form is typically filed by the executor of the estate, a family member, or another authorized representative. If you're dealing with the loss of a loved one and need to claim their benefits, this guide is here to support you.

Understanding the SSA-1724 Form

Before we dive into the step-by-step guide, it's essential to understand the purpose of the SSA-1724 form. This form is used to claim benefits that were due to the deceased beneficiary at the time of their passing. The benefits can include:

- Unpaid benefits for the month of death

- Benefits that were due but not yet paid

- Lump-sum death payments

Who Can File the SSA-1724 Form?

Not everyone can file the SSA-1724 form. The Social Security Administration (SSA) requires that the form be filed by an authorized representative, such as:

- The executor of the estate

- A family member (spouse, child, or parent)

- A court-appointed representative

- A guardian or conservator

Step-by-Step Guide to Filling Out Form SSA-1724

Now that we've covered the basics, let's move on to the step-by-step guide:

Step 1: Gather Required Documents

Before you start filling out the form, make sure you have the following documents:

- The deceased beneficiary's Social Security number

- Proof of death (death certificate or funeral home statement)

- Proof of relationship (birth or marriage certificate)

- The deceased beneficiary's most recent tax return (if applicable)

Step 2: Download and Print the SSA-1724 Form

You can download the SSA-1724 form from the SSA website or pick one up at your local SSA office. Make sure to print the form on standard 8.5 x 11-inch paper.

Step 3: Fill Out Section 1: Claimant Information

In this section, you'll need to provide your personal information, including:

- Your name and address

- Your relationship to the deceased beneficiary

- Your Social Security number (if applicable)

Step 4: Fill Out Section 2: Deceased Beneficiary Information

Here, you'll need to provide information about the deceased beneficiary, including:

- Their name and Social Security number

- Their date of birth and date of death

- Their most recent address

Step 5: Fill Out Section 3: Benefits Information

In this section, you'll need to provide information about the benefits you're claiming, including:

- The type of benefits (e.g., retirement, disability, or survivor benefits)

- The amount of benefits due

- The period for which you're claiming benefits

Step 6: Sign and Date the Form

Once you've completed the form, sign and date it. Make sure to use black ink and print your name clearly.

Step 7: Submit the Form

You can submit the SSA-1724 form by mail or in person at your local SSA office. Make sure to include all required documents and keep a copy of the form for your records.

What to Expect After Submitting the SSA-1724 Form

After submitting the SSA-1724 form, you can expect the SSA to process your claim within 2-3 months. During this time, the SSA will verify the information you provided and calculate the benefits due.

If your claim is approved, you'll receive a letter stating the amount of benefits due and the payment method. If your claim is denied, you'll receive a letter explaining the reason for the denial and your options for appeal.

Common Mistakes to Avoid

When filling out the SSA-1724 form, it's essential to avoid common mistakes that can delay or deny your claim. Some common mistakes include:

- Incomplete or inaccurate information

- Missing required documents

- Failure to sign and date the form

Conclusion: Filling Out Form SSA-1724 with Confidence

Filling out Form SSA-1724 can be a complex and emotional process, but with this step-by-step guide, you can navigate the process with confidence. Remember to take your time, gather all required documents, and avoid common mistakes.

If you have any questions or concerns, don't hesitate to reach out to the SSA or a qualified representative for assistance. By following these steps and providing accurate information, you can ensure a smooth and successful claim process.

We hope this article has been helpful in guiding you through the process of filling out Form SSA-1724. If you have any questions or would like to share your experience, please leave a comment below.

What is the SSA-1724 form used for?

+The SSA-1724 form is used to claim benefits due to a deceased beneficiary's Social Security account.

Who can file the SSA-1724 form?

+The SSA-1724 form can be filed by an authorized representative, such as the executor of the estate, a family member, or a court-appointed representative.

What documents are required to fill out the SSA-1724 form?

+The required documents include the deceased beneficiary's Social Security number, proof of death, proof of relationship, and their most recent tax return (if applicable).